Gold IRAs During Bear Markets: Your Shield Against Market Turmoil

Bear markets are brutal. The average bear market sees stock prices drop 36% over 14 months, wiping out years of retirement savings progress. If you watched your 401(k) shrink by hundreds of thousands during the 2008 crisis or the COVID crash, you understand the gut-wrenching reality of market downturns.

Traditional portfolios crumble when markets turn bearish. Stocks, bonds, and real estate often fall together, leaving investors with few places to hide. This correlation nightmare is exactly when diversification matters most—and why smart investors turn to gold IRAs as their financial fortress.

Gold offers protection because it typically moves opposite to stocks during market stress. While your neighbors watch their retirement accounts evaporate, gold IRA holders often see their precious metals holdings maintain or even increase in value when fear grips the markets.

Take control today by understanding how gold IRAs can shield your retirement wealth from the next inevitable bear market.

What Bear Markets Do to Your Retirement Money

The Damage is Real

Bear markets don't just nibble at your savings—they devour them. Consider these sobering statistics:

- 2007-2009 Financial Crisis: S&P 500 dropped 57%, lasting 517 days

- 2000-2002 Dot-Com Crash: NASDAQ fell 78%, lasting 929 days

- 2020 COVID Crash: S&P 500 plunged 34% in just 33 days

For someone with a $500,000 retirement account, these crashes meant losses of:

- 2008 Crisis: $285,000 gone

- Dot-com bubble: $390,000 vanished

- COVID crash: $170,000 disappeared

Why Traditional Diversification Fails

The problem with typical "diversified" portfolios is that during real crises, correlations spike toward 1.0—everything falls together. Stocks, bonds, REITs, and international markets often move in lockstep during fear-driven selloffs.

This is where precious metals shine differently.

How Gold IRAs Perform When Markets Crash

The Numbers Tell the Story

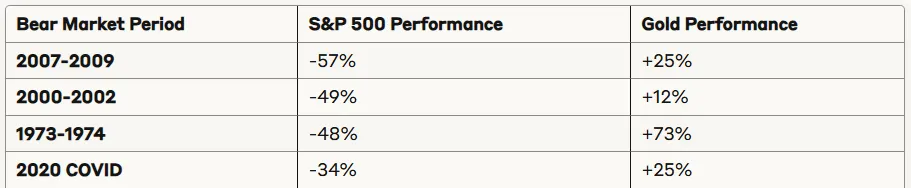

Gold's track record during major bear markets reveals its protective power:

Why Gold Rises When Stocks Fall

Several factors drive gold higher during market turmoil:

- Flight to Safety: Investors flee risky assets for perceived safe havens

- Currency Debasement: Central bank money printing weakens fiat currencies

- Inflation Hedge: Economic stimulus often triggers inflation concerns

- Geopolitical Uncertainty: Market crashes often coincide with global instability

During the 2008 financial crisis, while stock investors lost sleep and savings, gold IRA holders watched their precious metals allocation surge 25% higher, offsetting substantial losses in other portfolio components.

Building Your Bear Market Defense Strategy

Setting Up Gold IRA Protection

The key to weathering bear markets is positioning before the storm hits. Here's your action plan:

Step 1: Choose the Right Custodian Select a custodian experienced in precious metals IRAs, offering:

- IRS compliance verification

- Approved depository relationships

- Transparent fee structures

- Educational support resources

Step 2: Understand Investment Minimums

- Initial investment: $5,000 minimum

- Subsequent purchases: $1,000 minimum

- Annual contribution limits: $7,000 (or $8,000 if age 50+)

Step 3: Select IRS-Approved Products Gold must meet minimum 99.5% purity standards. Approved options include:

- American Gold Eagles

- Canadian Gold Maple Leafs

- Credit Suisse gold bars

- PAMP Suisse gold bars

Strategic Allocation for Maximum Protection

Financial advisors typically recommend these allocation strategies based on market conditions:

Conservative Bear Market Protection:

- 10-15% precious metals allocation

- 5-10% specifically in gold

- Remainder in cash and short-term bonds

Aggressive Bear Market Defense:

- 20-25% precious metals allocation

- 15-20% specifically in gold

- Higher allocation during obvious bubble conditions

Timing Your Gold IRA Moves

Dollar-Cost Averaging Strategy: Rather than trying to time the market perfectly, systematic monthly purchases smooth out volatility and build positions gradually.

Rebalancing Opportunities: Bear markets create excellent rebalancing opportunities. When stocks crash and gold rises, you can:

- Maintain target allocations by selling some gold

- Use proceeds to buy discounted stocks

- Position for the eventual recovery

Managing Costs During Market Stress

Understanding the Fee Structure

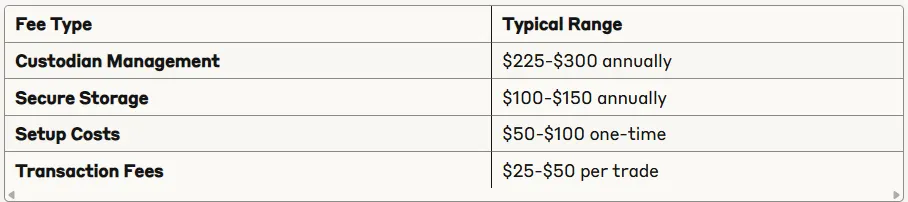

Annual costs for gold IRAs include:

Cost vs. Protection Analysis

While gold IRAs carry storage and management fees, compare these costs to potential bear market losses:

- Annual gold IRA fees: ~$400

- Potential bear market loss on $200,000 portfolio: $70,000-$114,000

- Protection value: 175-285 times the annual fee cost

The math is compelling—modest fees for potentially massive protection.

Exit Strategies and Recovery Planning

When to Hold Gold Positions

Maintain higher gold allocations during:

- Ongoing economic uncertainty

- High inflation periods

- Geopolitical tensions

- Overvalued stock markets

Rebalancing for Recovery

As markets recover and valuations normalize:

- Gradual Reduction: Slowly reduce gold allocation back to normal levels

- Profit Taking: Sell gold gains to buy discounted growth assets

- Tax Management: Time distributions to optimize tax implications

Distribution Considerations

Remember key withdrawal rules:

- Early withdrawal penalty: 10% if under age 59½

- Required minimum distributions begin at age 73

- Tax treatment follows traditional IRA rules

Protect Your Retirement Today - Don't Wait for the Next Crash

The clock is ticking. Market cycles are inevitable, and the next bear market could arrive without warning. Every day you delay implementing gold IRA protection is another day your retirement remains vulnerable to devastating losses.

Here's exactly what you need to do right now:

Step 1: Get Your Free Gold IRA Information Kit

Click here to request your complimentary Gold IRA guide from Birch Gold, one of the most trusted names in precious metals IRAs. This comprehensive kit includes:

- Current gold market analysis

- IRA rollover strategies

- Tax optimization techniques

- Portfolio allocation recommendations

- Step-by-step setup instructions

Step 2: Schedule Your Free Consultation

When you request your information kit, you'll also get access to a complimentary consultation with a precious metals specialist who can:

- Analyze your current portfolio's bear market vulnerability

- Calculate optimal gold allocation for your situation

- Explain rollover options from existing 401(k)s and IRAs

- Walk you through the entire setup process

Step 3: Take Action Within 72 Hours

Speed matters. Market conditions can change rapidly, and precious metals prices fluctuate daily. The investors who protect themselves are those who act decisively when they recognize the need.

Don't let another market crash catch you unprepared. The 2008 financial crisis, dot-com bubble, and COVID crash all arrived suddenly. Those who had gold IRAs in place were protected—those who didn't suffered massive losses.

Secure your retirement today with a free Gold IRA information kit →

Why Birch Gold?

Birch Gold IRA stands out among precious metals IRA companies because they offer:

- No-pressure education: Learn first, decide later

- Transparent pricing: No hidden fees or surprise costs

- IRS-compliant storage: Fully insured, segregated storage options

- Expert guidance: Seasoned precious metals specialists

- A+ BBB Rating: Proven track record of client satisfaction

Your future self will thank you for taking this crucial step toward bear market protection. While others watch their retirement savings evaporate during the next crash, you'll have the peace of mind that comes with a properly diversified, protected portfolio.

Request your free Gold IRA information kit now →

Time is your most valuable asset in retirement planning. Use it wisely.

This information is educational only and doesn't constitute financial advice. Consult qualified professionals before making investment decisions.