Taking Posession of Gold IRA Distributions: Your Complete Guilde to Physical Gold Withdrawals

Picture this scenario: You've spent years building your gold IRA, watching precious metals protect your retirement savings from market volatility. Now you're ready to access those funds—but here's where many investors hit a wall of confusion.

Can you actually take physical possession of the gold in your IRA? The short answer is yes, but the process involves specific rules, tax implications, and costs that could significantly impact your retirement strategy.

Understanding Gold IRA Distribution Basics

A distribution from your gold IRA occurs when you withdraw assets from the account. Unlike traditional IRAs holding stocks or bonds, gold IRAs present unique options for how you receive your money.

Distribution becomes penalty-free when you reach:

- Age 59½ for most circumstances

- Age 55 if you separate from service (for employer-sponsored plans)

- Earlier in specific hardship situations

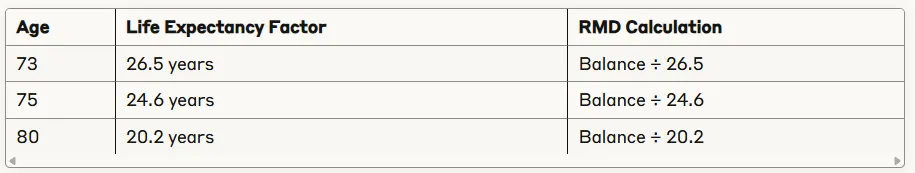

Required Minimum Distributions (RMDs) kick in at age 73 for traditional gold IRAs, forcing you to withdraw a calculated amount annually based on your life expectancy.

Your Two Distribution Options

Option 1: Cash Liquidation

Your custodian sells your precious metals and deposits cash into your account. This represents the most common distribution method because:

- Faster processing (typically 3-7 business days)

- Lower transaction costs

- Simpler tax reporting

- No storage concerns post-distribution

Option 2: Physical Possession (In-Kind Distribution)

You receive the actual gold, silver, platinum, or palladium from your IRA. This option appeals to investors who want to:

- Maintain direct control over their precious metals

- Continue holding physical assets outside the IRA structure

- Avoid potential liquidation timing issues

The Physical Possession Process: Step by Step

1. Contact Your Custodian Submit a distribution request specifying you want physical delivery. Most custodians require 5-10 business days advance notice.

2. Complete Required Paperwork You'll need to provide:

- Distribution request forms

- Shipping address verification

- Tax withholding elections

- Identity confirmation documents

3. Custodian Coordinates with Depository Your custodian instructs the IRS-approved depository to prepare your metals for shipment.

4. Shipping and Insurance Metals ship via insured, trackable methods (typically FedEx or UPS). You'll receive tracking information and delivery confirmation requirements.

5. Receipt and Verification Upon delivery, immediately verify the contents match your distribution paperwork. Report any discrepancies within 24 hours.

Timeline: Expect 7-14 business days from request to delivery.

Tax Implications You Must Understand

Traditional Gold IRA Distributions

Every dollar distributed counts as ordinary income for tax purposes, regardless of whether you take cash or physical metals.

Example calculation:

- Distribution amount: $50,000 in gold

- Your tax bracket: 24%

- Federal tax owed: $12,000

- Plus state taxes (varies by location)

Roth Gold IRA Distributions

Qualified distributions are completely tax-free if you're over 59½ and the account has existed for at least 5 years.

Early Withdrawal Penalties

10% penalty applies to traditional IRA distributions before age 59½, calculated on the full distribution amount.

Penalty calculation example:

- Early distribution: $30,000

- 10% penalty: $3,000

- Plus regular income taxes on the full $30,000

Check out the comprehensive rules about early withdrawals here: https://goldenkey.foundation/blog/gold-ira-early-withdrawal-penalty-what-you-need-to-know-before-touching-your-retirement-gold

Costs That Impact Your Distribution

Liquidation Fees

Cash distributions typically involve:

- Dealer buyback spreads: 2-5% below market value

- Transaction fees: $25-100 per transaction

Physical Delivery Costs

Taking possession involves:

- Shipping and insurance: $150-500 depending on value and distance

- Handling fees: $50-200 per shipment

- Potential storage costs if you need secure storage post-delivery

Smart Alternatives to Consider

Partial Distributions

Instead of emptying your entire account, consider taking smaller, strategic distributions to:

- Manage tax brackets more effectively

- Maintain some IRA tax advantages

- Reduce transaction costs

Rollover to Different Custodian

If you're unhappy with distribution options or fees, you can rollover your gold IRA to a different custodian offering:

- Better buyback policies

- Lower distribution fees

- More flexible distribution timing

Find out more about the best custodians here: https://goldenkey.foundation/blog/best-gold-ira-custodians

Professional Storage Solutions

After taking physical possession, many investors use:

- Home safes for smaller amounts

- Bank safety deposit boxes for medium holdings

- Private vault facilities for larger collections

Required Minimum Distribution Considerations

Starting at age 73, you must take annual RMDs from traditional gold IRAs. Here's what this means:

RMD penalty: 25% of the shortfall if you fail to take required distributions.

Making the Right Decision

Choose cash liquidation if you:

- Need funds quickly

- Want to minimize transaction costs

- Plan to invest proceeds elsewhere

- Prefer simplicity in tax reporting

Choose physical possession if you:

- Want continued precious metals exposure

- Have secure storage arrangements

- Don't need immediate liquidity

- Value direct asset control

Your Next Steps

Before making any distribution decisions:

- Calculate total costs including taxes, penalties, and fees

- Review your overall retirement strategy with a financial advisor

- Consider timing to optimize tax implications

- Verify storage options if taking physical possession

- Get quotes from multiple custodians for comparison

Remember: Once you take a distribution, you cannot return those funds to the IRA. This decision carries permanent tax consequences that could impact your long-term financial security.

Taking possession of gold from your IRA represents a significant financial decision requiring careful planning. While the process is straightforward, the tax and cost implications demand thorough consideration of your individual circumstances and retirement goals.