Traditional vs Roth Gold IRA

The tax structure you choose for your gold IRA could mean the difference between keeping thousands more of your retirement savings or handing them over to the IRS. Yet many investors rush into precious metals IRAs without understanding this critical decision.

A gold IRA allows you to hold physical precious metals like gold, silver, platinum, and palladium within a tax-advantaged retirement account. Unlike traditional IRAs that hold stocks and bonds, these self-directed accounts store actual metals in IRS-approved depositories.

The choice between Traditional and Roth gold IRAs isn't just about when you pay taxes—it shapes your entire retirement strategy.

Traditional Gold IRA: Pay Later Strategy

A Traditional gold IRA follows the "pay taxes later" approach that most people recognize from conventional retirement accounts.

How Traditional Gold IRAs Work:

- Pre-tax contributions: You may deduct contributions from your current year's taxes

- Tax-deferred growth: Your precious metals appreciate without annual tax consequences

- Taxable distributions: All withdrawals in retirement count as ordinary income

- Required distributions: You must start taking RMDs at age 73

Who Benefits Most from Traditional Gold IRAs

Traditional gold IRAs make sense if you:

- Currently earn a high income and want immediate tax relief

- Expect to be in a lower tax bracket during retirement

- Need the tax deduction to maximize your current contribution capacity

- Plan to retire in a state with lower income taxes

Example: A 45-year-old engineer earning $120,000 annually contributes $7,000 to a Traditional gold IRA. This reduces their current taxable income, potentially saving $1,680 in taxes (assuming a 24% bracket). The gold appreciates tax-free until retirement.

Roth Gold IRA: Pay Now Strategy

Roth gold IRAs flip the tax equation—you pay taxes upfront for complete tax freedom later.

How Roth Gold IRAs Work:

- After-tax contributions: No immediate tax deduction for contributions

- Tax-free growth: Precious metals appreciate without future tax liability

- Tax-free distributions: Qualified withdrawals are completely tax-free

- No RMDs: You never have to withdraw funds during your lifetime

Who Benefits Most from Roth Gold IRAs

Roth gold IRAs work best if you:

- Currently earn moderate income but expect higher retirement income

- Believe tax rates will increase in the future

- Want to leave tax-free assets to heirs

- Don't need the immediate tax deduction

Example: A 30-year-old teacher earning $55,000 contributes $6,000 to a Roth gold IRA using after-tax dollars. After 35 years, their gold has grown to $180,000. Every penny comes out tax-free in retirement.

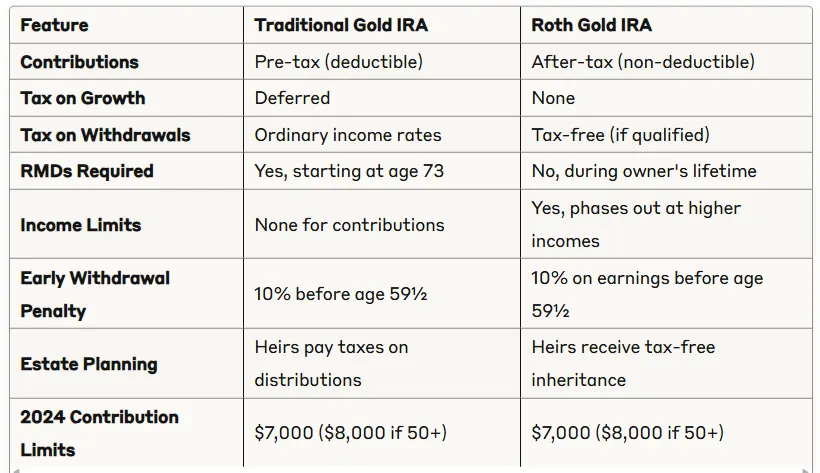

Traditional vs Roth Gold IRA: Complete Comparison

Key Decision Factors

Current vs Future Tax Rates

The fundamental question: Will you pay more in taxes now or later?

Choose Traditional if:

- You're in your peak earning years (typically 40s-50s)

- You expect significantly lower retirement income

- Current tax rates feel historically high

Choose Roth if:

- You're early in your career with room for income growth

- You believe tax rates will increase over time

- You want tax diversification in retirement

Age and Time Horizon

Younger investors (20s-30s) often benefit more from Roth gold IRAs because:

- Lower current income means lower tax cost for conversions

- Decades of tax-free growth

- More flexibility in retirement

Older investors (50s-60s) might prefer Traditional gold IRAs because:

- Higher current income makes tax deductions more valuable

- Less time to recover from paying taxes upfront

- May already have significant Roth assets

Income Considerations

Roth IRAs have income limits that can restrict high earners:

- 2024 limits: Phase-out begins at $138,000 (single) or $218,000 (married filing jointly)

- Backdoor Roth: High earners can contribute to Traditional IRA then convert to Roth

Traditional IRAs have no income limits for contributions, though deductibility may be limited if you have a workplace retirement plan.

Real-World Decision Scenarios

The Young Professional

Sarah, 28, Marketing Manager, $65,000 income

Sarah chooses a Roth gold IRA because:

- She's in a moderate tax bracket (22%)

- Expects higher income and tax rates in 30+ years

- Values the flexibility of no RMDs

- Wants to build tax-free wealth for potential early retirement

The Mid-Career Switcher

Mike, 42, Sales Director, $135,000 income

Mike splits between both:

- Maximizes Traditional 401(k) at work for immediate tax relief

- Contributes to Roth gold IRA for tax diversification

- Plans to do Roth conversions in early retirement years

The Pre-Retiree

Linda, 58, Business Owner, $200,000 income

Linda chooses Traditional gold IRA because:

- High current tax bracket (35%)

- Plans to retire to lower-tax state

- Expects lower retirement income

- Values immediate tax deduction

Making Your Decision: Action Steps

Step 1: Calculate Your Break-Even Point Compare the future value of paying taxes now vs later using online calculators that factor in tax rates and time horizons.

Step 2: Consider Your Complete Tax Picture

- Current retirement account balances

- Expected Social Security and pension income

- Other investment accounts

- Inheritance expectations

Step 3: Plan for Tax Diversification Having both Traditional and Roth accounts gives you flexibility to manage tax brackets in retirement.

Step 4: Consult Professionals Speak with:

- Tax professional about current situation

- Financial advisor about retirement projections

- Gold IRA custodian about implementation

The Bottom Line

Traditional gold IRAs work best for high earners who need immediate tax relief and expect lower retirement tax rates. Roth gold IRAs benefit younger investors and those who believe tax rates will rise.

The "right" choice depends on your unique situation, but here's the key insight: You don't have to choose just one. Many successful retirement savers use both Traditional and Roth accounts to create tax flexibility.

Whether you choose Traditional, Roth, or both, the most important decision is getting started. The tax advantages of either gold IRA type far outweigh keeping precious metals in taxable accounts.

Your retirement security depends on making informed decisions today. Take time to analyze your situation, run the numbers, and choose the gold IRA structure that aligns with your long-term financial goals.