401k to Gold IRA Coversion Timeline: Complete Step-by-Step Process

Converting your 401k to a Gold IRA typically takes 2-4 weeks from start to finish. However, the exact timeline depends on several factors including your current plan administrator, chosen custodian, and how quickly you complete the required paperwork.

Many investors feel overwhelmed by the conversion process, unsure about timing and potential delays. The good news? With proper preparation and understanding of each phase, you can complete your 401k to Gold IRA rollover smoothly and efficiently.

This guide breaks down the exact timeline, shows you what happens during each phase, and reveals how to avoid common delays that could extend your conversion process.

Understanding 401k to Gold IRA Conversions

A 401k to Gold IRA conversion allows you to transfer funds from your employer-sponsored retirement plan into a self-directed IRA that holds physical precious metals. This process, officially called a "rollover," must follow strict IRS guidelines to maintain your account's tax-advantaged status.

Two main rollover options exist:

- Direct Rollover: Funds transfer directly between custodians (recommended)

- Indirect Rollover: You receive funds temporarily, then deposit into new account within 60 days

Direct rollovers eliminate the risk of taxes and penalties, making them the preferred choice for most investors.

Pre-Conversion Preparation: Days 1-3

Day 1: Verify Eligibility and Gather Documentation

Check your 401k plan rules:

- Review your Summary Plan Description

- Confirm rollover eligibility (some plans restrict in-service withdrawals)

- Identify any plan-specific requirements or restrictions

Gather required documents:

- Photo identification (driver's license or passport)

- Social Security card

- Recent 401k statement

- Employment verification (if still employed)

- Beneficiary information

Day 2-3: Research and Select Your Gold IRA Custodian

Essential custodian criteria:

- IRS approval for precious metals IRAs

- Established track record and positive reviews

- Transparent fee structure

- Partnerships with approved depositories

- Educational resources and customer support

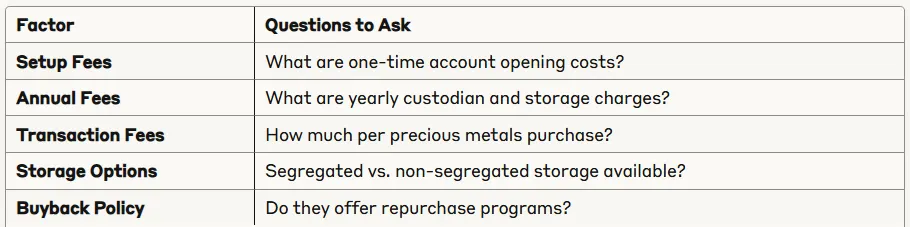

Compare key factors:

Based on industry standards, expect annual custodian fees of $225-$300 and storage fees of $100-$150.

The Conversion Timeline Breakdown

Week 1: Account Setup and Paperwork Processing

Days 4-5: Gold IRA Account Opening

- Complete custodian application

- Submit identification and documentation

- Fund account setup (typically 1-2 business days)

Days 6-7: Rollover Initiation

- Complete rollover paperwork with new custodian

- Submit distribution request to 401k administrator

- Receive confirmation of initiated transfer

Days 8-10: Processing and Verification

- Custodians verify account details

- 401k plan processes distribution request

- Documentation review and approval

Week 2: Fund Transfer and Account Funding

Days 11-12: Distribution Processing

- 401k plan administrator issues distribution

- Funds sent via check or wire transfer

- Transit time varies (1-5 business days)

Days 13-15: Deposit and Confirmation

- Funds arrive at Gold IRA custodian

- Account funding confirmation

- Cash settlement in new account

Days 16-17: Investment Planning

- Custodian contacts you for metal selection

- Review available IRA-approved products

- Discuss allocation strategy

Week 3-4: Precious Metals Purchase and Storage

Days 18-20: Metal Selection and Purchase

- Choose specific gold products (coins, bars, or both)

- Confirm pricing and availability

- Execute purchase orders

Popular IRA-approved gold options:

- American Gold Eagles

- Canadian Gold Maple Leafs

- Austrian Gold Philharmonics

- Credit Suisse gold bars

- PAMP Suisse gold bars

Days 21-25: Delivery and Storage

- Metals shipped to IRS-approved depository

- Storage allocation (segregated or non-segregated)

- Final documentation and confirmations

Days 26-28: Account Finalization

- Receive storage receipts

- Account statements generated

- Conversion process complete

Factors That Affect Your Timeline

Custodian Processing Speed

Different custodians operate at varying speeds. Established companies with streamlined processes typically complete their portions within 3-5 business days, while newer or less efficient providers may take 7-10 days.

401k Plan Administrator Efficiency

Your current plan administrator significantly impacts timeline:

Fast Processors (3-5 days):

- Fidelity

- Vanguard

- Charles Schwab

Average Processors (5-10 days):

- Many regional providers

- Some employer-specific plans

Slow Processors (10+ days):

- Smaller plan administrators

- Plans with manual processing

Documentation Completeness

Complete, accurate paperwork submitted on the first attempt prevents delays. Missing signatures, incorrect account numbers, or incomplete forms can add 3-7 days to your timeline.

Market Conditions

High demand periods for precious metals may extend purchase and delivery phases. During market volatility or economic uncertainty, processing times can increase by 2-5 days.

Common Delays and Prevention Strategies

Incomplete Paperwork Issues

Problem: Missing signatures, incorrect beneficiary information, or incomplete forms

Solution: Review all documents carefully before submission. Use checklists provided by your custodian.

Communication Gaps

Problem: Delayed responses between custodians and plan administrators

Solution: Maintain regular contact with both parties. Request confirmation numbers for all submissions.

Plan Administrator Delays

Problem: Some 401k plans have lengthy internal processing procedures

Solution: Submit requests early in the week and follow up within 3-5 business days if no confirmation received.

Documentation Verification Issues

Problem: Identification or verification documents rejected or unclear

Solution: Provide high-quality copies or originals when required. Ensure all information matches exactly across documents.

Post-Conversion Account Management

Storage Confirmation

Within 30 days of completion, verify:

- Metals arrived at designated depository

- Storage allocation matches your selection

- Insurance coverage is active and adequate

Ongoing Monitoring

Monthly: Review account statements for accuracy

Quarterly: Assess portfolio performance and allocation

Annually: Review custodian fees and service quality

Required Documentation Retention

Maintain copies of:

- Original rollover paperwork

- Purchase confirmations

- Storage receipts

- Annual statements

- Tax reporting documents

Accelerating Your Conversion Timeline

Preparation Strategies

Start early: Begin research and documentation gathering 1-2 weeks before initiating Choose efficient providers: Select custodians known for fast processing

Submit complete packages: Double-check all paperwork before submission

Communication Best Practices

Stay proactive: Contact custodians every 2-3 days for status updates

Maintain records: Document all conversations and confirmation numbers

Address issues immediately: Resolve any problems as soon as they arise

Tax Considerations and Reporting

Converting your 401k to a Gold IRA through a direct rollover typically involves no immediate tax consequences. However, ensure:

- The transfer is custodian-to-custodian

- All funds are transferred within required timeframes

- Proper documentation is maintained for tax records

Important: Consult with a tax professional to understand your specific situation, particularly if you're considering partial rollovers or have multiple retirement accounts.

Start Your 401k to Gold IRA Conversion Today

Converting your 401k to a Gold IRA requires careful planning and execution, but the 2-4 week timeline is achievable with proper preparation.

Your immediate action plan:

- This week: Verify 401k rollover eligibility and gather required documentation

- Next week: Research and select your Gold IRA custodian

- Week 3: Complete account opening and initiate rollover paperwork

- Week 4: Monitor fund transfer and begin precious metals selection

Ready to begin your 401k to Gold IRA conversion?

Don't let another day pass watching your retirement savings remain vulnerable to market volatility and economic uncertainty.

The process becomes simpler when you work with experienced professionals who understand the intricacies of precious metals IRAs and can guide you through each step of the timeline.

Click here to speak with a Gold IRA specialist and start your conversion process today →

You'll receive:

- Free consultation on your specific 401k conversion options

- Timeline customized to your current plan administrator

- Complete documentation checklist to prevent delays

- Access to IRA-approved precious metals at competitive pricing

Remember: The key to a smooth, timely conversion lies in choosing experienced custodians, maintaining complete documentation, and staying actively involved throughout the process.

Success with your 401k to Gold IRA conversion isn't just about timeline—it's about setting up a precious metals retirement strategy that protects and grows your wealth over the long term. By following this timeline and avoiding common pitfalls, you'll complete your conversion efficiently and begin building a more diversified retirement portfolio.

Take the first step toward protecting your retirement savings.

Get your free Gold IRA consultation now →

This information is educational and does not constitute financial advice. Consult with qualified professionals before making investment decisions.