Protect Your Retirement Nest Egg with Gold: A Complete Guide to Precious Metals IRAs

Your retirement savings are under siege. Inflation erodes purchasing power. Market volatility threatens decades of careful saving. Traditional portfolios built on stocks and bonds face unprecedented challenges in today's economic climate.

Smart investors are waking up to a time-tested solution that's protected wealth for over 5,000 years: gold. While your neighbors watch their 401(k)s swing wildly with market sentiment, you could be building a fortress around your retirement nest egg with precious metals.

The desire for financial security drives millions to seek alternatives to traditional retirement planning. Gold offers something paper assets cannot: tangible value that doesn't depend on corporate earnings, government promises, or market psychology.

Take action now to understand how gold IRAs can shield your retirement savings from economic turbulence while potentially growing your wealth through one of history's most reliable stores of value.

Why Gold Deserves a Place in Your Retirement Portfolio

Historical Wealth Preservation

Gold has maintained purchasing power across millennia, surviving the collapse of currencies, governments, and entire civilizations. While the Roman denarius became worthless, gold retained its value. This track record matters when you're planning for decades of retirement.

Consider these compelling statistics:

- Gold has averaged 7.78% annual returns over the past 50 years

- During the 2008 financial crisis, gold gained 25% while stocks plummeted

- Since 1971, gold has outpaced inflation by an average of 2% annually

Inflation Protection That Actually Works

Traditional retirement accounts often struggle against inflation's silent theft. Gold historically moves inverse to the dollar's purchasing power, making it a natural hedge against rising prices.

Real-world example: If inflation runs 6% annually (as we've seen recently), your $100,000 retirement account loses $6,000 in purchasing power yearly. Gold's tendency to rise with inflation can help offset these losses.

Portfolio Diversification Benefits

Modern portfolio theory emphasizes diversification, but most retirement accounts remain dangerously concentrated in paper assets. Gold typically exhibits low correlation with stocks and bonds, meaning it often moves independently of traditional investments.

The diversification advantage:

- Low correlation: Gold often rises when stocks fall

- Crisis performance: Precious metals tend to rally during economic uncertainty

- Currency protection: Gold maintains value regardless of dollar strength

- Geopolitical hedge: Physical assets provide stability during international tensions

Understanding Gold IRAs: The Basics

What Is a Gold IRA?

A Gold IRA (Individual Retirement Account) allows you to hold physical precious metals within a tax-advantaged retirement account structure. Unlike traditional IRAs limited to stocks, bonds, and mutual funds, Gold IRAs expand your options to include tangible assets.

Key characteristics:

- Same tax advantages as traditional IRAs

- Physical precious metals ownership

- Professional storage requirements

- IRS-approved products only

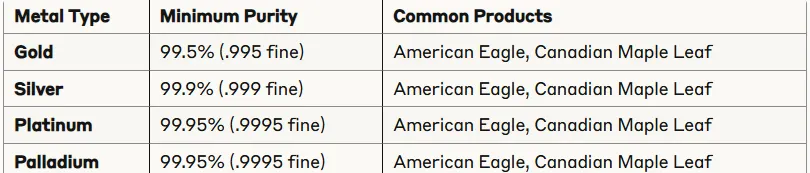

IRS Requirements and Standards

The Internal Revenue Service maintains strict standards for precious metals in retirement accounts. Understanding these requirements prevents costly mistakes.

Traditional vs. Roth Gold IRAs

Traditional vs. Roth Gold IRAs

Traditional Gold IRA:

- Tax-deductible contributions (subject to income limits)

- Tax-deferred growth

- Taxed as ordinary income upon withdrawal

- Required Minimum Distributions begin at age 73

Roth Gold IRA:

- After-tax contributions

- Tax-free growth potential

- Tax-free qualified withdrawals

- No required distributions during owner's lifetime

IRA-Approved Gold Products

Government-Issued Coins

American Gold Eagle

- Purity: 91.67% gold (22-karat)

- Weights: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz

- Legal tender backed by U.S. government

- Most popular choice for IRAs

American Gold Buffalo

- Purity: 99.99% gold (24-karat)

- Weight: 1 oz only

- First 24-karat gold coin from U.S. Mint

- Premium collectible status

Canadian Gold Maple Leaf

- Purity: 99.99% gold (24-karat)

- Weights: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz

- Distinctive maple leaf design

- Advanced security features

Austrian Gold Philharmonic

- Purity: 99.99% gold (24-karat)

- Weights: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz

- Beautiful musical instrument design

- Popular European option

Approved Gold Bars

Eligible Manufacturers:

- PAMP Suisse: Swiss quality, "Lady Fortuna" design

- Credit Suisse: Serial numbered, LBMA-accredited

- Johnson Matthey: Highly respected (discontinued but still accepted)

- Perth Mint: Australian government backing

- Royal Canadian Mint: Canadian government guarantee

Standard Weights:

- 1 oz bars (most common for individual investors)

- 10 oz bars (suitable for larger investments)

- 100 oz bars (institutional size, lower premiums)

Setting Up Your Gold IRA: Step-by-Step Process

1. Choose a Qualified Custodian

Not all IRA custodians handle precious metals. Select specialists offering:

Essential Services:

- IRS compliance expertise

- Established depository relationships

- Transparent fee structures

- Educational resources and support

- Buyback programs

Red flags to avoid:

- Pressure tactics or high-pressure sales

- Promises of guaranteed returns

- Lack of regulatory compliance

- Hidden fees or unclear pricing

2. Fund Your Account

Funding options:

- Direct contribution: Cash contributions up to annual limits

- Rollover: Transfer funds from existing 401(k) or IRA

- Transfer: Move money between similar account types

2025 Contribution Limits:

- Under 50: $7,000 annually

- Age 50+: $8,000 annually (includes $1,000 catch-up)

Minimum Investment:

- Most custodians require $5,000 minimum initial investment

- Subsequent purchases typically $1,000 minimum

3. Select Your Precious Metals

Work with your custodian to choose IRA-approved products based on:

- Investment goals: Growth vs. stability focus

- Premium costs: Coins typically carry higher premiums than bars

- Liquidity preferences: Popular products easier to sell

- Storage considerations: Smaller denominations increase flexibility

4. Arrange Secure Storage

IRS requirements:

- All IRA precious metals must be stored at approved depositories

- Personal possession triggers taxable distribution

- Segregated storage options available for additional fees

Leading Depository Options:

- Delaware Depository (Wilmington, DE)

- Brink's Global Services (Salt Lake City, UT)

- International Depository Services (Dallas, TX)

- HSBC Bank USA (New York, NY)

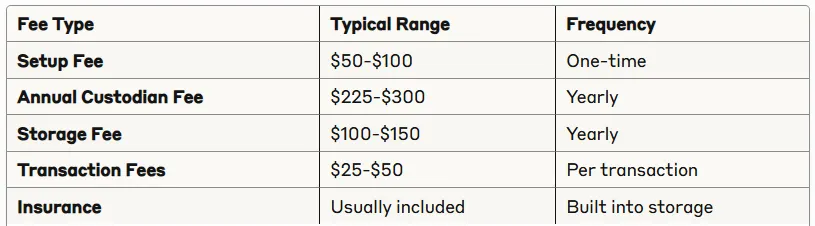

Cost Analysis: What You'll Really Pay

Fee Structure Breakdown

Premium Costs Over Spot Price

Typical premiums:

- Gold coins: 3-8% over spot price

- Gold bars: 1-4% over spot price

- Rare/collectible coins: 10-50% premiums

Premium factors:

- Product popularity and availability

- Market demand conditions

- Dealer markup policies

- Order size (larger orders often get better pricing)

Tax Implications You Must Know

Traditional Gold IRA:

- Contributions may be tax-deductible

- Growth is tax-deferred

- Withdrawals taxed as ordinary income

- Early withdrawal penalty: 10% before age 59½

- Required Minimum Distributions begin at age 73

Roth Gold IRA:

- No immediate tax deduction

- Tax-free growth potential

- Qualified withdrawals are tax-free

- Same early withdrawal penalties apply

- No required distributions during owner's lifetime

Strategic Portfolio Allocation

Professional Recommendations

Conservative Approach (Ages 55+):

- 5-10% precious metals allocation

- Focus on stability and wealth preservation

- Emphasis on gold over other metals

Moderate Approach (Ages 40-55):

- 10-15% precious metals allocation

- Balanced growth and protection strategy

- Mix of gold and silver

Aggressive Approach (Ages 25-40):

- 15-20% precious metals allocation

- Higher growth potential acceptance

- Diversified across all four metals

Diversification Within Precious Metals

Recommended allocation within precious metals portion:

- Gold: 60-70% (core holding)

- Silver: 20-25% (industrial demand upside)

- Platinum: 5-10% (automotive/jewelry applications)

- Palladium: 5-10% (technology applications)

Risk Management Strategies

Dollar-cost averaging: Make regular purchases regardless of price to smooth out volatility.

Rebalancing schedule: Review and adjust allocations annually or when markets move significantly.

Exit planning: Develop clear strategies for distributions, considering tax implications and market timing.

Common Mistakes to Avoid

1. Choosing the Wrong Custodian

Research thoroughly. Verify credentials, read reviews, and understand all fees upfront.

2. Focusing Only on Price

The cheapest option often comes with hidden costs or poor service. Balance price with quality and service.

3. Over-Concentrating in Precious Metals

Even gold enthusiasts should maintain diversified portfolios. Don't put all retirement eggs in one basket.

4. Ignoring Storage Costs

Factor ongoing storage and insurance costs into your return calculations.

5. Panic Selling During Volatility

Precious metals can be volatile short-term. Maintain long-term perspective aligned with retirement timeline.

The Bottom Line: Is Gold Right for Your Retirement?

Gold IRAs offer compelling advantages:

- Historical wealth preservation track record

- Inflation protection potential

- Portfolio diversification benefits

- Tangible asset ownership

- Tax-advantaged growth

Consider gold if you:

- Worry about inflation eroding retirement purchasing power

- Want diversification beyond traditional paper assets

- Believe in precious metals' long-term value

- Can afford the additional fees and complexity

- Have a long-term investment horizon

Gold may not be suitable if you:

- Need immediate income from investments

- Cannot afford additional fees

- Prefer maximum liquidity

- Are comfortable with traditional portfolios

- Have a very short investment timeline

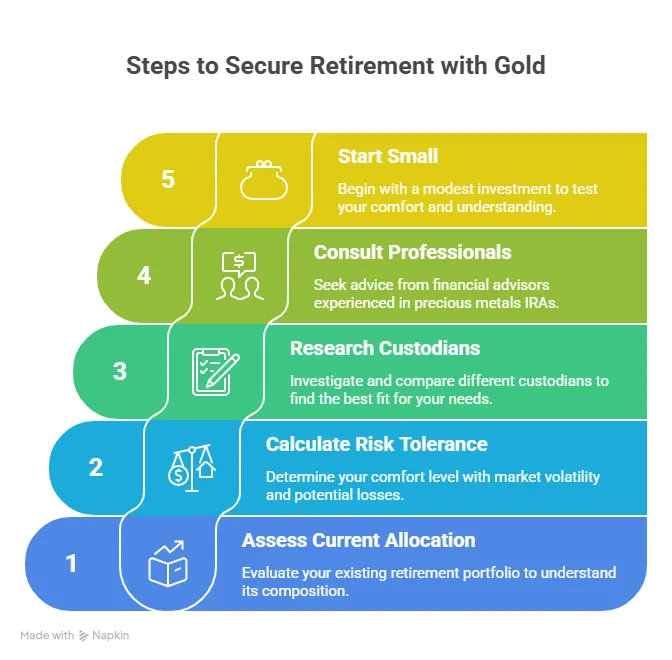

Take Action: Your Next Steps

Ready to explore gold for your retirement portfolio?

- Assess your current allocation: How much of your retirement is in traditional assets?

- Calculate your risk tolerance: Can you handle precious metals volatility for long-term gains?

- Get expert guidance: Click here to speak with precious metals IRA specialists who can help you evaluate your options and get started.

- Research qualified custodians: Get quotes from at least three reputable companies.

- Consult professionals: Speak with fee-only financial advisors familiar with precious metals IRAs.

- Start small: Consider beginning with a modest allocation to test your comfort level.

The window for retirement protection won't stay open forever. Economic uncertainty, inflation concerns, and market volatility make today's environment particularly favorable for precious metals diversification.

Your future self will thank you for taking steps now to build a more resilient retirement nest egg. While others worry about market crashes and currency debasement, you can rest easier knowing part of your wealth rests in humanity's oldest store of value.

Ready to get started? Contact precious metals IRA experts today to discuss your retirement protection strategy and receive personalized guidance on Gold IRA options.

This information is for educational purposes only and does not constitute financial advice. Consult with qualified tax and financial professionals before making investment decisions.