Gold Price Projection for 2025

What Investors Need to Know

Gold has already delivered spectacular returns in 2025, with the current gold price as of 25.05.2025 is $3 357.84. The maximum price was reached on 22.04.2025 at $3499.88. But where is gold headed for the rest of the year? Here's what the experts are predicting.

Current Market Status: Gold's Record-Breaking Run

Gold has been on an unprecedented tear this year. Spot gold prices have risen by a quarter so far in 2025, almost equalling the 27% increase recorded for the whole of 2024. This performance has outpaced most traditional asset classes during a period of significant market uncertainty.

Key 2025 Performance Metrics:

- Current price: $3,357.84 (as of May 25, 2025)

- Year-to-date gain: 25%

- Record high: $3,499.88 (April 22, 2025)

Expert Price Forecasts for 2025

Major Investment Banks Lead Bullish Outlook

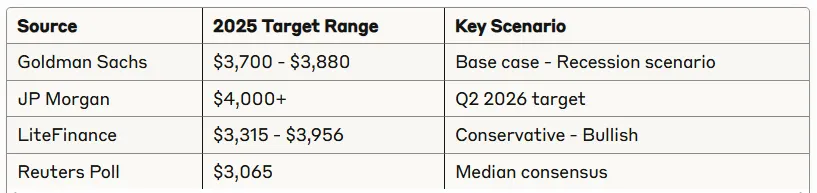

Goldman Sachs: Goldman Sachs Research predicts gold will rise to $3,700 a troy ounce by the end of 2025 (from $3,220 on May 15) as central banks buy many tonnes of the precious metal every month. In a recession scenario, they see gold potentially reaching $3,880 a troy ounce.

JP Morgan: The bank forecasts gold prices crossing the $4,000 per ounce milestone next year, following increased recession probabilities amid boosted U.S. tariffs and an ongoing U.S.-China trade war.

Reuters Poll Consensus: The poll of 29 analysts and traders returned a median forecast of $3,065 per troy ounce of gold for this year, up from $2,756 predicted in a poll three months ago.

Analyst Price Ranges

Most forecasters cluster around similar targets:

Most analysts predict that the price of gold will rise to $3,560.59–$3,925.39 by the end of 2025. The most bullish forecasts suggest that the price will surge to $3,956.22. According to more conservative forecasts, the price of this safe-haven asset could reach $3,315.00 by the end of the year.

Key Drivers Powering Gold's 2025 Rally

1. Central Bank Demand Remains Robust

Central bank purchasing continues as a primary driver. Central banks' impressive demand for gold continued in Q1 as a further 244t was added to global official reserves. While this demand was markedly lower than the previous quarter, in absolute terms it was still healthy at 24% above the five-year quarterly average.

Critical Insight: A 2024 World Gold Council survey revealed that nearly 70% of central banks plan to increase the share of gold in their reserves over the next five years, reflecting a deliberate shift away from US dollar holdings in the face of growing geopolitical and financial risks.

2. Trade War and Tariff Uncertainty

Key factors fuelled gold's price rise: the spectre of US tariffs, geopolitical uncertainty, stock market volatility and US dollar weakness. The ongoing U.S.-China trade tensions have created persistent safe-haven demand.

3. Monetary Policy Expectations

Interest rate policy remains crucial. As we look into 2025, market consensus suggests that the Fed will deliver 100 bps in cuts by year end, with inflation softening but still above target. Lower rates typically benefit gold as a non-yielding asset.

4. Investment Demand Surge

A sharp revival in gold ETF inflows fuelled a more-than-doubling of total investment demand to 552t (+170% y/y); its highest since Q1'22.

Potential Risks and Challenges

Warning Signs from Technical Analysts

Not all experts are uniformly bullish. Some technical analysts warn of potential corrections: We now expect a sharp, multi-month decline of at least 20%—a move that could be swift and jarring, especially for those unprepared.

Key Risk Factors

1. Central Bank Demand Shift: In terms of a potential bearish case for gold, an unexpected drop off in central bank demand remains the biggest fundamental risk

2. Resilient Economic Growth: Stronger than expected U.S. economic performance could reduce safe-haven demand

3. Aggressive Fed Policy: Higher interest rates to combat inflation could pressure gold prices

4. Overextended Rally: Some analysts worry about speculative excess at current levels

Investment Implications for Different Scenarios

Bull Case ($3,700 - $4,000+)

- Continued central bank buying

- Recession materializes

- Trade war escalation

- Fed cuts rates aggressively

Base Case ($3,300 - $3,600)

- Moderate economic growth

- Steady central bank demand

- Controlled inflation

- Limited Fed rate cuts

Bear Case ($2,800 - $3,200)

- Strong economic resilience

- Central bank buying slowdown

- Trade tensions ease

- Fed holds rates higher

Strategic Positioning for Gold's 2025 Outlook

For Conservative Investors

Consider gold as 5-10% of portfolio for diversification and inflation protection, given the strong institutional support and uncertain economic environment.

For Growth-Oriented Investors

Monitor key indicators:

- Central bank purchase data

- Fed policy shifts

- Trade war developments

- Dollar strength

For Tactical Traders

Watch for technical levels around:

- Support: $3,200 - $3,300

- Resistance: $3,500 - $3,600

- Breakout targets: $3,700 - $4,000

The Bottom Line

Gold's 2025 trajectory looks positive based on fundamental drivers, with most expert forecasts targeting $3,300 - $4,000 by year-end. The commodity is also likely to climb as ETF investors increase their holdings in anticipation of interest rate cuts and amid growing recession concerns.

However, the rapid 25% year-to-date gain suggests some caution is warranted. The key will be monitoring central bank demand, Fed policy decisions, and trade war developments.

Key Takeaway: While gold appears well-positioned for continued gains, investors should prepare for potential volatility and consider gold as part of a diversified strategy rather than a standalone bet on economic uncertainty.