Required Minimum Distributions for Gold IRAs: What You Need to Know

Your golden years shouldn't come with golden surprises. Yet many Gold IRA holders discover too late that Required Minimum Distributions (RMDs) can dramatically impact their retirement strategy, especially when dealing with physical precious metals.

If you're 73 or approaching this milestone with a Gold IRA, understanding RMDs isn't just important—it's financially critical. Miss an RMD, and you'll face a crushing 25% penalty on the amount you should have withdrawn.

What Are Required Minimum Distributions?

Required Minimum Distributions are mandatory annual withdrawals from traditional retirement accounts that begin at age 73. The IRS created this rule to ensure they eventually collect taxes on money that's been growing tax-deferred for decades.

Key RMD Facts:

- Start at age 73 (changed from 72 in 2023)

- Apply to Traditional Gold IRAs, SEP-IRAs, and SIMPLE IRAs

- Do NOT apply to Roth Gold IRAs during the owner's lifetime

- Must be taken by December 31st each year

- First RMD can be delayed until April 1st of the following year

For Gold IRA holders, RMDs present unique challenges because you're dealing with physical assets rather than easily liquidated stocks or bonds.

How RMDs Are Calculated for Gold IRAs

The IRS uses a standardized formula based on your account balance and life expectancy. Here's the process:

RMD Calculation Formula:

RMD Amount = Account Balance ÷ Life Expectancy Factor

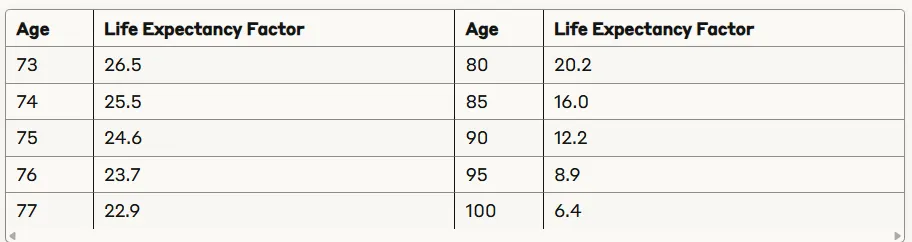

Life Expectancy Factors by Age

Example Calculation:

- Account balance: $100,000

- Age: 75

- Life expectancy factor: 24.6

- Required RMD: $100,000 ÷ 24.6 = $4,065

Gold IRA-Specific RMD Challenges

1. Liquidation Requirements

Unlike traditional IRAs holding stocks, Gold IRAs require physical liquidation of precious metals. This means:

- Selling precious metals to generate cash for distribution

- Working with dealers who may not offer optimal pricing

- Timing the market for precious metals sales

- Coordinating with custodians who handle the physical assets

2. Valuation Complexities

Gold and precious metals values fluctuate daily, creating valuation challenges:

- Account balance must be determined as of December 31st

- Market volatility can significantly impact RMD calculations

- Professional appraisals may be required for rare coins

- Custodians typically use current market prices for common bullion

3. Storage and Custodian Coordination

Gold IRAs involve multiple parties:

- IRS-approved custodians who calculate RMDs

- Depository facilities storing your physical metals

- Precious metals dealers facilitating sales

- Account holders coordinating the entire process

Annual fees compound these challenges:

- Storage fees: Typically $100-300 annually

- Custodian fees: Usually $225-400 annually

- Transaction fees: Applied to each sale or purchase

Penalties and Tax Implications

The 25% Penalty

Missing an RMD triggers one of the harshest IRS penalties:

Penalty Calculation:

Penalty = (Required RMD - Actual Withdrawal) × 25%

Example:

- Required RMD: $5,000

- Actual withdrawal: $3,000

- Shortfall: $2,000

- Penalty: $2,000 × 25% = $500

Tax Treatment

RMDs from Traditional Gold IRAs are taxed as ordinary income:

- Federal taxes apply at your marginal tax rate

- State taxes may apply depending on your state

- No capital gains treatment even for appreciation in gold value

Tax Planning Tip: Consider your total tax situation when timing RMDs. You might benefit from taking distributions early in the year or spreading them across multiple months.

Strategies for Managing Gold IRA RMDs

1. Plan Ahead

Start planning 2-3 years before age 73:

- Review account balances and project future RMDs

- Understand your custodian's RMD process

- Consider partial conversions to Roth IRAs

- Evaluate your precious metals mix for liquidity

2. Optimize Timing

Consider these timing strategies:

- Take RMDs early in the year for planning certainty

- Monitor precious metals prices for favorable selling opportunities

- Coordinate with tax planning for optimal timing

- Consider quarterly distributions to spread market risk

3. Work with Professionals

Build a support team:

- Tax professionals familiar with precious metals

- Financial advisors experienced with Gold IRAs

- Custodians with strong RMD processes

- Reputable precious metals dealers

4. Consider Alternatives

Explore these options before RMDs begin:

- Roth IRA conversions (pay taxes now, avoid RMDs later)

- Charitable distributions directly from your IRA

- Asset reallocation to more liquid precious metals

- Partial account consolidation

Common Mistakes to Avoid

- Waiting until December to plan your RMD

- Ignoring market timing when selling precious metals

- Failing to coordinate with custodians early

- Overlooking tax implications of the distribution timing

- Not maintaining records of all transactions and valuations

The Bottom Line

Required Minimum Distributions from Gold IRAs require careful planning and coordination. The unique nature of physical precious metals adds complexity that stock-based IRAs don't face.

Key Action Items:

- Understand your RMD obligations before age 73

- Establish relationships with qualified custodians and dealers

- Plan for the tax implications of mandatory distributions

- Consider Roth conversions to avoid future RMDs

- Monitor your account regularly for accurate calculations

Remember, the 25% penalty for missing RMDs is one of the steepest IRS penalties. When combined with regular income taxes, a missed RMD can easily cost you 50% or more of the required distribution amount.

Don't let RMD requirements catch you off guard. Start planning now to ensure your Gold IRA continues working for you throughout retirement, not against you.

This article provides general information about RMDs and Gold IRAs. Tax laws are complex and individual situations vary significantly. Always consult with qualified tax professionals and financial advisors before making withdrawal decisions or retirement planning moves.