Gold American Eagles in IRA: Your Complete Investment Guide

Picture this scenario: You're reviewing your retirement portfolio and realize that 100% of your savings are tied to paper assets—stocks, bonds, and mutual funds. What happens when inflation surges, markets crash, or currency values plummet? Smart investors are turning to Gold American Eagles in IRAs as a proven hedge against economic uncertainty.

The numbers tell the story. Gold American Eagles rank as the most popular gold bullion coins worldwide, with millions of ounces sold annually. More importantly, they're among the few gold coins that qualify for IRA investment despite having lower purity than typical IRA-approved gold products.

Here's what makes them special: Unlike other gold investments that require 99.5% purity, American Gold Eagles qualify for IRAs at 22-karat (91.67% pure gold) due to specific IRS exemptions for certain U.S. government-issued coins.

Why Gold American Eagles Solve Modern Retirement Challenges

Today's retirees face unprecedented challenges that previous generations never encountered:

Inflation Reality Check

- Currency devaluation erodes purchasing power

- Traditional savings accounts offer negative real returns

- Fixed-income investments fail to keep pace with rising costs

Market Volatility Concerns

- Stock market crashes can devastate retirement savings

- Bond portfolios struggle in rising interest rate environments

- Economic uncertainty creates unpredictable investment landscapes

Portfolio Concentration Risk

- Over-reliance on paper assets creates vulnerability

- Geographic concentration in single economies

- Lack of tangible asset allocation

Gold American Eagles address these concerns by providing a tangible, government-backed precious metal that has maintained value for thousands of years.

IRS Requirements and Eligibility Standards

Special Exception Status

Gold American Eagles benefit from a unique IRS exemption that allows them to qualify for IRA investment despite their 22-karat purity. Here's the regulatory framework:

IRS Code Section 408(m)(3)(A) specifically permits:

- American Gold Eagle coins

- American Silver Eagle coins

- American Platinum Eagle coins

- American Palladium Eagle coins

Storage Requirements:

- Must be held at IRS-approved depositories

- Cannot be stored at home or in personal safes

- Professional custody required at all times

Condition Standards:

- Brilliant uncirculated condition required for bullion versions

- Proof coins must be in original mint packaging

- No damaged or cleaned coins accepted

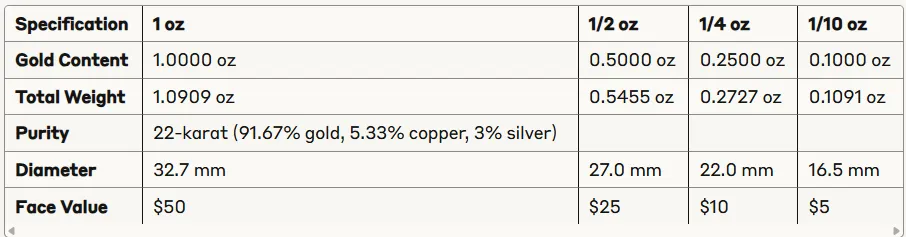

Gold American Eagle Specifications

Physical Characteristics

Design Elements

Obverse (Front):

- Augustus Saint-Gaudens' iconic Liberty design

- Originally created for the 1907 $20 Double Eagle

- Considered one of America's most beautiful coin designs

Reverse (Back):

- Miley Busiek's family of eagles design

- Male eagle carrying olive branch to nest

- Female eagle and eaglets in nest

Setting Up Your Gold American Eagle IRA

Step 1: Choose a Qualified Custodian

Not all IRA custodians handle precious metals. Select custodians offering:

Essential Services:

- IRS compliance verification

- Established depository relationships

- Transparent fee structures

- Educational resources and support

Top Considerations:

- Minimum investment requirements (typically $5,000-$10,000)

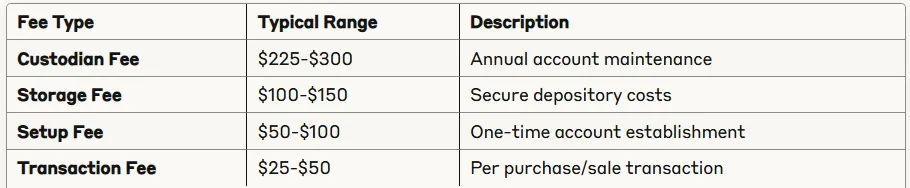

- Annual fees ($225-$300 range)

- Storage costs ($100-$150 annually)

- Transaction fees ($25-$50 per trade)

Step 2: Fund Your Account

Three Primary Funding Methods:

1. 401(k) Rollover

- Transfer funds from employer-sponsored plans

- No tax penalties when done properly

- Maintain tax-deferred status

2. IRA Transfer

- Move existing IRA funds to precious metals custodian

- Direct trustee-to-trustee transfers avoid tax issues

- Preserve current tax treatment

3. Annual Contributions

- 2025 limits: $7,000 annually ($8,000 if age 50+)

- Traditional IRA: Potential tax deduction

- Roth IRA: Tax-free qualified withdrawals

Step 3: Select Your Products

Bullion vs. Proof Versions:

Bullion American Eagles:

- Lower premiums over spot gold price

- Mass-produced for investment purposes

- Brilliant uncirculated condition

- Typical premiums: 3-6% over spot

Proof American Eagles:

- Higher premiums due to limited mintages

- Collector appeal and numismatic value

- Mirror-like finish and frosted designs

- Typical premiums: 15-25% over spot

Cost Analysis and Fee Structure

Premium Costs Over Spot Price

Gold American Eagles carry premiums above the spot gold price due to:

Manufacturing Costs:

- U.S. Mint production expenses

- Quality control and certification

- Distribution network markups

Market Factors:

- Supply and demand dynamics

- Dealer margins and overhead

- Storage and insurance costs

Annual Fees Breakdown

Cost-Benefit Analysis

While Gold American Eagles carry higher premiums than generic gold bars, they offer unique advantages:

Benefits Justifying Premiums:

- Government backing and guaranteed content

- High liquidity and universal recognition

- IRA eligibility despite lower purity

- Potential numismatic appreciation

Investment Strategy and Portfolio Allocation

Recommended Allocation Percentages

Financial advisors typically suggest:

Conservative Investors (Age 60+):

- 5-10% precious metals allocation

- 80-90% of metals in gold

- Emphasis on wealth preservation

Moderate Investors (Age 40-60):

- 10-15% precious metals allocation

- 70-80% of metals in gold

- Balance growth and protection

Aggressive Investors (Under 40):

- 15-20% precious metals allocation

- 60-70% of metals in gold

- Higher growth potential focus

Risk Management Considerations

Benefits of Gold American Eagles:

- Inflation hedge historically

- Portfolio diversification

- Crisis insurance against economic uncertainty

- Currency devaluation protection

Risk Factors to Consider:

- Price volatility in short term

- No dividend or interest income

- Storage and insurance costs

- Liquidity considerations during market stress

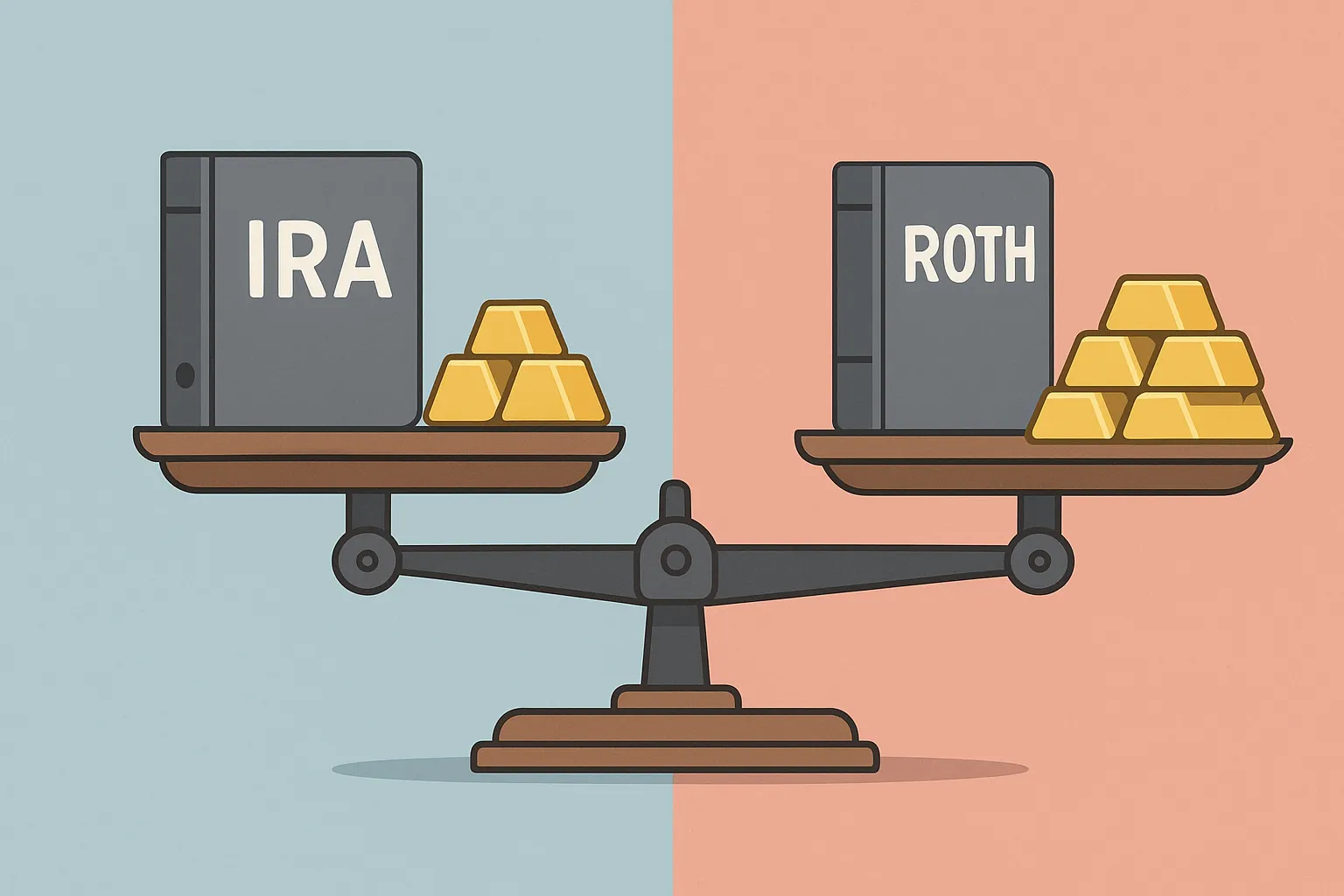

Tax Implications and Withdrawal Strategies

Tax Treatment Options

Traditional Gold IRA:

- Contributions may be tax-deductible

- Tax-deferred growth during accumulation

- Ordinary income tax on withdrawals

- Required minimum distributions begin at age 73

Roth Gold IRA:

- After-tax contributions (no deduction)

- Tax-free growth and qualified withdrawals

- No required minimum distributions

- Five-year rule for earnings withdrawals

Distribution Strategies

Age 59½ and Beyond:

- Penalty-free withdrawals available

- Choose cash liquidation or in-kind distribution

- Consider tax implications of withdrawal timing

Required Minimum Distributions:

- Begin at age 73 for traditional IRAs

- Custodian can liquidate metals to meet RMD requirements

- Plan distribution strategy to minimize tax impact

Gold American Eagles vs. Other Precious Metals Options

Comparison with Other Gold Products

American Eagles vs. Canadian Maple Leafs:

- Eagles: 22-karat, government backing, higher premiums

- Maple Leafs: 24-karat, lower premiums, higher purity

American Eagles vs. Gold Bars:

- Eagles: Higher premiums, better liquidity, numismatic potential

- Bars: Lower premiums, pure investment play, less recognition

Gold vs. Other Precious Metals

Silver Considerations:

- Higher volatility than gold

- Industrial demand component

- Lower entry costs for small investors

Platinum and Palladium:

- Higher industrial exposure

- More volatile pricing

- Smaller markets and liquidity concerns

Take Action: Secure Your Retirement with Gold American Eagles

The time to act is now. Every day you delay adding Gold American Eagles to your retirement portfolio is another day your savings remain vulnerable to inflation, market crashes, and currency devaluation.

Here's your immediate action plan:

Step 1: Get Your Free Gold IRA Kit

Stop researching and start protecting your retirement today.

Click the link below to receive a comprehensive Gold IRA information kit that includes:

- Complete guide to Gold American Eagle IRAs

- Fee comparison charts across top custodians

- Tax implications worksheet

- Portfolio allocation recommendations

- Current gold market analysis

Click here to request your FREE Gold IRA Kit →

Step 2: Speak with a Precious Metals Specialist

Don't navigate this alone.

Within 24 hours of requesting your kit, a qualified precious metals specialist will contact you to:

- Assess your current retirement portfolio

- Calculate optimal Gold American Eagle allocation

- Explain rollover options from 401(k) or existing IRA

- Answer all your questions about the process

Step 3: Fund Your Gold American Eagle IRA

Choose your funding method:

- 401(k) Rollover - Transfer funds tax-free from employer plans

- IRA Transfer - Move existing IRA funds to precious metals custodian

- Annual Contribution - Add $7,000 annually ($8,000 if 50+)

Why Act Today?

Gold prices are at historic levels, but smart investors know that protection matters more than timing the market perfectly.

Consider these facts:

- Inflation continues eroding purchasing power of cash and bonds

- Stock market volatility threatens traditional retirement portfolios

- Currency uncertainty makes tangible assets more valuable

- Limited-time incentives may be available for new Gold IRA accounts

Professional Consultation Benefits

When you request your free kit, you gain access to:

Expert Guidance:

- Certified precious metals specialists

- IRA rollover specialists

- Tax-advantaged strategy consultations

- No-pressure educational approach

Comprehensive Support:

- Step-by-step account setup assistance

- Product selection guidance

- Ongoing portfolio monitoring

- Educational resources and market updates

Transparent Pricing:

- No hidden fees or surprise charges

- Competitive premium pricing

- Clear fee structure explanation

- Best price guarantees on qualifying purchases

Success Stories from Gold American Eagle Investors

"I wish I had done this sooner," says Robert M., age 67. "My Gold American Eagles have provided peace of mind during market downturns that my stock portfolio never could. When everything else was falling, I knew my gold was still there."

"The rollover process was easier than I expected," reports Sarah K., age 52. "The specialist walked me through every step, and now 15% of my retirement is protected with Gold American Eagles. I sleep better knowing I'm diversified."

Don't Wait - Your Financial Security Depends on Action

Every month you delay costs you potential protection. While others watch their paper assets fluctuate with market emotions, you can own tangible Gold American

Eagles backed by the U.S. government.

The process takes just minutes to start:

- Click the link below to request your free information kit

- Review the materials at your own pace

- Speak with a specialist to answer your questions

- Fund your Gold American Eagle IRA and protect your retirement

Get Your FREE Gold IRA Information Kit Now →

Limited Time: New accounts may qualify for special incentives, including reduced fees or bonus silver purchases. Don't miss this opportunity to protect your retirement with America's most trusted gold coin.

Summary: Your retirement deserves the protection that only Gold American Eagles can provide. Take the first step today by requesting your free information kit and speaking with a precious metals specialist who can guide you through the process.

Secure Your Retirement with Gold American Eagles - Click Here →

This information is for educational purposes only and does not constitute financial advice. Consult with qualified tax and financial professionals before making investment decisions. Gold and precious metals investing involves risk and may not be suitable for all investors.