BRIC Countries Gold Purchasing

Strategic Asset Accumulation Reshaping Global Markets

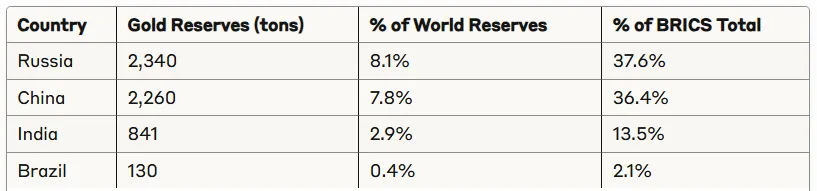

The BRIC nations—Brazil, Russia, India, and China—are dramatically reshaping global gold markets through unprecedented purchasing patterns. These emerging economic powerhouses collectively control over 21% of worldwide gold reserves and show no signs of slowing their accumulation strategy.

What Are BRIC Countries and Why Gold Matters

Originally coined by Goldman Sachs economist Jim O'Neill in 2001, BRIC represents four major emerging economies: Brazil, Russia, India, and China. The group has since expanded to BRICS with South Africa's inclusion in 2010, and further expanded to 10 members by 2025 with Egypt, Ethiopia, Iran, UAE, and Indonesia joining.

Central banks are on track to purchase 2,700 tons of gold since 2022, the fastest pace in recent history. The BRICS alliance continues its gold buying spree in 2024 as China, Russia, and India stockpile the precious metal to their Central Banks.

Individual Country Analysis: The Big Players

China Leads the Charge

China dominates BRIC gold purchasing through its People's Bank of China (PBoC). The PBoC was one of the top gold buyers out the world's central banks for 2024, purchasing another 44 MT of gold during the year. In 2001, the PBoC had 400 MT of gold in reserve, but in just a little more than two decades that total has climbed by 459 percent.

Key China Gold Statistics:

- Current reserves: 2,279.56 metric tons

- Growth since 2001: 459% increase

- Strategic significance: As of February 2024, gold accounts reached 4.3% of China's official foreign exchange reserves from 2.9% in 2019

The Chinese strategy reflects broader geopolitical considerations. After the EU and US slapped Russia with sanctions, which included freezing its central bank's foreign reserves, it made many central banks rethink on the kind of reserve assets they should be holding

Russia's Strategic Response

Russia holds the largest BRIC gold reserves at 2,340 metric tons, representing 8.1% of global reserves. In early 2022, Russia tied its currency, the ruble, to the yellow metal. "The plan was to shift the currency away from a pegged value and into the gold standard itself so the ruble would become a credible gold substitute at a fixed rate"

The sanctions imposed after Ukraine's invasion accelerated Russia's gold accumulation strategy as a hedge against Western financial restrictions.

India's Cultural and Strategic Buying

India combines cultural affinity for gold with strategic central bank purchasing. The Reserve Bank of India (RBI) was once again a major purchaser in 2024, having bought gold every month before leaving reserves unchanged in December. Its annual purchases totalled 73t, more than four times the level of its gold buying in 2023 (16t)

India's Gold Position:

- Current reserves: 876 metric tons (13.5% of BRICS total)

- 2024 purchases: 73 metric tons

- Share of total reserves: 11%

Brazil: The Emerging Player

Brazil holds 129.7 metric tons, representing 2.1% of BRICS gold reserves. While smaller than its counterparts, Brazil's position as 2025 BRICS president signals potential expansion of its gold strategy.

Motivations Behind Massive Gold Accumulation

Diversification Away from US Dollar Dominance

By the end of 2023, USD accounted for approximately 58% of global foreign exchange reserves, compared to more than 70% in the 1990s

The systematic reduction in dollar dependence drives BRIC gold purchasing. Central banks seek assets immune to currency manipulation and sanctions.

Geopolitical Insurance Policy

Central bank purchases of gold have since gone into top gear after the US weaponized the dollar in 2022, through financial sanctions on Russia after its invasion of Ukraine. Gold has soared from $1,942/oz at the end of first quarter 2022 to $2,689/oz

Inflation Hedging and Economic Stability

Central banks view gold as protection against:

- Currency devaluation

- Inflation pressures

- Financial market volatility

- Economic uncertainty

The planned purchases are chiefly motivated by a desire to rebalance to a more preferred strategic level of gold holdings, domestic gold production, and financial market concerns including higher crisis risks and rising inflation

Market Impact: Gold Price Explosion

BRIC purchasing patterns directly influence global gold markets:

2024 Performance Metrics:

- Central banks added 1,044.6 MT of gold to their vaults in 2024, the third year in a row that gold purchases in this segment surpassed the 1,000 MT mark

- Record highs: Gold peaked at $2,778/oz in October 2024

- Q4 2024: In the fourth quarter of 2024 alone, central banks picked up another record 332.9 MT of gold

Supply and Demand Dynamics

BRIC nations control significant portions of global reserves:

The BRICS Currency Factor

The Brics nations are exploring the creation of a common currency that would be pegged partly to gold and partly to a basket of their own currencies. The initiative, which would leverage distributed ledger technology as its foundation, has already drawn sharp criticism.

Potential Gold-Backed Currency Benefits:

- Reduced transaction costs

- Lower exchange rate volatility

- Enhanced trade efficiency

- Independence from dollar-dominated systems

If even 50% of intra-Brics trade shifted to such a currency, cost savings of 1% to 2% per transaction would add up to billions of dollars.

Future Implications for Investors

Coordinated Purchasing Power

As of mid-2024, Brics nations collectively held 5,700 tonnes of gold, representing 16% of global reserves. Over the past two decades, these reserves have grown threefold.

Investment Considerations

Bullish Factors:

- 29% of central banks respondents intend to increase their gold reserves in the next twelve months, the highest level we have observed since we began this survey in 2018

- Continued geopolitical tensions

- Dollar diversification trends

- Inflation concerns

Market Outlook:

- We think its price could go as high as $3,100/oz in 2025

- Central bank demand remains structurally strong

- BRICS expansion could accelerate purchasing

What This Means for Global Finance

BRIC gold purchasing represents more than investment strategy—it signals a fundamental shift in global monetary architecture. BRICS nations represented more than 26% of the world's GDP in 2023. They intend to diversify their foreign exchange reserves and promote the use of their national currencies.

The concentrated effort to accumulate gold reflects these nations' determination to reduce dependence on Western financial systems while building alternative monetary frameworks. For investors, this trend suggests continued upward pressure on gold prices as the world's largest emerging economies systematically increase their precious metal reserves.

The BRIC gold purchasing phenomenon demonstrates how economic power shifts can reshape entire asset classes. As these nations control over 40% of global population and 30% of GDP, their collective gold strategy deserves serious attention from investors planning for a multipolar financial future.