Perth Mint Gold Products for IRA: The Smart Investor's Secret Weapon

Attention investors: While most people chase volatile stocks and bonds, savvy investors are quietly building wealth with government-backed gold that offers tax advantages and inflation protection.

Here's what Wall Street doesn't want you to know: Perth Mint gold products can supercharge your retirement portfolio while providing the security your 401(k) can't match.

Why Perth Mint Stands Above the Competition

The Perth Mint isn't just another precious metals dealer. It's owned by the Government of Western Australia and operates under a unique government guarantee that backs all precious metal holdings. This means when you invest in Perth Mint gold products, you're getting something most gold dealers can't offer: government-level security.

The Perth Mint advantage:

- Operating in the precious metals industry for more than 125 years

- The only mint in the world backed by a government guarantee

- Stored more than AUD 7.3 billion worth of precious metals for clients worldwide in 2023-24

- Global accreditations for ethically sourced gold and silver

Perth Mint Gold Products That Qualify for Your IRA

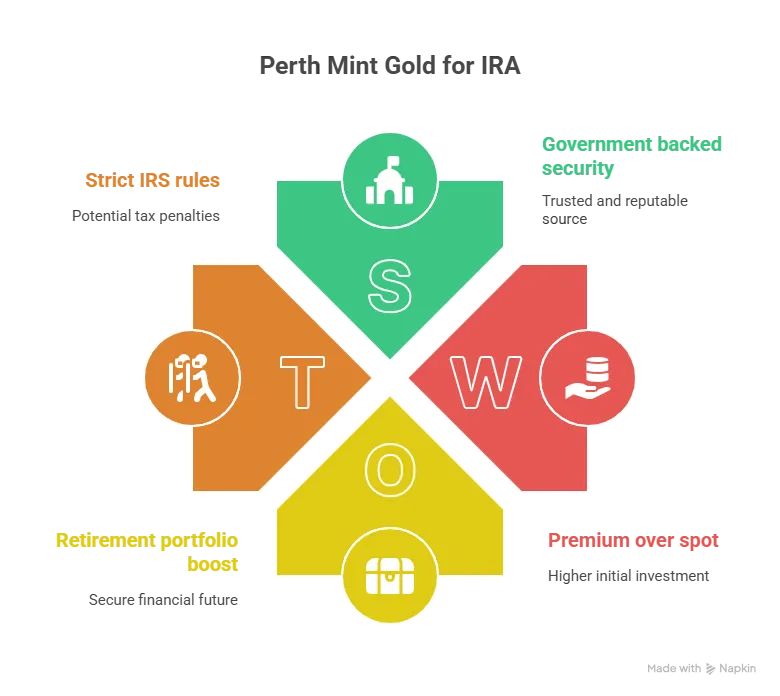

Not all gold qualifies for IRA investment. The IRS has strict rules about purity and production standards. Fortunately, Perth Mint products exceed these requirements.

Gold Kangaroo Coins: The Crown Jewel

The Australian Gold Kangaroo coin contains 1 troy oz of .9999 fine gold and is eligible for inclusion in a self-directed IRA. These aren't just investment vehicles—they're masterpieces.

Key specifications:

- Purity: 99.99% (.9999 fine gold)

- Weight: 1 troy ounce

- Legal tender: $100 AUD face value

- Design: Features a different image of a kangaroo each year since 1990

- Authentication: Incorporates micro-laser engraved authentication features

Perth Mint Gold Bars: Pure Investment Power

Perth Mint gold bars feature 99.99% (.9999) purity and are available in sizes from 1 gram to 1 kg with serial numbered, tamper-evident packaging.

Available sizes:

- 1 gram to 1 kilogram

- Serial numbered for authenticity

- Tamper-evident packaging

- Swan logo of the Perth Mint and assay cards verifying purity and weight

The IRA Gold Rules You Must Know

The IRS doesn't mess around when it comes to precious metals in retirement accounts. Here's what you need to understand:

Purity Requirements

Gold must be 99.99% (.9999) pure to qualify for IRA inclusion. Perth Mint products exceed this requirement, making them perfect for retirement investing.

Storage Rules

Critical point: You cannot store IRA gold at home. The IRS requires that coins or bars be held in a qualifying 'depository', which is responsible for the security and maintenance of the metal.

Contribution Limits

The annual contribution limit for IRAs in 2025 is $7,000 yearly, with an increase to $8,000 yearly when you reach 50 years of age in the form of a "catch-up contribution".

How to Add Perth Mint Gold to Your IRA

Step 1: Choose Your Method

Transfer vs. Rollover: Fewer rules apply to transfers than rollovers. Funds distributed via transfers never touch the account holder's bank account, which presents fewer opportunities for accidentally violating regulations and triggering a tax event.

Transfer (Recommended):

- Direct movement between custodians

- No tax implications

- No limit on frequency

- Lower risk of mistakes

Rollover:

- The IRS allows only one penalty-free rollover per 365-day period

- 60-day completion requirement

- Higher risk of tax penalties

Step 2: Find an Approved Custodian

Not all financial institutions can handle precious metals IRAs. You need a custodian that specializes in alternative assets and works with approved depositories.

Step 3: Select Your Perth Mint Products

Focus on IRA-eligible options:

- Australian Gold Kangaroo coins (any year)

- Perth Mint gold bars (1 oz and larger)

- Ensure .9999 purity certification

Step 4: Arrange Secure Storage

Your gold must be stored in an IRS-approved depository. These facilities offer:

- Professional security systems

- Insurance coverage

- Detailed record-keeping

- Segregated or allocated storage options

Investment Costs and Considerations

Premium Over Spot Price

Perth Mint products typically carry a premium above the spot gold price due to:

- Manufacturing costs

- Government backing

- Brand recognition

- Annual design changes (Kangaroo coins)

Storage and Management Fees

Annual costs typically include:

- Custodian fees: $100-$300 per year

- Storage fees: 0.5-1.0% of account value annually

- Insurance: Often included in storage fees

- Transaction fees: Varies by custodian

Tax Advantages

Traditional IRA: Tax-deductible contributions, tax-deferred growth Roth IRA: After-tax contributions, tax-free growth and withdrawals in retirement

The Perth Mint Advantage for Retirement Planning

Inflation Protection

Gold has historically maintained purchasing power during inflationary periods. While stocks and bonds can lose value during economic uncertainty, physical gold often moves inversely to traditional assets.

Portfolio Diversification

By placing physical gold inside of an IRA, Gold Kangaroos offer a level of diversification that is independent of fluctuations in stocks or bonds.

Government Backing

The Government of Western Australia guarantees Perth Mint liabilities in accordance with the Gold Corporation Act 1987, ensuring they are one of the lowest risk precious metals enterprises in the world.

Common Mistakes to Avoid

1. Home Storage Temptation

Never store IRA gold at home. This triggers immediate tax penalties and defeats the purpose of the retirement account.

2. Non-Eligible Products

Avoid collectibles. Collectible coins or rare coins, including graded or certified coins, are not eligible for a Precious Metal IRA.

3. Improper Rollovers

Stick to transfers when possible. The once-per-year rollover rule can trap investors if they need to change custodians.

Market Outlook for Perth Mint Gold

Perth Mint is a global leader with assurances of quality, value and service, with renowned bullion bars and coins sought after by global investors. This recognition translates to:

- Strong liquidity when selling

- Stable premiums over time

- Global market acceptance

- Reliable value retention

Taking Action: Your Next Steps

Ready to secure your retirement with Perth Mint gold?

- Research custodians that specialize in precious metals IRAs

- Compare storage options and fee structures

- Determine your allocation - many experts suggest 5-20% of portfolio in precious metals

- Choose your products - Focus on IRA-eligible Kangaroo coins or bars

- Execute your strategy - Use transfers rather than rollovers when possible

Start Your Gold IRA Journey Today

Don't let another day pass without protecting your retirement savings.

The smart money is already moving into precious metals IRAs while most investors remain unaware of this powerful wealth-building strategy. Every month you delay is a month your retirement portfolio remains vulnerable to market crashes, inflation, and economic uncertainty.

Click Here to Get Your FREE Gold IRA Information Kit

This comprehensive guide reveals:

- ✅ How to rollover your existing 401(k) or IRA tax-free

- ✅ The top Perth Mint products for maximum growth potential

- ✅ Storage solutions that meet IRS requirements

- ✅ Tax strategies that could save you thousands

- ✅ Expert insights on timing your precious metals allocat

The Bottom Line

Perth Mint gold products offer a unique combination of government backing, IRS approval, and global recognition that's hard to match in the precious metals space.

Due to their world-renowned pureness, quality, limited supply and unique yearly mintage, Gold Kangaroos can carry a "numismatic" value higher than their intrinsic market value.

While stocks and bonds face increasing volatility, Perth Mint gold in your IRA provides:

- Tangible asset ownership

- Government guarantee backing

- Tax-advantaged growth

- Inflation protection

- Portfolio diversification

The question isn't whether you should consider Perth Mint gold for your IRA—it's whether you can afford to ignore this opportunity while others quietly build generational wealth.

Don't wait for the next financial crisis to realize the value of real money.

Get Your FREE Gold IRA Guide Now →

Your future self will thank you for taking action today.

Important Note: This article is for educational purposes only and does not constitute financial advice. Consult with qualified financial and tax professionals before making investment decisions. Past performance does not guarantee future results.