Gold Performance During Recession: Your Ultimate Safe-Haven Guide

When financial markets start shaking and recession warnings flash across headlines, smart investors turn their attention to one time-tested asset: gold. But does the yellow metal really live up to its reputation as the ultimate recession-proof investment?

The answer might surprise you. While gold doesn't guarantee profits during every economic downturn, its track record during major recessions reveals compelling patterns that every investor should understand.

How Gold Has Performed in Major Recessions

The 2008 Financial Crisis: Gold's Shining Moment

During the 2008-2009 Great Recession, gold delivered exactly what investors hoped for. While the S&P 500 plummeted 37% in 2008, gold prices surged approximately 25%. The precious metal continued climbing through 2011, reaching an all-time high of over $1,900 per ounce.

Key Performance Metrics (2008-2011):

- Gold price increase: 166%

- S&P 500 performance: -37% (2008), then gradual recovery

- Timeline: Gold began outperforming stocks in late 2007

COVID-19 Recession (2020): Modern Validation

The pandemic-induced recession of 2020 provided fresh evidence of gold's recession resilience. Despite initial volatility in March 2020, gold recovered quickly and reached new record highs.

2020 Performance Highlights:

- Gold gained 25% for the year

- Hit new all-time high of $2,075 per ounce

- Outperformed most asset classes during peak uncertainty

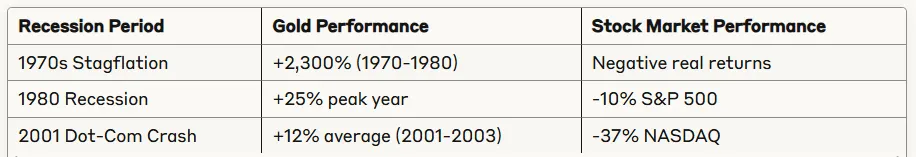

Earlier Recessions: Consistent Patterns

Historical data reveals gold's consistent performance during economic stress:

Why Gold Thrives When Economies Struggle

1. Inflation Hedge Protection

Recessions often trigger aggressive monetary policies, including money printing and near-zero interest rates. These actions typically lead to currency devaluation and inflation - two scenarios where gold historically excels.

How Gold Fights Inflation:

- Maintains purchasing power over time

- Benefits from currency weakness

- Acts as store of value when paper assets decline

2. Flight to Safety Phenomenon

During economic uncertainty, investors abandon risky assets for perceived safe havens. Gold represents the ultimate "flight to safety" destination because:

- No counterparty risk (unlike bonds or bank deposits)

- 5,000+ year history as a store of value

- Global recognition and liquidity

- Physical tangibility in an increasingly digital world

3. Central Bank Demand Surge

Central banks worldwide increase gold purchases during recessions to:

- Diversify away from volatile currencies

- Hedge against their own monetary policies

- Strengthen national reserves during uncertainty

Gold vs Other "Safe" Assets During Recessions

Government Bonds: The Traditional Alternative

While government bonds traditionally served as recession hedges, several factors now challenge this assumption:

Bonds vs Gold During Recessions:

- Bonds vulnerable to inflation erosion

- Near-zero interest rates reduce bond appeal

- Gold offers inflation protection bonds cannot match

- Physical gold provides tangible security

Real Estate: The Illiquid Alternative

Real estate often struggles during recessions due to:

- Liquidity constraints during market stress

- Correlation with local economic conditions

- High transaction costs and time requirements

- Leverage risks during credit crunches

Gold offers superior liquidity and global market access.

Stock Market: Maximum Volatility

Equities typically experience the most severe declines during recessions:

- 2008: S&P 500 fell 57% from peak to trough

- 2020: 34% decline in just 33 days

- 2000-2002: NASDAQ fell 78%

Gold's negative correlation with stocks provides crucial portfolio protection.

Timing Gold Investments for Recession Protection

Leading Recession Indicators to Watch

Smart gold investors monitor these early warning signals:

Economic Indicators:

- Inverted yield curve (historically precedes recessions by 6-24 months)

- Rising unemployment claims

- Declining manufacturing activity

- Consumer confidence drops

Market Signals:

- Increased market volatility

- Currency weakness signals

- Central bank policy shifts toward accommodation

- Geopolitical tensions escalating

Optimal Entry Strategies

Historical analysis suggests the best gold buying opportunities often occur:

- 12-18 months before official recession declaration

- During initial market panic phases

- When real interest rates turn negative

- At the start of quantitative easing programs

Building Recession-Proof Gold Strategies

Portfolio Allocation Guidelines

Financial experts typically recommend:

Conservative Approach:

- 5-10% portfolio allocation to gold

- Focus on physical gold or gold-backed securities

- Gradual accumulation during economic expansion

Aggressive Recession Hedge:

- 15-25% allocation during high recession probability

- Include both physical gold and mining stocks

- Consider gold IRAs for tax-advantaged growth

Gold IRA Advantages During Recessions

Gold IRAs offer unique recession protection benefits:

- Tax-deferred or tax-free growth potential

- Professional storage and insurance

- Regulatory compliance and security

- Long-term wealth preservation focus

Important Considerations:

- Higher fees than traditional IRAs

- Storage and custodian requirements

- Limited liquidity compared to paper assets

- Professional guidance recommended

Risk Management Essentials

Even gold investments require proper risk management:

Diversification Within Gold:

- Physical gold (coins, bars)

- Gold ETFs and mutual funds

- Gold mining stocks (higher risk/reward)

- International gold exposure

Timing Considerations:

- Dollar-cost averaging during accumulation phases

- Profit-taking during extreme overvaluation

- Rebalancing as economic conditions change

The Bottom Line: Gold's Recession Record

Gold's performance during recessions demonstrates clear patterns:

Strengths:

- Consistent outperformance during major economic crises

- Inflation protection when currencies weaken

- Portfolio diversification and risk reduction

- Global liquidity and recognition

Limitations:

- Doesn't generate income or dividends

- Can be volatile during short-term market stress

- Storage and insurance costs for physical holdings

- May underperform during economic expansion periods

Your Next Steps for Recession Protection

Based on gold's historical recession performance, consider these action steps:

- Assess Your Current Exposure: Review your portfolio's recession vulnerability

- Research Gold Investment Options: Compare physical gold, ETFs, and Gold IRAs

- Monitor Economic Indicators: Watch for recession warning signals

- Consult Financial Professionals: Discuss gold allocation strategies with qualified advisors

- Start Gradually: Begin building gold positions before economic stress peaks

Remember, successful recession investing requires preparation before the storm hits. Gold's track record during past recessions provides compelling evidence for its role in defensive portfolios, but timing and allocation remain crucial for optimal results.

The next recession will come - the question isn't if, but when.

Will your portfolio be ready? Find out about the Birch Gold Group in our article: https://goldenkey.foundation/blog/birch-gold-group-review

and/or claim your free gift HERE.