Home Storage Gold IRA: Legal Nightmare of Legitimate Strategy?

The Truth About DIY Precious Metals Storage

Are you considering storing your Gold IRA at home to save on custodial fees and maintain direct control over your precious metals?

Stop right there.

Before you make a decision that could cost you thousands in penalties and potentially disqualify your entire retirement account, you need to understand the legal realities of home storage Gold IRAs.

The internet is flooded with conflicting information about whether you can legally store IRA gold in your personal safe. Some companies promise "checkbook control" and home storage solutions, while others warn of devastating IRS penalties.

So what's the truth?

The Home Storage Gold IRA Myth Exposed

Here's the uncomfortable reality:

The IRS does not permit individual investors to store their IRA gold at home.

This isn't a gray area or a matter of interpretation. Internal Revenue Code Section 408(a) explicitly requires that IRA assets be held by a qualified custodian or trustee. Your bedroom safe, bank safety deposit box, or home vault doesn't qualify.

Yet every month, thousands of investors fall for marketing schemes promising "legal" home storage solutions. These investors often discover the harsh truth only when the IRS comes knocking with penalties, taxes, and account disqualification notices.

What Happens When You Store IRA Gold at Home

When you take physical possession of your IRA gold, the IRS considers this a distribution.

This triggers several devastating consequences:

- Immediate taxation on the full value of the distributed gold

- 10% early withdrawal penalty if you're under 59½ years old

- Permanent removal of the gold from your IRA's tax-advantaged status

- Potential audit and additional scrutiny of your tax returns

One investor learned this lesson the hard way when he stored $300,000 worth of IRA gold at home. The IRS hit him with $75,000 in taxes plus a $30,000 early withdrawal penalty. His "savings" on custodial fees cost him over $100,000.

What the IRS Actually Says About Gold IRA Storage

The IRS requirements for precious metals IRAs are crystal clear:

Required Storage Standards

- Qualified Custodian: All IRA assets must be held by an IRS-approved custodian

- Segregated Storage: Your metals must be stored separately from the custodian's assets

- Insured Facility: Storage must occur at an IRS-approved depository with proper insurance

- Detailed Records: Complete documentation of all transactions and storage arrangements

Approved Storage Locations

The IRS recognizes only these storage options for Gold IRAs:

- IRS-approved depositories (such as Delaware Depository, Brinks, or HSBC)

- Qualified financial institutions with proper licensing

- Custodian-controlled facilities meeting strict security requirements

Your home, local bank, or personal storage facility cannot meet these requirements.

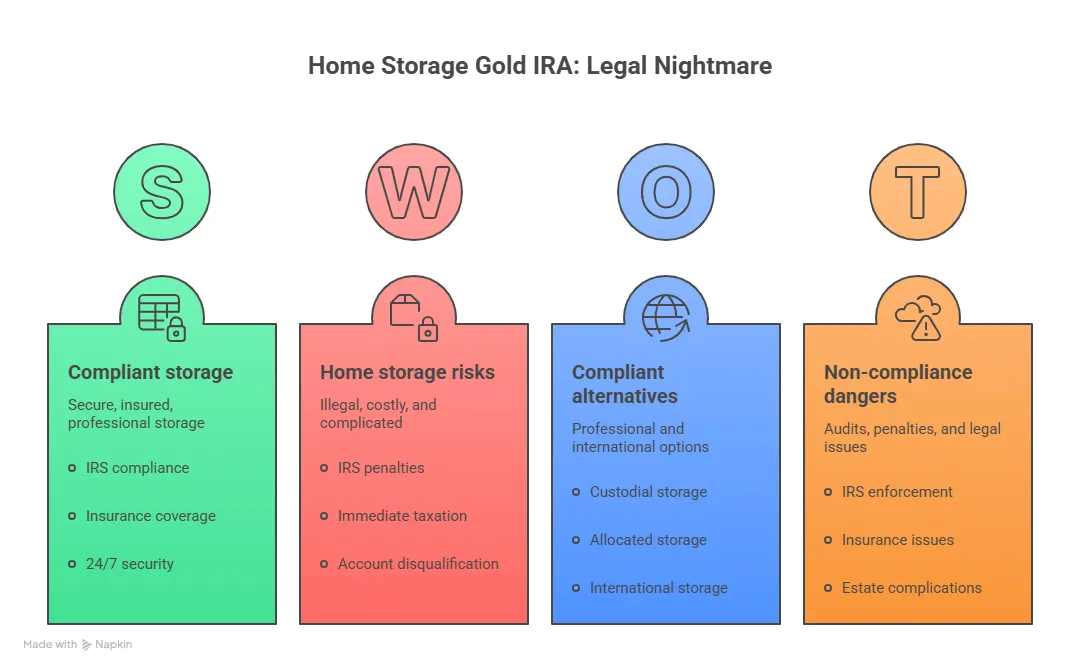

Legal Risks That Could Cost You Everything

Beyond immediate tax consequences, home storage of IRA gold exposes you to additional legal and financial risks:

IRS Enforcement Actions

- Account disqualification retroactive to the date of first violation

- Prohibited transaction penalties of 15% annually until corrected

- Criminal charges for willful tax evasion in extreme cases

Insurance and Security Issues

- Homeowner's insurance typically excludes large precious metals collections

- Theft or loss becomes your personal financial responsibility

- Natural disasters could wipe out your entire retirement savings

Estate Planning Complications

- Probate complications when beneficiaries can't locate or access stored metals

- Family disputes over physical possession of valuable assets

- Tax complications for heirs receiving improperly stored IRA assets

The "Checkbook Control" Loophole (And Why It's Dangerous)

Some companies promote "checkbook control" structures, typically involving:

- Setting up a self-directed IRA LLC

- Making yourself the LLC manager

- Using LLC funds to purchase precious metals

- Storing metals "for the LLC" at your location

This strategy is legally questionable at best.

While some taxpayers have used these structures without immediate IRS challenges, several factors make them extremely risky:

- IRS hasn't explicitly approved these arrangements

- Court cases have gone both ways on similar structures

- High audit risk due to the controversial nature

- Expensive legal setup often costing $3,000-$5,000 upfront

Even if initially successful, IRS policy changes or court decisions could retroactively disqualify these arrangements.

Legitimate Alternatives for Gold IRA Investors

Rather than risking everything with home storage, consider these IRS-compliant alternatives:

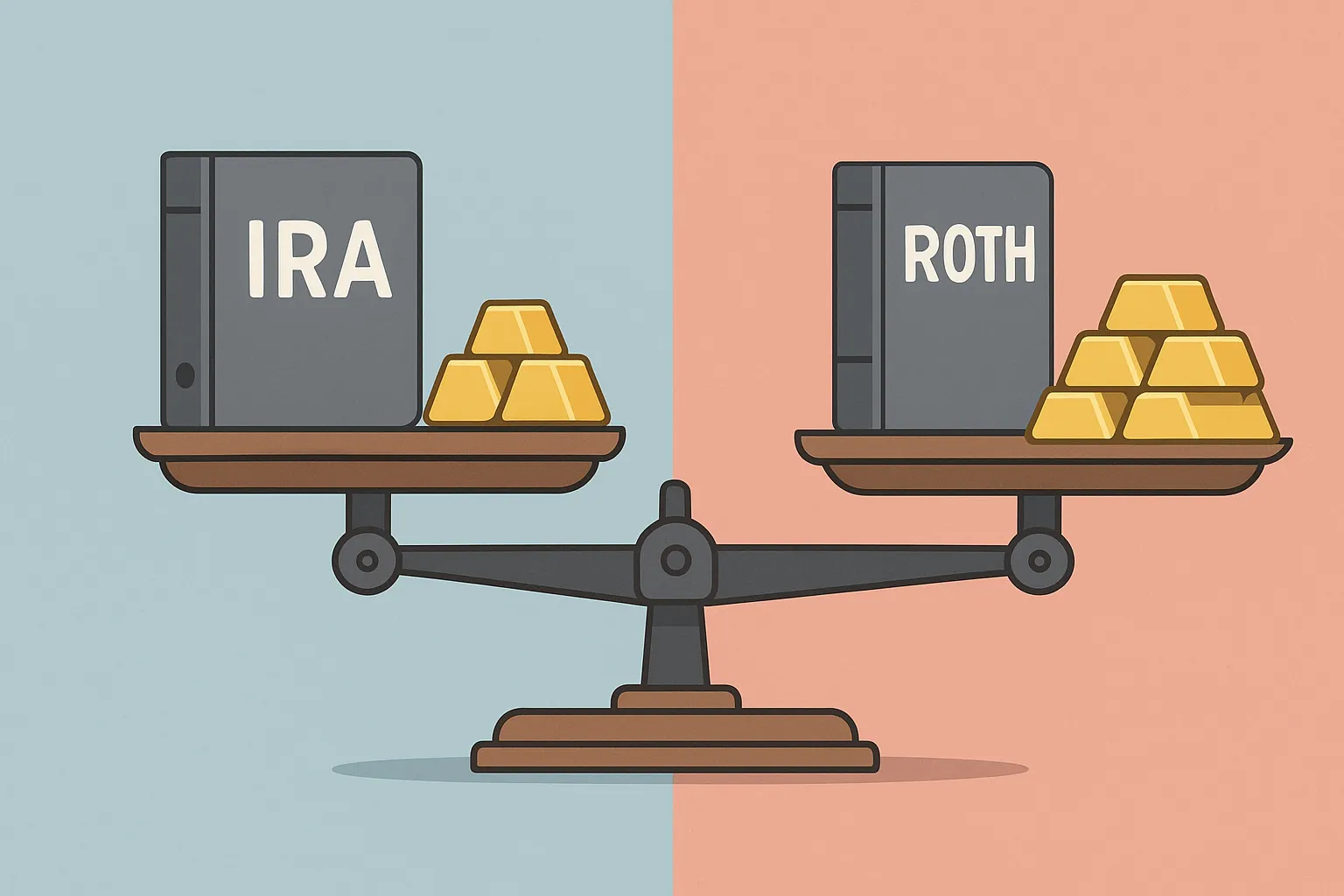

Professional Custodial Storage

Benefits:

- Full IRS compliance and audit protection

- Professional insurance coverage

- 24/7 security monitoring

- Segregated storage ensuring your metals remain separate

- Online account access and reporting

Typical Costs:

- Setup fees: $50-$100

- Annual custodial fees: $100-$300

- Storage fees: $100-$300 annually

Allocated vs. Unallocated Storage

Allocated Storage:

- Specific metals assigned to your account

- Higher storage costs but maximum security

- Complete audit trail for each bar/coin

Unallocated Storage:

- Your metals pooled with others but separately accounted

- Lower costs while maintaining IRS compliance

- Suitable for most investors

International Storage Options

Some custodians offer offshore storage in countries like:

- Singapore: Political stability and strong property rights

- Switzerland: Traditional precious metals haven

- Canada: Close proximity with excellent security

These options provide geographic diversification while maintaining full IRA compliance.

How to Set Up a Compliant Gold IRA

Setting up a legitimate Gold IRA requires careful attention to IRS regulations:

Step 1: Choose an IRS-Approved Custodian

Select a custodian specializing in precious metals IRAs with:

- Proper IRS licensing and registration

- Established relationships with approved depositories

- Transparent fee structures

- Positive customer reviews and BBB ratings

Step 2: Fund Your Account

Transfer or rollover funds from existing retirement accounts:

- Direct rollover from 401(k) or other employer plan

- Transfer from existing IRA accounts

- Annual contributions up to IRS limits

Step 3: Select Approved Precious Metals

Only certain gold products qualify for IRA investment:

Approved Gold Products:

- American Gold Eagle coins

- American Gold Buffalo coins

- Canadian Gold Maple Leaf coins

- Gold bars from approved refiners with 99.5% purity minimum

Prohibited Items:

- Collectible coins

- Jewelry or artwork

- Gold below minimum purity requirements

Step 4: Arrange Professional Storage

Work with your custodian to:

- Select an approved depository

- Choose segregated vs. non-segregated storage

- Set up insurance coverage

- Establish online account access

The Bottom Line: Professional Storage Protects Your Future

While the appeal of home storage is understandable, the legal and financial risks far outweigh any potential benefits. Professional custodial storage costs a few hundred dollars annually but protects you from devastating IRS penalties that could cost tens of thousands.

Remember: Your retirement security is worth more than saving a few dollars on storage fees.

Take Action: Protect Your Gold IRA Investment

Don't gamble with your financial future by attempting risky home storage schemes. Work with experienced professionals who understand IRS regulations and can help you build a compliant, secure Gold IRA.

Ready to explore legitimate Gold IRA options?

Birch Gold Group has helped thousands of investors navigate precious metals IRA regulations while maintaining full IRS compliance. Their experienced team can help you:

- Set up IRA-compliant precious metals accounts

- Choose approved gold and silver products

- Arrange secure, insured storage at IRS-approved facilities

- Navigate rollovers and transfers from existing retirement accounts

Get your FREE Gold IRA information kit and speak with a precious metals specialist

Don't let legal complications derail your retirement planning. Take the first step toward a secure, compliant Gold IRA investment strategy.

This article provides general information about Gold IRA regulations and should not be considered legal or tax advice. Consult with qualified professionals regarding your specific situation.