IRA Eligible Palladium Coins: Your Complete 2025 Investment Guide

Are you ready to discover the precious metal that's 15 times rarer than gold and could be the key to diversifying your retirement portfolio?

Palladium is 150 times more rare than gold, yet many investors overlook this remarkable metal when building their retirement savings. With the electric vehicle revolution driving unprecedented demand and experts believing that the need for palladium will be at a high, now might be the perfect time to explore IRA-eligible palladium coins for your retirement strategy.

Why Smart Investors Are Adding Palladium to Their IRAs

The palladium market is experiencing a perfect storm of opportunity. Palladium is being used in industries which are growing at an alarming rate which is unlike other metals, particularly in the automotive sector where it's essential for catalytic converters in both traditional and hybrid vehicles.

Here's what makes palladium compelling for retirement investors:

• Scarcity Advantage: With extremely limited supply and growing industrial demand

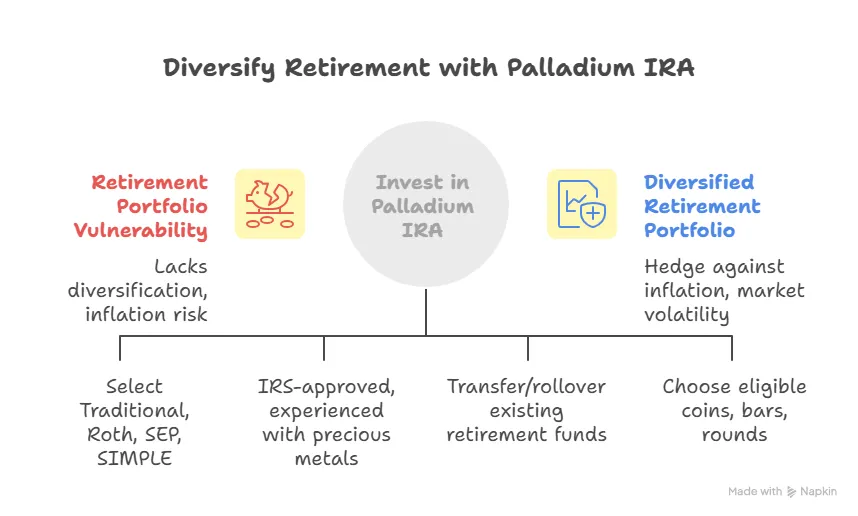

• Portfolio Diversification: Provides hedge against inflation and market volatility

• Tax Benefits: Enjoy tax-deferred growth within your IRA structure

• Growing Market: EV industry expansion continues driving demand

But there's a catch - not all palladium qualifies for your IRA. The IRS has strict requirements that could make or break your investment strategy.

Ready to explore palladium for your retirement? Get your FREE Precious Metals IRA Guide from Birch Gold Group - a trusted leader with an A+ BBB rating and thousands of satisfied customers.

The IRS Rules You Must Follow (Or Face Penalties)

IRA eligible platinum and palladium must have a minimum purity of 99.95% to be eligible. This isn't negotiable - fail to meet these requirements and you could face immediate tax consequences.

Critical IRS Requirements for Palladium IRAs:

1. Minimum Purity: Palladium must be 99.95% pure

2. Approved Sources: Must be produced by a refiner, assayer, or manufacturer that is accredited/certified by NYMEX, COMEX, NYSE/Liffe, LME, LBMA, LPPM, TOCOM, ISO 9000, or national government mint

3. Professional Storage: You are required to keep your coins & bars of palladium in IRS-approved depository only

4. No Home Storage: The IRS prohibits private possession of IRA-owned precious metals, as keeping them at home would be considered a distribution

Warning: The majority of the well-known palladium bullion items on the market are not suitable for use in an IRA, and if you are caught using them, you could face penalties from the IRS.

Top IRA-Approved Palladium Coins That Make the Grade

1. American Palladium Eagle - The Gold Standard

The American Palladium Eagle is the only official palladium coin from the U.S. Mint and represents the pinnacle of IRA-eligible palladium investing.

Key Features:

• Purity: 99.95% (.9995)

• Design: Features a high-relief likeness of Winged Liberty from the Mercury Dime obverse

• Backing: U.S. government guarantee for weight, content, and purity

• Rarity: Fewer than 25,000 bullion and 15,000 proof Palladium Eagles minted from 2017 to 2023

2. Canadian Palladium Maple Leaf - International Excellence

Highly recognized, features the iconic maple leaf design, backed by the Canadian government.

Specifications:

• Purity: 99.95% (.9995)

• Mint: Royal Canadian Mint

• Recognition: Global acceptance and liquidity

3. Australian Palladium Emu - Limited Availability

Features the image of an emu, limited mintage, produced by a reputable mint.

Details:

• Purity: 99.95% (.9995)

• Mint: Perth Mint

• Special Feature: Limited production runs

IRA-Eligible Palladium Bars: More Metal for Your Money

Bars typically offer lower premiums over spot price compared to coins, making them attractive for larger investments.

Credit Suisse Palladium Bars

Trusted brand, serial numbered, LBMA-accredited

• Purity: 99.95% (.9995)

• Sizes: 1 oz, 10 oz

PAMP Suisse Palladium Bars

"Lady Fortuna" design, high-quality Swiss production, serial numbered

• Purity: 99.95% (.9995)

• Sizes: 1 oz, 10 oz

Johnson Matthey Palladium Bars

Highly respected brand, still accepted despite discontinued production

• Purity: 99.95% (.9995)

• Sizes: 1 oz, 10 oz

Baird Palladium Bars

Made by Baird & Co. This product features a very simplistic design. This bar has 1 troy oz of 99.95 fine palladium

Setting Up Your Palladium IRA: The Step-by-Step Process

Step 1: Choose Your IRA Type

You will work with your designated Precious Metals Specialist to review your account options—choosing from Traditional, Roth, SEP, or SIMPLE IRA options

Step 2: Select an Approved Custodian

Your custodian must be IRS-approved and experienced with precious metals IRAs.

Step 3: Fund Your Account

Transfer or rollover funds from existing retirement accounts.

Step 4: Purchase Eligible Palladium

You'll get to choose between gold, silver, platinum, and palladium. Additionally, there are specific coins, rounds, and bars available in each

Don't navigate this complex process alone. Connect with Birch Gold Group's precious metals specialists who will walk you through every step and ensure IRS compliance. Their expert team has helped thousands of Americans protect their retirement with precious metals.

2025 Contribution Limits and Key Restrictions

Annual Contribution Limits:

• The annual contribution limit in 2024 was $7,000, or $8,000 for people over the age of 50. In 2025, these limits will remain the same

Important Restrictions:

• Early Withdrawal Penalties: Withdrawals before the age of 59 ½ can incur a 10% early withdrawal penalty

• Required Minimum Distributions: Once you reach a certain age, you may be required to withdraw a certain amount from your Palladium IRA annually

• Five-Year Rule: You have to wait at least five years to make a withdrawal

Storage Requirements: Where Your Palladium Must Live

IRA-eligible precious metals must be stored securely with an approved custodian. This ensures compliance and protects your investment.

Approved Storage Options Include:

• Delaware Depository Service Company

• International Depository Services

• Brink's Global Services

• HSBC Bank USA

• JPMorgan Chase Bank

• CNT Depository

Storage Costs: Expect annual fees ranging from $100-$500+ depending on your chosen facility and account size.

Investment Considerations: The Risks and Rewards

The Upside Potential

• Industrial Demand: Growing EV market drives consumption

• Supply Constraints: Limited mining production

• Portfolio Diversification: Non-correlated asset class

• Inflation Hedge: Tangible asset protection

The Risks to Consider

• Volatility: Palladium prices can be extremely volatile

• Storage Costs: Ongoing fees reduce returns

• Liquidity: Less liquid than gold or silver

• Market Dependence: Heavily tied to automotive industry

Common Mistakes That Could Cost You Thousands

Mistake #1: Buying Non-Eligible Products

Purchasing metals that don't meet IRS purity standards can result in immediate tax consequences.

Mistake #2: Improper Storage

Using non-approved custodians or depositories can jeopardize the tax benefits of your IRA

Mistake #3: Ignoring Fees

Ignoring storage and custodian fees can erode the value of your investment over time

Mistake #4: Over-Allocation

Don't put all your retirement eggs in the palladium basket. Most experts recommend limiting precious metals to 5-20% of your total portfolio.

Market Outlook: What the Experts Are Saying

The palladium market faces interesting dynamics heading into 2025:

Supply Side Pressures:

• Continued production challenges in major mining regions

• Limited new mine development

• Geopolitical risks affecting supply chains

Demand Drivers:

• Automotive industry recovery and growth

• Expanding EV market requiring palladium in hybrid systems

• Industrial applications in electronics and hydrogen fuel cells

Your Next Steps: Getting Started with Palladium IRAs

Ready to add this rare metal to your retirement strategy? Here's your action plan:

1. Research Reputable Dealers: Look for companies with strong track records in precious metals IRAs

2. Compare Custodian Options: Evaluate fees, storage locations, and customer service

3. Start Small: Consider beginning with 5-10% allocation to test the waters

4. Stay Informed: Monitor palladium market trends and industrial demand factors

5. Consult Professionals: Work with tax advisors familiar with precious metals IRAs

Take Action Today: Request your complimentary Precious Metals IRA Kit from Birch Gold Group and speak with their experienced specialists about adding palladium to your retirement portfolio. With their A+ BBB rating and personalized service, you'll have the guidance needed to make informed decisions.

The Bottom Line: Is Palladium Right for Your IRA?

The American Palladium Eagle is eligible for both home delivery orders and placement in a Precious Metals IRA, making it accessible for retirement investors. With proper due diligence and adherence to IRS requirements, palladium can provide valuable diversification to your retirement portfolio.

However, remember that precious metals should complement, not replace, a well-diversified retirement strategy. The key is understanding the rules, choosing eligible products, and working with experienced professionals who can guide you through the process.

The opportunity is clear: As industrial demand continues growing and supply remains constrained, IRA-eligible palladium coins could play an important role in protecting and growing your retirement wealth. The question isn't whether you should consider palladium - it's whether you can afford not to explore this remarkable investment opportunity.

Secure Your Financial Future Today

Don't let inflation and market volatility erode your retirement dreams. Palladium offers a unique opportunity to diversify beyond traditional assets and potentially benefit from growing industrial demand.

🎯 Ready to Take Control of Your Retirement?

Click here to get your FREE Precious Metals IRA Information Kit from Birch Gold Group and discover how palladium coins can strengthen your retirement portfolio.

What you'll receive:

✅ Complete guide to precious metals IRAs

✅ Market insights and expert analysis

✅ Step-by-step setup process

✅ No-obligation consultation with precious metals specialists

✅ A+ BBB rated company with thousands of satisfied customers

Time is critical. With palladium prices influenced by supply constraints and growing demand, the best opportunities may not wait. Get started with Birch Gold Group today and take the first step toward a more secure retirement.

Your future self will thank you for taking action today.