What Happens to Gold if the US defaults on Debt?

The specter of US debt default looms larger with each debt ceiling debate. As America's national debt approaches $33 trillion, many investors wonder: what would happen to gold prices if the unthinkable occurred?

History suggests gold would likely surge dramatically. But the complete picture involves complex economic dynamics that every investor should understand.

The Anatomy of a US Debt Default

A US debt default would occur if the government cannot meet its debt obligations.

This could happen through:

- Technical default: Missing interest payments due to debt ceiling constraints

- Selective default: Prioritizing some payments over others

- Full default: Complete inability to service debt obligations

Each scenario would trigger different market responses, but all would fundamentally shake global confidence in US financial stability.

The last time America came close was 2011, when Standard & Poor's downgraded US credit ratings. Gold prices jumped from $1,500 to over $1,900 per ounce within months.

Gold's Historical Crisis Performance

When financial systems crack, gold shines brightest. Historical data reveals consistent patterns:

Major Crisis Responses:

- 2008 Financial Crisis: Gold rose from $800 to $1,900 (137% gain)

- 1970s Inflation: Gold surged from $35 to $850 (2,300% increase)

- European Debt Crisis (2010-2012): Gold gained 70% as sovereign risks mounted

Gold's appeal during crises stems from its unique characteristics:

✓ No counterparty risk

✓ Limited supply

✓ 5,000-year track record as store of value

✓ Central bank reserve asset

Immediate Market Reactions to Default Risk

A US debt default would trigger massive market dislocations:

Flight to Safety Surge

Institutional investors would frantically seek safe havens. Gold, along with other precious metals, would absorb enormous capital flows as traditional "risk-free" US Treasuries lose their luster.

Dollar Devaluation

The dollar's reserve currency status depends on US creditworthiness. Default would:

- Weaken dollar significantly

- Increase gold's relative value

- Force central banks to diversify reserves

- Accelerate de-dollarization trends

Volatility Explosion

Markets hate uncertainty. Default fears would create:

- Wild price swings across all assets

- Liquidity shortages

- Margin calls forcing asset sales

- Panic buying of physical gold

Long-term Gold Price Implications

Beyond immediate price spikes, default would fundamentally alter gold's long-term trajectory:

Inflation Expectations

Default would likely force massive money printing to manage the crisis. This would:

- Increase inflation expectations dramatically

- Reduce real returns on paper assets

- Drive sustained demand for inflation hedges like gold

Reserve Currency Shifts

The dollar's dominance isn't guaranteed forever. Default could accelerate shifts toward:

- Gold-backed currency systems

- Cryptocurrency alternatives

- Regional currency blocs

- Increased central bank gold purchases

Geopolitical Realignment

US default would reshape global power dynamics:

- China and Russia would promote alternative systems

- BRICS nations might accelerate gold accumulation

- International trade could shift away from dollars

- Gold could reclaim monetary system prominence

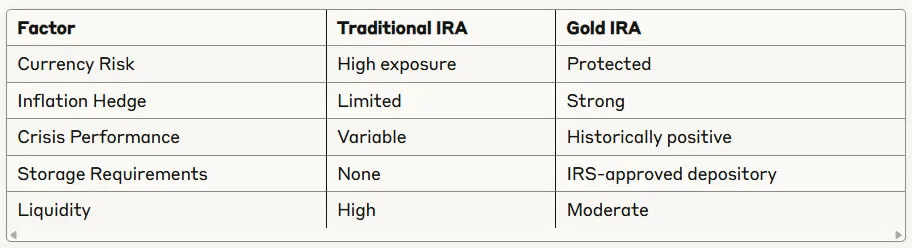

Gold IRA Strategy During Economic Uncertainty

For retirement investors, Gold IRAs offer structured exposure to precious metals during uncertain times:

Diversification Benefits

Gold IRAs provide:

- Portfolio protection against currency devaluation

- Hedge against inflation and economic instability

- Non-correlated asset performance

- Long-term wealth preservation

Key Considerations:

Gold IRAs maintain tax benefits while providing crisis protection:

- Tax-deferred growth (Traditional)

- Tax-free withdrawals (Roth)

- No immediate tax on precious metals appreciation

- Required minimum distributions apply normally

Practical Investment Strategies

Smart investors prepare before crises hit:

Position Sizing Guidelines

- Conservative approach: 5-10% portfolio allocation

- Moderate approach: 10-20% allocation

- Aggressive approach: 20%+ allocation

Consider your risk tolerance and time horizon carefully.

Timing Considerations

Don't wait for default headlines. Gold often moves before events:

- Monitor debt ceiling negotiations

- Watch credit rating agency commentary

- Track central bank gold purchases

- Follow geopolitical tensions

Physical vs. Paper Gold

During extreme crises, physical gold offers advantages:

- No counterparty risk

- Direct ownership

- Crisis liquidity

- Regulatory protection

However, Gold IRAs require IRS-approved storage, which actually provides:

- Professional security

- Insurance coverage

- Compliance assurance

- Ease of management

Risk Management Approaches

Even gold investments carry risks:

Potential Downsides:

- Price volatility: Gold can be extremely volatile short-term

- Storage costs: Physical gold requires secure storage

- No income: Gold doesn't pay dividends or interest

- Regulatory changes: Government policies could affect ownership

Mitigation Strategies:

- Dollar-cost averaging into positions

- Diversifying across precious metals

- Maintaining adequate cash reserves

- Understanding tax implications

The Bottom Line

US debt default would likely drive gold prices significantly higher through multiple channels: flight to safety, dollar devaluation, inflation fears, and long-term monetary system changes.

While default remains unlikely, the mere possibility creates compelling reasons to consider gold allocation. For retirement investors, Gold IRAs offer tax-advantaged exposure to this crisis hedge.

The key is preparation, not panic. Start building precious metals positions before you need them. As the old saying goes: "Buy gold when nobody wants it, not when everybody needs it."

Smart investors understand that true wealth preservation requires thinking beyond traditional assets. In a world of mounting debt and monetary uncertainty, gold's 5,000-year track record speaks louder than any government promise. Take a look at this amazing offer from Birch Gold Group: https://bitira.go2cloud.org/SHAZ

Remember: This analysis provides educational information only. Consult qualified financial and tax professionals before making investment decisions. Individual situations vary, and past performance doesn't guarantee future results.