IRA Approved Palladium Products: Your Complete Investment Guide

Attention investors: Palladium presents a unique opportunity to diversify your retirement portfolio with one of the world's rarest precious metals. While gold and silver dominate precious metals IRAs, savvy investors are discovering the compelling benefits of IRA-approved palladium products.

Interest grows because palladium is one of the ten least occurring elements on Earth's surface, making it significantly rarer than gold, silver, or platinum. This scarcity, combined with strong industrial demand—particularly from the automotive industry for catalytic converters—creates a dynamic investment landscape.

Desire builds as investors realize palladium's dual nature: it serves both as an industrial commodity and a store of value, potentially offering protection against inflation and economic uncertainty while providing exposure to technological advancement.

Take action by understanding which palladium products qualify for IRA investment and how to structure your precious metals retirement strategy effectively.

IRS Requirements for Palladium IRAs

The Internal Revenue Service maintains strict standards for precious metals eligible for Individual Retirement Accounts. Understanding these requirements is crucial before making any palladium investments.

Minimum Purity Standards

Palladium must meet a minimum fineness of 99.95% (.9995) to qualify for IRA inclusion. This purity requirement exceeds standards for gold (99.5%) and silver (99.9%), reflecting palladium's premium status among precious metals.

Approved Manufacturer Criteria

All IRA-eligible palladium products must be produced by refiners, assayers, or manufacturers accredited by recognized institutions including:

- NYMEX/COMEX (New York Mercantile Exchange/Commodity Exchange)

- LME (London Metal Exchange)

- LBMA (London Bullion Market Association)

- LPPM (London Platinum and Palladium Market)

- NYSE/Liffe exchanges

- TOCOM (Tokyo Commodity Exchange)

- ISO 9000 certified facilities

- National government mints

Storage and Condition Requirements

Non-proof bullion coins must be in brilliant uncirculated condition and free from damage. All IRA palladium must be stored at IRS-approved depositories, not in personal possession.

IRA-Approved Palladium Coins

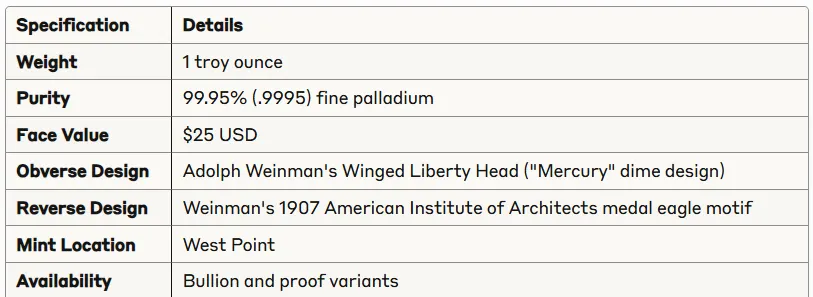

American Palladium Eagle

Released by the U.S. Mint in 2017, the American Palladium Eagle represents the first official palladium bullion coin from the United States. Here are the key specifications:

The coin was authorized by the American Eagle Palladium Bullion Coin Act of 2010, though production didn't begin until 2017. Initial releases sold out rapidly, demonstrating strong market demand.

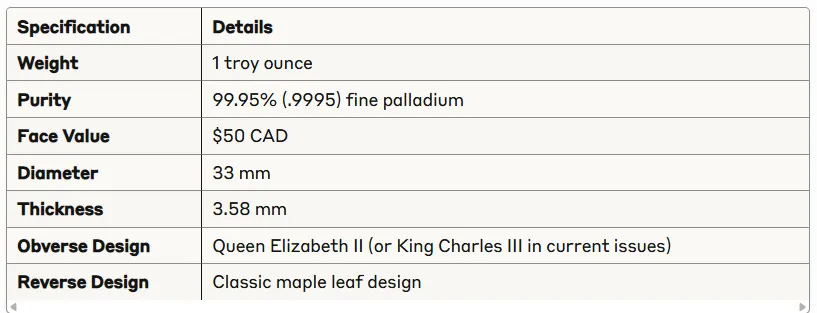

Canadian Palladium Maple Leaf

First issued by the Royal Canadian Mint in November 2005, the Canadian Palladium Maple Leaf was among the first government-issued palladium coins. Production history includes:

- Initial Run: 2005-2007

- Revival: Single year production in 2009

- Current Era: Reintroduced in 2015, produced annually since

The coin meets IRA purity requirements and is guaranteed by the Royal Canadian Mint for weight and content.

Other Approved Foreign Coins

Additional IRA-eligible palladium coins include the Australian Emu palladium coin from Perth Mint, featuring 99.95% purity and limited mintage production.

IRA-Approved Palladium Bars

Palladium bars offer an alternative to coins, often carrying lower premiums over spot prices. Several reputable manufacturers produce IRA-eligible palladium bars:

Major Approved Manufacturers

Credit Suisse

- Purity: 99.95% (.9995)

- Available sizes: 1 oz, 10 oz

- Features: Serial numbered, LBMA-accredited

PAMP Suisse

- Purity: 99.95% (.9995)

- Available sizes: 1 oz, 10 oz

- Features: "Lady Fortuna" design, Swiss production quality

Johnson Matthey

- Purity: 99.95% (.9995)

- Available sizes: 1 oz, 10 oz

- Features: Highly respected brand (discontinued but still accepted)

Size and Weight Specifications

Small bullion bars (other than large bars like 100 oz palladium) must be manufactured to exact weight specifications.

Standard IRA-eligible sizes include:

- 1 oz bars: Most common for individual investors

- 10 oz bars: Suitable for larger investments

- Special sizes: 100 oz palladium bars (exempt from exact weight requirements)

Setting Up a Palladium IRA

Custodian Selection Process

Palladium IRAs require specialized custodians experienced in precious metals.

Choose custodians offering:

- IRS Compliance: Verified track record with precious metals IRAs

- Storage Partnerships: Relationships with approved depositories

- Transparent Pricing: Clear fee structures and no hidden costs

- Educational Resources: Support for informed decision-making

Why not give Birch Gold Group a call and find out about their free metals offer?

Minimum Investment Requirements

Investors must make a minimum initial purchase of $5,000 of approved metals to establish a precious metals IRA, with subsequent purchases of at least $1,000.

Annual Contribution Limits

Gold IRAs follow the same contribution limits as traditional IRAs: $7,000 annually for 2025, or $8,000 if you're 50 or older.

Storage Considerations

All IRA palladium must be stored at IRS-approved depositories. These facilities provide:

- Security: Armed guards, surveillance systems, insurance coverage

- Segregated Storage: Individual allocation options

- Regular Auditing: Verified inventory management

- Geographic Distribution: Multiple locations for risk mitigation

Investment Considerations

Market Dynamics and Pricing

Palladium markets exhibit unique characteristics:

Supply Factors:

- Limited global production (primarily Russia and South Africa)

- Mining complexity and high extraction costs

- Recycling limitations compared to other precious metals

Demand Drivers:

- Automotive industry catalytic converters (80% of demand)

- Electronics and technology applications

- Jewelry and investment demand

- Industrial catalysts and chemical processes

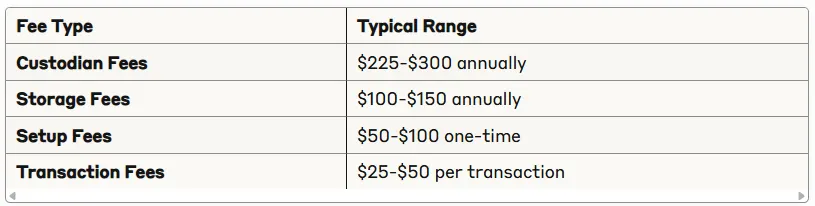

Annual Fees and Costs

Premium fees on metals in an IRA range from 1-3% for bullion bars and 2-5% for coins over spot, depending on demand and rarity.

Typical annual costs include:

Tax Implications

Palladium IRAs follow traditional IRA tax treatment:

- Traditional IRA: Tax-deferred contributions, taxed upon withdrawal

- Roth IRA: After-tax contributions, tax-free qualified withdrawals

- Early Withdrawal: 10% penalty if withdrawn before age 59½

- Required Minimum Distributions: Begin at age 73 for traditional IRAs

Risk Management and Portfolio Allocation

Diversification Benefits

Palladium offers unique diversification advantages:

- Low Correlation: Often moves independently of stocks and bonds

- Industrial Exposure: Benefits from technological advancement

- Inflation Hedge: Historically maintains purchasing power

- Currency Protection: Denominated in physical assets, not fiat currency

Allocation Strategies

Financial advisors typically recommend:

- Conservative Approach: 5-10% precious metals allocation

- Aggressive Strategy: 15-20% precious metals allocation

- Palladium Specific: 1-5% of total precious metals allocation

Risk Factors to Consider

Market Volatility: Palladium prices can be highly volatile due to supply constraints and industrial demand fluctuations.

Liquidity Concerns: Smaller market size compared to gold and silver may impact liquidity during market stress.

Industrial Dependence: Heavy reliance on automotive industry creates concentration risk.

Geopolitical Risk: Major supply sources in politically sensitive regions.

Withdrawal Strategies and Exit Planning

Distribution Options

When ready to access IRA funds, investors have several options:

- Cash Liquidation: Custodian sells metals, distributes proceeds

- In-Kind Distribution: Take physical possession of metals (triggers taxable event)

- Partial Distributions: Gradual withdrawal strategy

- Required Minimum Distributions: Mandatory withdrawals beginning at age 73

Market Timing Considerations

Successful exit strategies often consider:

- Market Cycles: Historical price patterns and market conditions

- Tax Planning: Coordinating withdrawals with overall tax strategy

- Estate Planning: Beneficiary designations and inheritance implications

Future Outlook for Palladium Investment

Industry Trends

Several trends support long-term palladium demand:

Electric Vehicle Impact: While EVs reduce catalytic converter demand, hybrid vehicles still require significant palladium content.

Hydrogen Economy: Emerging hydrogen fuel cell technology creates new palladium demand sources.

Technology Applications: Growing use in electronics, medical devices, and renewable energy systems.

Supply Outlook

Supply challenges continue:

- Mine Depletion: Existing mines reaching end-of-life

- Exploration Limitations: Limited new deposit discoveries

- Recycling Gaps: Current recycling rates insufficient to meet demand

Conclusion: Building Your Palladium IRA Strategy

IRA-approved palladium products offer sophisticated investors a unique opportunity to diversify retirement portfolios with one of the world's rarest precious metals. The combination of strict IRS purity requirements, limited supply, and growing industrial demand creates a compelling investment thesis.

Key takeaways for success:

- Focus on Quality: Choose IRA-approved products from reputable manufacturers meeting 99.95% purity standards

- Understand Costs: Factor in custodian fees, storage costs, and premiums when calculating returns

- Diversify Wisely: Use palladium as part of a broader precious metals allocation strategy

- Plan for the Long Term: Consider palladium's volatility and liquidity characteristics in your overall retirement planning

The bottom line: Palladium IRAs represent an advanced diversification strategy for investors seeking exposure to rare precious metals with strong industrial fundamentals. Success requires careful product selection, cost management, and integration with broader retirement planning objectives.

Whether you choose American Palladium Eagles, Canadian Maple Leafs, or approved bars from leading refiners, ensure your palladium IRA strategy aligns with your risk tolerance, time horizon, and overall financial goals. As with any significant investment decision, consult with qualified financial professionals to determine if palladium IRAs fit your specific circumstances.

This information is for educational purposes only and does not constitute financial advice. Consult with qualified tax and financial professionals before making investment decisions.