PAMP Suisse Gold Bars for IRAs: Your Complete Investment Guide

Swiss precision meets retirement security. When it comes to precious metals IRAs, discerning investors consistently choose PAMP Suisse gold bars for one compelling reason: unmatched quality standards that have defined Swiss excellence for over five decades.

Your retirement deserves better than ordinary gold. While countless refiners produce gold bars, PAMP Suisse stands apart with its meticulous attention to detail, innovative security features, and global recognition that ensures your IRA investment maintains maximum liquidity and value.

Smart investors understand that not all gold bars are created equal. PAMP Suisse products command premium recognition worldwide, making them ideal for retirement portfolios that demand both security and growth potential.

Take action today by understanding exactly how PAMP Suisse gold bars can strengthen your retirement strategy through a properly structured precious metals IRA.

The PAMP Suisse Legacy: Swiss Excellence Since 1977

PAMP (Produits Artistiques Métaux Précieux) Suisse established itself as the world's leading precious metals refiner through an unwavering commitment to quality that mirrors Switzerland's reputation for precision manufacturing.

Key credentials that matter to IRA investors:

- LBMA Accreditation: Full London Bullion Market Association certification ensuring global acceptance

- ISO 9001 Certification: Quality management systems meeting international standards

- Swiss Manufacturing: Produced in Castel San Pietro, Switzerland with legendary Swiss precision

- Global Recognition: Accepted by major exchanges, dealers, and institutions worldwide

This reputation translates directly into investment advantages: higher liquidity, better resale values, and universal acceptance when you need to liquidate your holdings.

IRS Requirements: Why PAMP Suisse Qualifies

The Internal Revenue Service maintains strict standards for gold eligible for Individual Retirement Accounts. Understanding these requirements explains why PAMP Suisse products consistently meet IRA eligibility criteria.

Minimum Purity Standards

Gold must achieve minimum fineness of 99.5% (.995) to qualify for IRA inclusion. PAMP Suisse gold bars exceed this requirement at 99.99% (.9999) purity, providing a substantial margin above IRS minimums.

Approved Manufacturer Criteria

All IRA-eligible gold products must originate from refiners accredited by recognized institutions. PAMP Suisse holds accreditation from:

- London Bullion Market Association (LBMA)

- Major commodity exchanges worldwide

- Swiss regulatory authorities

- International quality certification bodies

Storage and Condition Requirements

IRA gold must be stored at IRS-approved depositories in brilliant uncirculated condition. PAMP products arrive sealed in protective assay cards, maintaining pristine condition throughout the investment period.

PAMP Suisse Gold Bar Specifications

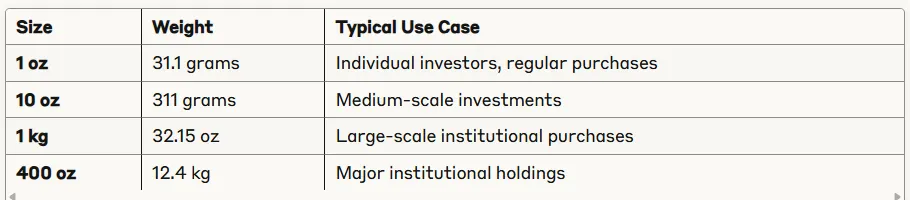

Available Sizes for IRA Investment

PAMP Suisse produces gold bars in multiple sizes suitable for retirement accounts:

Most IRA investors prefer 1 oz and 10 oz bars for their flexibility and manageable premiums over spot prices.

Purity and Authentication Features

Gold Content: 99.99% (.9999) fine gold Certification: Each bar includes detailed assay certificate Serial Numbers: Unique identification for tracking and authentication Protective Packaging: Sealed in tamper-evident assay cards

The Iconic Lady Fortuna Design

PAMP Suisse's signature Lady Fortuna design has become synonymous with quality precious metals investment. The classical goddess of fortune and luck graces the front of each bar, while the reverse displays:

- PAMP Suisse logo and name

- Weight and purity specifications

- Serial number

- Fineness designation

This distinctive design provides instant recognition and authentication, crucial factors for IRA liquidity.

Setting Up Your PAMP Suisse Gold IRA

Choosing the Right Custodian

PAMP Suisse gold bars require specialized IRA custodians experienced with precious metals. Select custodians offering:

- Proven Track Record: Years of precious metals IRA experience

- Transparent Pricing: Clear fee structures without hidden costs

- Storage Partnerships: Relationships with multiple IRS-approved depositories

- Customer Education: Resources to support informed decision-making

Investment Minimums and Requirements

Initial Investment: $5,000 minimum purchase of approved precious metals Subsequent Purchases: $1,000 minimum for additional investments

Annual Contributions: $7,000 for 2025 ($8,000 if age 50 or older)

Purchase Process Steps

- Account Setup: Establish precious metals IRA with qualified custodian

- Funding: Transfer funds from existing retirement accounts or make new contributions

- Product Selection: Choose specific PAMP Suisse gold bar sizes and quantities

- Purchase Execution: Custodian executes purchase through authorized dealers

- Storage Allocation: Bars transported to IRS-approved depository for secure storage

Cost Analysis: Understanding Your Investment

Premium Structure

PAMP Suisse gold bars typically carry premiums of 2-4% over spot gold prices, varying by:

- Bar Size: Larger bars generally carry lower percentage premiums

- Market Conditions: Supply and demand fluctuations affect pricing

- Dealer Margins: Different dealers offer varying premium structures

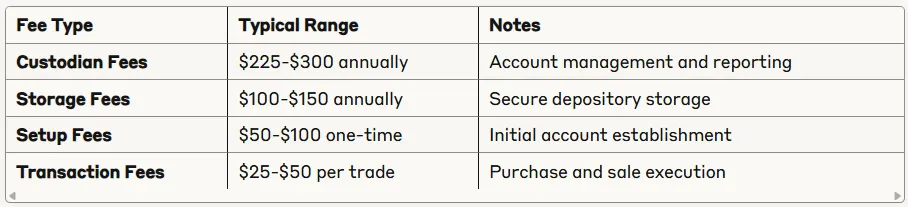

Annual Fees

Cost Comparison Advantages

PAMP Suisse bars often provide better value than coins due to:

- Lower Premiums: Generally 1-2% lower than popular gold coins

- No Collectible Premium: Pure bullion value without numismatic considerations

- Efficient Storage: Rectangular bars maximize storage efficiency

- Consistent Pricing: Standardized products with predictable premium structures

Investment Benefits and Strategic Considerations

Liquidity Advantages

PAMP Suisse gold bars offer superior liquidity through:

Global Recognition: Accepted by dealers and exchanges worldwide

Standardized Products: Consistent specifications simplify transactions

Trusted Brand: Reputation reduces verification time and costs

Active Secondary Market: Strong resale demand maintains competitive pricing

Portfolio Diversification Benefits

Adding PAMP Suisse gold bars to your IRA provides:

- Inflation Protection: Historical hedge against currency devaluation

- Economic Uncertainty Buffer: Safe-haven asset during market volatility

- Currency Diversification: Non-dollar denominated wealth preservation

- Geopolitical Insurance: Tangible assets independent of political stability

Risk Management Considerations

Market Volatility: Gold prices can fluctuate significantly short-term

Storage Dependency: Reliance on third-party custodian and depository services Liquidity Timing: Physical settlement may take longer than paper assets

Fee Impact: Annual costs can affect long-term returns

Tax Implications and Withdrawal Strategies

Tax Treatment

PAMP Suisse gold IRAs follow standard IRA tax rules:

- Traditional IRA: Tax-deferred contributions, ordinary income tax on withdrawals

- Roth IRA: After-tax contributions, tax-free qualified withdrawals

- Early Withdrawal: 10% penalty before age 59½

- Required Distributions: Begin at age 73 for traditional IRAs

Distribution Options

When accessing your gold IRA:

- Cash Liquidation: Custodian sells bars, distributes proceeds

- In-Kind Distribution: Take physical possession (triggers taxable event)

- Partial Liquidation: Gradual withdrawal strategy

- Estate Planning: Beneficiary designations for inheritance planning

Getting Started: Your Action Plan

Step 1: Education Research precious metals IRA regulations and tax implications

Step 2: Custodian Selection Compare custodians specializing in precious metals IRAs

Step 3: Account Funding Determine contribution amounts and funding sources

Step 4: Product Selection Choose PAMP Suisse bar sizes matching your investment goals

Step 5: Implementation Execute your precious metals IRA strategy with professional guidance

Conclusion: Excellence Meets Retirement Security

PAMP Suisse gold bars represent the pinnacle of precious metals manufacturing, combining Swiss precision with global acceptance to create ideal IRA investment products. Their superior purity standards, distinctive Lady Fortuna design, and worldwide recognition provide the quality foundation your retirement portfolio deserves.

The key advantages are clear:

- IRS Compliance: Exceeds all regulatory requirements for precious metals IRAs

- Superior Quality: 99.99% purity with Swiss manufacturing precision

- Global Liquidity: Universal acceptance ensures easy liquidation when needed

- Cost Efficiency: Competitive premiums with transparent fee structures

Your next step: Contact qualified precious metals IRA custodians to discuss how PAMP Suisse gold bars can strengthen your retirement strategy. The combination of Swiss excellence and American tax advantages creates a compelling opportunity for sophisticated retirement planning.

Remember: This information is educational only. Consult qualified tax and financial professionals before making investment decisions that affect your retirement planning.