Gold: Your Ultimate Hedge Against Inflation in 2025

Are you watching your purchasing power erode as inflation continues to impact your savings? With inflation concerns dominating financial headlines and central banks worldwide grappling with monetary policy, investors are scrambling to protect their wealth. Enter gold – the time-tested guardian against currency debasement that has preserved wealth for over 5,000 years.

If you're looking for a proven strategy to shield your portfolio from inflation's devastating effects, this guide reveals everything you need to know about using gold as your financial fortress.

What Makes Gold the Ultimate Inflation Fighter?

Gold serves as an inflation hedge because it maintains its purchasing power when the value of paper currency declines. Unlike cash sitting in your bank account, gold is a real asset with intrinsic value that typically rises alongside general price levels.

Here's the key insight: When inflation strikes, central banks often respond by printing more money, which dilutes the currency's value. Gold, being finite and impossible to create out of thin air, becomes more valuable in terms of that weakened currency.

The Historical Track Record: Gold's Inflation-Fighting Performance

The 1970s Stagflation Crisis

The most compelling evidence comes from the 1970s, when the U.S. experienced devastating stagflation:

- Inflation rate: Peaked at 14.8% in 1980

- Gold performance: Rose from $35/ounce in 1970 to over $800/ounce by 1980

- Total return: More than 2,000% during the decade

This wasn't luck – it was gold fulfilling its role as a monetary safe haven when paper currencies failed.

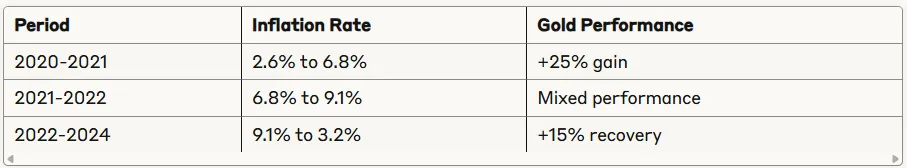

Recent Inflation Cycles (2020-2025)

During the recent inflationary surge:

Why the mixed results? Rising interest rates and dollar strength temporarily overshadowed inflation concerns, proving that gold hedging works best over longer time horizons.

How Gold Protects Your Purchasing Power

1. Currency Debasement Shield

When governments print money to fund spending or stimulate economies, each dollar becomes worth less. Gold maintains its intrinsic value regardless of how many dollars exist.

2. Supply Constraints

Unlike paper money, gold cannot be created on demand. Annual gold production increases by only 1-2%, making it naturally inflation-resistant.

3. Universal Acceptance

Gold has been valued across all cultures and time periods. This universal recognition provides stability when local currencies lose credibility.

4. No Counterparty Risk

Physical gold doesn't depend on any institution's promise to pay. It's yours, completely and permanently.

The Complete Pros and Cons Analysis

✅ Advantages of Gold as Inflation Protection

- Proven track record: 5,000+ years as a store of value

- High liquidity: Easily bought and sold worldwide

- Portfolio diversification: Low correlation with stocks and bonds

- Crisis performance: Thrives during economic uncertainty

- No default risk: Can't go bankrupt like companies or governments

❌ Potential Disadvantages

- No income generation: Doesn't pay dividends or interest

- Storage and insurance costs: Physical gold requires secure storage

- Short-term volatility: Can be volatile over months or years

- Opportunity cost: May underperform growth assets during stable periods

Your Gold Investment Options for Inflation Protection

1. Physical Gold

Best for: Maximum control and crisis protection

Options include:

- Gold coins (American Eagles, Canadian Maples)

- Gold bars (1 oz to 1000 oz sizes)

- Allocated storage programs

Considerations: Storage costs, insurance, and potential delivery delays during crises.

2. Gold ETFs and Mutual Funds

Best for: Convenience and liquidity

Top choices:

- SPDR Gold Shares (GLD)

- iShares Gold Trust (IAU)

- Aberdeen Standard Physical Gold Shares (SGOL)

Benefits: Easy to buy/sell, lower costs than physical gold, no storage hassles.

3. Digital Gold Platforms

Best for: Fractional investing and modern convenience

Modern digital platforms offer an excellent middle ground between physical ownership and ETF convenience. These platforms allow you to:

- Buy gold starting with small amounts

- Own actual physical gold stored in secure vaults

- Avoid storage and insurance hassles

- Access your investment 24/7 online

Start building your gold position today with a trusted digital platform →

4. Gold Mining Stocks

Best for: Potential leveraged returns

Considerations: Higher volatility, company-specific risks, but potential for greater gains during gold bull markets.

When Gold Might Not Protect Against Inflation

Be aware of these scenarios:

- Rapidly rising interest rates: High real yields can make gold less attractive

- Deflationary periods: Gold may decline when general prices fall

- Strong dollar environments: Gold is priced in dollars, so dollar strength can offset inflation protection

- Short-term periods: Gold works best as a long-term inflation hedge

Your Gold Implementation Strategy

Recommended Portfolio Allocation

Conservative approach: 5-10% of total portfolio

Moderate approach: 10-15% of total portfolio

Aggressive approach: 15-25% of total portfolio

Dollar-Cost Averaging Method

Instead of trying to time the market, consider:

- Monthly purchases of fixed dollar amounts

- Automatic investment programs through digital gold platforms

- Gradual accumulation during market downturns

Timing Considerations

Best times to increase gold allocation:

- Rising inflation expectations

- Currency debasement concerns

- Geopolitical tensions

- Central bank monetary easing

The Bottom Line: Your Inflation Defense Strategy

Gold isn't just a shiny metal – it's financial insurance against currency destruction. While it won't make you rich overnight, it can preserve your purchasing power when traditional investments fail.

Here's your action plan:

- Assess your inflation risk exposure: How much of your wealth is in cash or fixed-income investments?

- Choose your gold investment method: Physical gold for maximum protection, digital platforms for convenience, or a combination approach

- Start with a small allocation: Begin with 5-10% of your portfolio and adjust based on economic conditions

- Think long-term: Gold works best as a multi-year inflation hedge, not a short-term trading vehicle

Don't Wait – Start Protecting Your Wealth Today

The window for inflation protection is closing fast. Every day you delay is another day your purchasing power faces erosion from currency debasement and rising prices.

Professional investors and institutions are already moving significant portions of their portfolios into gold. Central banks worldwide have been net buyers of gold for over a decade. Smart money recognizes what's coming.

Ready to join them?

Take Action Now – Your Financial Future Depends on It

Secure Your Gold Position Today – Click Here to Get Started →

✅ Start with any amount – No minimum investment required

✅ Own real physical gold – Not paper promises

✅ Secure vault storage – Professional-grade security

✅ 24/7 online access – Monitor your investment anytime

✅ Easy buying and selling – Liquidity when you need it

Time is your enemy when inflation accelerates. The longer you wait, the more purchasing power you lose to currency debasement. Gold has protected wealth for 5,000 years – let it protect yours.

Don't let inflation steal your financial future. Take control today.

Click here to start building your inflation-proof portfolio now →

Remember: In the battle between finite gold and infinite paper money printing, history shows us which side typically wins. The question isn't whether you can afford to own gold – it's whether you can afford not to.

Your future self will thank you for taking action today.