Premium Over Spot Price Gold IRA: The Hidden Cost That Could Sink Your Returns

You check the gold price and see $3,000 per ounce. You call your Gold IRA dealer expecting to pay around that amount. Then comes the shock: they quote you $3,350 per ounce. Welcome to the world of premiums over spot price – the often-overlooked cost that can significantly impact your Gold IRA returns.

What Is Premium Over Spot Price?

The spot price represents the current market price for immediate delivery of one ounce of gold in its raw form. Think of it as the wholesale price for gold as a commodity.

The premium is the additional amount you pay above spot price when purchasing physical gold products. This premium covers:

- Manufacturing and minting costs

- Dealer profit margins

- Distribution and handling

- Storage preparation for IRA compliance

- Market demand factors

For Gold IRA investors, understanding premiums is crucial because IRS regulations require specific types of gold products – and these approved products almost always carry premiums above spot price.

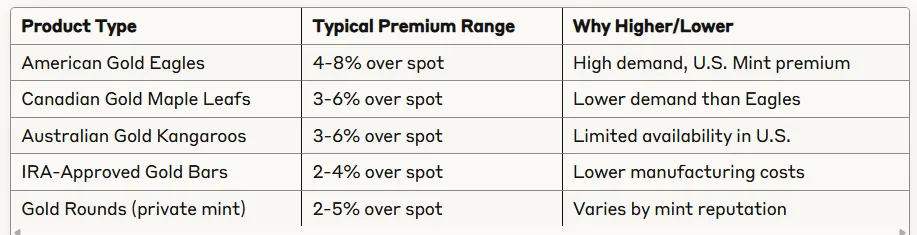

Premium Ranges by Gold IRA Product Type

Different IRA-eligible gold products carry varying premium levels:

Product Popularity and Recognition

American Gold Eagles command the highest premiums because they're the most recognized and liquid gold coins in the U.S. market. When it comes time to sell, this recognition can work in your favor.

Manufacturing Complexity

Coins require more intricate manufacturing processes than bars. The U.S. Mint charges dealers a premium for Gold Eagles, which gets passed to consumers.

Market Conditions

During times of high demand or supply shortages, premiums can spike dramatically. The 2020 pandemic saw premiums reach 10-15% over spot for popular coins.

Dealer Markup Structure

Different dealers have varying markup strategies:

- High-volume dealers may offer lower premiums due to economies of scale

- Boutique dealers might charge higher premiums but offer better service

- Online dealers typically offer lower premiums than brick-and-mortar stores

IRA Storage Requirements

Gold IRA products must be stored in IRS-approved depositories. This requirement can influence premiums because:

- Products must be in "investable" condition

- Packaging and shipping costs increase

- Insurance requirements are higher

How Premiums Impact Your Investment Returns

Consider this scenario:

Investment Details:

- Gold spot price: $2,000/oz

- Premium paid: 6% ($120/oz)

- Total cost: $2,120/oz

- Investment amount: $50,000 (≈23.6 ounces)

Break-Even Analysis: For your investment to break even, gold prices need to rise to $2,120/oz – a 6% increase just to recover your premium.

10-Year Projection: If gold appreciates 4% annually over 10 years:

- Gold price after 10 years: $2,960/oz

- Your investment value: $69,856

- Without premium (hypothetical): $73,920

- Premium cost over time: $4,064

This example shows how premiums create a hurdle that your gold investment must clear before generating real returns.

Strategies to Minimize Premium Costs

Choose Lower-Premium Products

Gold bars typically carry the lowest premiums among IRA-eligible products. While they lack the numismatic appeal of coins, they maximize your actual gold ownership per dollar invested.

Time Your Purchases

Premium levels fluctuate based on market conditions:

- Avoid panic buying during market turmoil when premiums spike

- Consider dollar-cost averaging to smooth out premium variations

- Monitor premium trends across different dealers

Work With Reputable, High-Volume Dealers

Established dealers with high transaction volumes often offer:

- More competitive premiums

- Better inventory availability

- Transparent pricing structures

Consider Larger Purchases

Some dealers offer volume discounts that can reduce effective premiums:

- Minimum order quantities for wholesale pricing

- Bulk purchase incentives

- Reduced per-unit shipping and handling costs

Red Flags: When Premiums Signal Problems

Excessive Markups

Be wary of premiums exceeding these ranges:

- Gold Eagles: Over 10%

- Gold Maple Leafs: Over 8%

- Gold bars: Over 6%

Hidden Premium Components

Watch for dealers who:

- Quote "competitive" spot prices but add excessive handling fees

- Charge separate "IRA setup premiums"

- Include premiums in shipping and insurance costs

Pressure Sales Tactics

Legitimate dealers don't create artificial urgency around premiums:

- "Today only" premium pricing

- Claims that premiums will "never be this low again"

- Refusal to provide written premium breakdowns

Making Smart Premium Decisions

When evaluating Gold IRA premiums, consider:

Immediate Costs vs. Long-Term Liquidity Higher-premium products like American Gold Eagles may be easier to sell when you need distributions, potentially offsetting initial premium costs.

Your Investment Timeline Longer investment horizons can help absorb premium costs through gold price appreciation.

Total Cost Analysis Factor premiums into your overall Gold IRA cost structure, including:

- Annual storage fees ($100-300)

- Custodian fees ($200-400)

- Transaction fees for purchases and sales

The Bottom Line

Premium over spot price is an unavoidable cost of Gold IRA investing, but it doesn't have to devastate your returns. By understanding how premiums work, choosing appropriate products, and working with reputable dealers, you can minimize these costs while building a solid precious metals retirement portfolio.

Remember: the lowest premium isn't always the best deal if it comes with poor service, questionable product quality, or limited liquidity. Focus on finding the right balance between cost efficiency and long-term investment success.

Action Steps:

- Request premium breakdowns from multiple Gold IRA dealers

- Compare total costs, not just premiums

- Research current premium ranges for your preferred products

- Factor premium recovery time into your investment timeline

- Consider starting with lower-premium products if cost minimization is your priority

The key to successful Gold IRA investing isn't eliminating premiums – it's managing them strategically while building wealth for your retirement future.