How Gold Performs During High Inflation Periods: A Historical Analysis

Picture this: It's 1980, and gold has just hit $850 per ounce—an astronomical price that seemed impossible just a decade earlier when it traded around $35. What drove this explosive 2,200% surge? The answer lies in one of the most challenging economic periods in modern history: the stagflation of the 1970s.

Today, as inflation concerns resurface and gold recently touched new all-time highs above $3,500 per ounce, investors are once again asking the critical question: How does gold truly perform during periods of high inflation?

The answer isn't just academic—it could determine whether your portfolio survives or thrives during economic turbulence.

The 1970s: When Gold Became King

The Perfect Storm of Economic Crisis

The 1970s delivered a brutal economic reality that challenged everything economists thought they knew. Unlike typical recessions where unemployment rises but inflation falls, America experienced stagflation—a toxic combination of:

- Soaring inflation reaching 14% by 1980

- High unemployment climbing to nearly 11%

- Economic stagnation with growth averaging just 3.2% for the decade

This economic nightmare was triggered by multiple shocks:

- Oil crises in 1973 and 1979 sent energy prices skyrocketing over 1,000%

- End of the gold standard in 1971 unleashed monetary expansion

- Excessive government spending on Vietnam War and social programs

- Declining productivity growth hampered economic output

Gold's Explosive Performance

During this chaos, gold emerged as the decade's undisputed champion asset.

Here's the remarkable performance breakdown:

Period Gold Price Range Performance 1970 ~$35/oz Starting point 1976-1980 $100 to $850/oz 2,200% total gain Annual Average - 35% annual returns Gold was the single best-performing asset class of the 1970s, rising from $35 an ounce to over $800, a 2200% gain. During this time inflation averaged approximately 8.8% per year and gold gained an astonishing 35% annual return.

To put this in perspective: $1,000 invested in gold in 1970 would have been worth $23,000 by 1980—all while the stock market struggled and bonds got crushed by inflation.

The Stagflation Advantage

What made gold so powerful during stagflation? The point is that inflation makes us all poorer but in such an environment, gold attracts additional interest and can more than keep up with the pace of inflation. Unlike stocks, which suffered as corporate margins got squeezed, or bonds, which hemorrhaged value as interest rates soared, gold thrived because:

- Physical scarcity couldn't be manipulated by central banks

- Universal acceptance as a store of value during currency crisis

- Independence from corporate earnings or government solvency

Historical Performance: The Full Picture

Inflation-Adjusted Reality Check

While nominal gold prices tell a compelling story, the inflation-adjusted picture reveals important nuances. In 1980, gold peaked at $850 per ounce, which, when adjusted for inflation, equates to approximately $3,493 in today's dollars.

This means recent gold highs above $3,500 represent the first time gold has truly surpassed its 1980 peak in real terms—a 45-year wait for a new inflation-adjusted record.

Beyond the 1970s: Mixed Results

Gold's inflation-hedging performance varies significantly depending on the type and duration of inflationary pressures:

Strong Performance Periods:

- 1970s stagflation: 35% annual gains during 8.8% average inflation

- 2000s financial crisis: Rose from $300 to over $1,900 as monetary policy loosened

- 2020-2022: Surged above $2,000 amid pandemic fiscal stimulus

Weaker Performance Periods:

- 1980s-1990s: Declined as Volcker's aggressive rate hikes tamed inflation

- 2013-2015: Dropped to $1,050 despite moderate inflation concerns

- Late 2022-2023: Pressured by aggressive Fed rate hikes

The Key Insight

Gold is often promoted by financial advisors as a reliable hedge against inflation. However, the data tells a different story. When adjusted for inflation, gold's price appreciation has remained stagnant since the late 1970s.

This doesn't mean gold failed—it means gold preserved purchasing power rather than delivering spectacular real returns. Sometimes, preservation is precisely what investors need.

Why Gold Thrives During High Inflation

The Debasement Defense

Gold's inflation-fighting power stems from fundamental monetary dynamics:

1. Currency Debasement Protection

- As central banks print money, currency purchasing power erodes

- Gold maintains intrinsic value independent of monetary policy

- Historical precedent shows gold rising with money supply expansion

2. Real Asset Advantage

- Unlike paper assets, gold has tangible, physical properties

- Cannot be created at will by governments or corporations

- Supply increases slowly and predictably through mining

3. Crisis Confidence

- During high inflation, confidence in traditional investments wavers

- Gold becomes the "go-to" asset when other options fail

- Network effect: as more investors buy, price momentum builds

Modern Validation

Episodes of stagflation are extremely rare and, therefore, making quantitative conclusions from them is fraught with difficulty. Between Q3 1973 and Q1 1975, U.S. GDP had been declining in real terms and, over that period, inflation rose from 7.4% to 10.3%. In the same period, gold prices had risen 73%.

Recent market behavior echoes these historical patterns. Gold & miners show classic stagflation behavior, crushing markets. The dramatic outperformance is highlighted in a chart shared by Otavio Costa of Crescat Capital, which shows the VanEck Gold Miners ETF GDX crushing every single sector of the S&P 500 year-to-date.

The 2020s: History Repeats?

Familiar Patterns Emerging

Current economic conditions show troubling similarities to the 1970s setup:

- Massive fiscal stimulus during pandemic

- Supply chain disruptions driving costs higher

- Energy price volatility amid geopolitical tensions

- Central bank policy mistakes potentially ahead

More recently, gold has been climbing since the end of 2019, heralding the inflation (this time in consumer goods) that took off in mid-2020. Above all, the astronomical budget deficits in the United States and several European countries, including France, could force central banks to start printing money again.

The Critical Difference

Unlike the 1970s, today's policymakers face a more complex challenge:

- Unprecedented debt levels make aggressive rate hikes potentially catastrophic

- Global interconnectedness amplifies policy transmission effects

- Political constraints limit painful but necessary adjustments

The Fed's governor at the time, Paul Volcker, was forced to raise the key rate to 20% in order to significantly reduce inflation. Even half that would be inconceivable today, given the scale of public and private debt.

Investment Considerations: The Complete Truth

When Gold Works Best

Gold performs exceptionally during inflation when:

- Central bank credibility is questioned

- Real interest rates remain negative

- Currency stability is threatened

- Geopolitical tensions escalate

- Traditional assets are struggling

When Gold Disappoints

Gold can underperform during inflationary periods if:

- Real interest rates rise significantly above inflation

- Dollar strength dominates global markets

- Deflation fears overshadow inflation concerns

- Aggressive monetary tightening restores confidence

- Alternative assets offer better real returns

Portfolio Strategy Framework

Conservative Allocation (5-10% Gold):

- Basic inflation hedge for traditional portfolios

- Appropriate during stable economic conditions

- Focus on physical gold or low-cost ETFs

Defensive Allocation (10-20% Gold):

- Heightened inflation concerns warrant increased exposure

- Include gold mining stocks for leverage

- Consider international gold exposure

Crisis Allocation (20%+ Gold):

- Stagflation risk or currency crisis scenarios

- Maximum diversification across gold vehicles

- Prepare for extended holding periods

Smart investors are already taking action. If current economic conditions concern you, get your free consultation with Birch Gold Group to explore tax-advantaged ways to add precious metals to your retirement portfolio.

The Timing Challenge

Perfect timing is impossible, but historical patterns suggest increasing gold exposure when:

- Inflation expectations consistently exceed 4%

- Real yields turn negative

- Central bank rhetoric shifts dovish despite high inflation

- Fiscal policy remains expansionary

The Bottom Line: Gold's Inflation Report Card

After analyzing decades of data, here's the verdict on gold during high inflation periods:

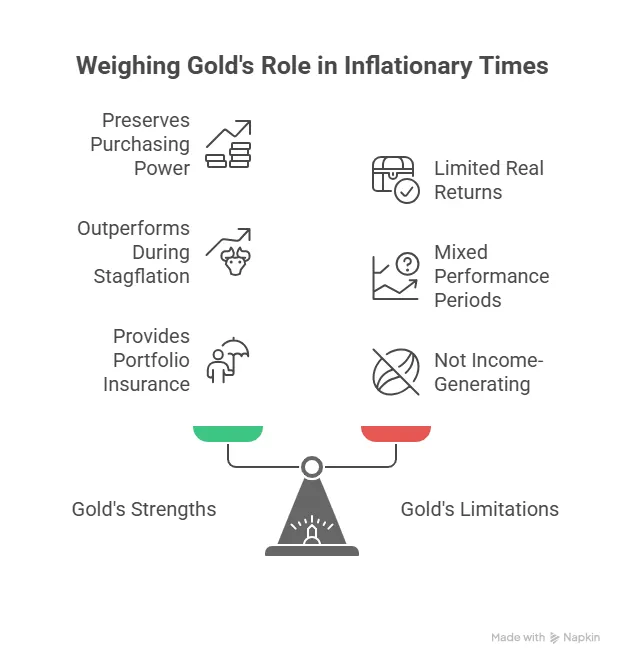

What Gold Does Exceptionally Well:

- Preserves purchasing power over extended periods

- Outperforms during stagflation scenarios

- Provides portfolio insurance when traditional assets fail

- Maintains value during currency crises

What Gold Doesn't Do:

- Generate real returns consistently above inflation

- Perform uniformly across all inflationary periods

- Replace income-generating assets in portfolios

- Guarantee profits in any specific timeframe

The Investment Imperative

Historically, gold has served as a hedge against economic uncertainty and inflation. Its intrinsic value, scarcity and universal acceptance contribute to its status as a safe-haven asset. During periods of economic turmoil, investors flock to gold as a means of preserving wealth and diversifying portfolios.

For investors concerned about inflation, gold deserves serious consideration—not as a get-rich-quick scheme, but as financial insurance against monetary debasement and economic chaos.

Take Action: Protect Your Wealth Today

The 1970s taught us that when everything else fails, gold endures. As we navigate today's complex economic landscape with mounting debt, potential stagflation risks, and currency uncertainties, that lesson may prove more valuable than ever.

Don't wait for the next crisis to hit your portfolio.

If you're a professional over 40 who has worked hard to build wealth, you understand the importance of protecting what you've earned. Just as those who bought gold before 1973 watched their wealth multiply by 2,200% during the stagflation crisis, today's informed investors are positioning themselves ahead of potential monetary chaos.

Get Your Free Gold Investment Kit from Birch Gold Group →

Birch Gold Group specializes in helping conservative investors like you diversify retirement portfolios with precious metals. Their experts can show you:

✓ How to rollover existing 401(k) or IRA funds into gold without penalties

✓ Which gold investment vehicles work best for your situation

✓ How to position your portfolio for potential stagflation scenarios

✓ Tax-advantaged strategies for precious metals investing

The question isn't whether you can afford to own gold during inflation—it's whether you can afford not to.

Claim Your Free Investment Guide Now and discover how to protect your retirement savings with the same asset that delivered 35% annual returns during America's last great inflation crisis.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Consult with qualified financial and tax professionals before making investment decisions.