Best Gold IRA Custodians

Are you considering adding physical precious metals to your retirement portfolio? A Gold IRA offers a way to diversify with tangible assets, but selecting the right custodian is crucial for security, compliance, and cost efficiency. This guide breaks down everything you need to know about the top Gold IRA custodians in 2025.

Why You Need a Specialized Gold IRA Custodian

Unlike traditional IRAs that hold paper assets such as stocks and bonds, a Gold IRA holds physical precious metals. The IRS requires these physical assets to be managed by an authorized custodian and stored in an approved depository.

A Gold IRA custodian:

- Handles the administrative paperwork and IRS reporting

- Facilitates purchases of IRS-approved precious metals

- Arranges secure storage at an approved depository

- Manages transactions when you want to sell metals or take distributions

Choosing the wrong custodian can result in higher fees, limited investment options, poor customer service, and potentially even IRS penalties if regulations aren't followed correctly.

What to Look for in a Gold IRA Custodian

Before diving into specific companies, here are the key factors that separate the best Gold IRA custodians from the rest:

1. Reputation and Track Record

- Years in business

- Better Business Bureau rating

- Customer reviews and testimonials

- Regulatory compliance history

2. Fee Structure

- Setup fees

- Annual maintenance fees

- Storage fees (segregated vs. non-segregated)

- Transaction/commission fees

- Buyback policies

3. Available Metals and Services

- Selection of IRA-eligible gold, silver, platinum, and palladium

- Educational resources

- Rollover assistance

- Account management tools

4. Storage Options

- Choice of depositories

- Segregated vs. commingled storage

- Geographic diversification

5. Customer Service

- Dedicated account representatives

- Educational support

- Transparent practices

Top Gold IRA Custodians in 2025

1. Augusta Precious Metals

Augusta Precious Metals stands out for its transparency and educational approach. They emphasize customer education and offer a streamlined process for Gold IRA setup and management.

Strengths:

- Exceptional educational resources

- Transparent fee structure with no hidden costs

- Strong focus on customer service

- Lifetime customer support

Consideration:

- Higher minimum investment requirement ($50,000)

- Limited metal selection compared to some competitors

2. Goldco

Goldco has built a reputation for excellent customer service and specializes in helping clients roll over existing retirement accounts into precious metals IRAs.

Strengths:

- Straightforward rollover process

- Competitive pricing

- Strong buyback program

- Comprehensive educational materials

Consideration:

- Account setup may take longer than some competitors

3. Birch Gold Group

Birch Gold Group emphasizes education and personalized service, making them popular among first-time precious metals investors.

Strengths:

- Extensive educational resources

- Low minimum investment

- Wide selection of IRA-eligible metals

- Strong customer support team

Consideration:

- Storage fees may be higher than some competitors

4. American Hartford Gold

American Hartford Gold offers a streamlined approach with a focus on making the Gold IRA process accessible to all investors.

Strengths:

- No minimum investment requirement

- Fast processing times

- Free storage for qualifying accounts

- Simple fee structure

Consideration:

- More limited selection of platinum and palladium products

5. Noble Gold Investments

Noble Gold distinguishes itself with unique storage options and emergency preparedness packages.

Strengths:

- Rare metals options

- Texas storage facility option

- Royal Survival Packs for crisis preparation

- Low pressure sales approach

Consideration:

- Newer to the industry than some competitors

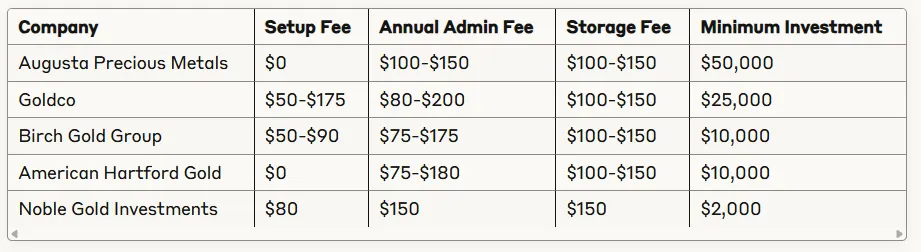

Custodian Fee Comparison

Note: Fees may vary based on account size and specific services. Always verify current fees directly with the custodian.

Note: Fees may vary based on account size and specific services. Always verify current fees directly with the custodian.

Storage Options and Security

All IRS-approved gold must be stored in an authorized depository. The most common options include:

- Delaware Depository - Located in Wilmington, Delaware with state-of-the-art security

- Brinks Global Services - Worldwide network of secure vaults

- Texas Precious Metals Depository - A newer option offering storage within Texas state borders

Most custodians offer two storage options:

- Segregated storage - Your metals are stored separately from others (higher fee)

- Non-segregated storage - Your metals are stored alongside others' assets (lower fee)

Both options provide full insurance coverage and regular audits to verify holdings.

How to Choose the Right Custodian for Your Needs

The best custodian for you depends on your specific situation:

1. For retirement investors with larger portfolios ($50,000+): Augusta Precious Metals offers premium service with strong educational support

2. For those primarily concerned with rollovers: Goldco specializes in efficient transfers from existing retirement accounts

3. For first-time precious metals investors: Birch Gold Group provides excellent educational resources and lower minimums

4. For those with smaller investment amounts: Noble Gold offers the lowest entry point at $2,000

5. For those wanting storage in Texas: Consider Noble Gold or American Hartford Gold

Steps to Set Up Your Gold IRA

- Select a custodian based on your research and needs

- Complete application paperwork (online or physical)

- Fund your account through:

- Direct contribution (subject to annual limits)

- Rollover from existing IRA

- Transfer from 401(k), 403(b), or TSP

- Select your metals from IRA-approved options

- Finalize purchase and arrange for secure storage

- Monitor and manage your investment

Take Action Now to Secure Your Retirement

Gold IRAs provide a tangible hedge against inflation and economic uncertainty. By selecting the right custodian, you ensure your precious metals investment complies with IRS regulations while minimizing fees and maximizing security.

Before making your decision:

- Request information kits from multiple custodians

- Compare fee structures carefully

- Read customer reviews

- Speak with representatives to gauge knowledge and service quality

- Verify all claims about storage and security

Remember that a Gold IRA should be part of a diversified retirement strategy. Most financial advisors recommend allocating 5-15% of your portfolio to precious metals for optimal diversification.

By taking the time to select the right custodian now, you'll set yourself up for a smoother precious metals investing experience and greater peace of mind about your retirement security.