Gold IRA vs Physical Gold: Which Investment Strategy Wins in 2025?

Are you watching your retirement savings shrink while inflation eats away at your

purchasing power?

If you're over 40 and politically conservative, you've probably noticed something alarming: traditional retirement accounts aren't providing the security they once promised. With economic uncertainty looming and currency devaluation concerns growing, smart investors are asking one crucial question:

Should I protect my wealth with a Gold IRA or physical gold ownership?

Here's the truth most financial advisors won't tell you...

The Great Gold Rush: Why Precious Metals Are Booming

Professional Americans are flooding into gold investments like never before. Why? Because they've realized that paper assets can vanish overnight, but gold has preserved wealth for over 5,000 years.

But here's where it gets tricky: Not all gold investments are created equal.

You have two primary paths:

- Gold IRA (tax-advantaged retirement account)

- Physical gold ownership (direct possession)

Each strategy serves different goals, and choosing wrong could cost you thousands in missed opportunities or unexpected expenses.

Gold IRA: Your Retirement Account's Golden Shield

What Is a Gold IRA?

A Gold IRA (Individual Retirement Account) allows you to hold IRS-approved precious metals within a tax-advantaged retirement account. Think of it as your traditional IRA's sophisticated cousin that holds gold bars and coins instead of stocks and bonds.

How Gold IRAs Work

The Process:

- Open an account with an approved custodian

- Fund your account (rollover from existing 401k/IRA or new contributions)

- Select approved metals (gold, silver, platinum, palladium)

- Secure storage in an IRS-approved depository

- Monitor and manage your precious metals portfolio

Gold IRA Benefits

Tax Advantages:

- Traditional Gold IRA: Tax-deductible contributions, tax-deferred growth

- Roth Gold IRA: Tax-free withdrawals in retirement

- Protection from current income taxes on gains

Professional Management:

- Expert custodians handle compliance

- Secure, insured storage facilities

- Regular account statements and reporting

Diversification Power:

- Hedge against stock market volatility

- Protection from currency devaluation

- Portfolio balance during economic uncertainty

Gold IRA Drawbacks

Limited Access:

- Can't physically possess your metals

- Early withdrawal penalties before age 59½

- Required minimum distributions after age 73

Ongoing Costs:

- Annual custodian fees ($75-$300)

- Storage fees ($100-$300 annually)

- Setup and transaction fees

Physical Gold: The Ultimate Wealth Insurance

What Is Physical Gold Ownership?

Physical gold ownership means you directly purchase and possess gold coins, bars, or bullion. You control storage, access, and can hold your wealth in your hands.

How Physical Gold Works

The Process:

- Research reputable dealers and compare prices

- Purchase approved gold products (coins, bars, rounds)

- Arrange secure storage (home safe, bank deposit box, private vault)

- Insure your holdings against theft or loss

- Monitor market conditions for buying/selling opportunities

Physical Gold Benefits

Complete Control:

- Immediate access to your wealth

- No custodian fees or restrictions

- Privacy in your transactions

Ultimate Security:

- No counterparty risk

- Protection from banking system failures

- Tangible asset you can touch and verify

Flexibility:

- Buy and sell anytime

- No contribution limits

- Pass down to heirs easily

Physical Gold Drawbacks

Storage Challenges:

- Home storage security risks

- Bank deposit box limitations

- Private vault storage costs

Tax Implications:

- Capital gains taxes on profits

- No tax-deferred growth benefits

- Classified as collectible (higher tax rates)

Liquidity Concerns:

- Finding buyers for large quantities

- Dealer premiums and spreads

- Authentication requirements

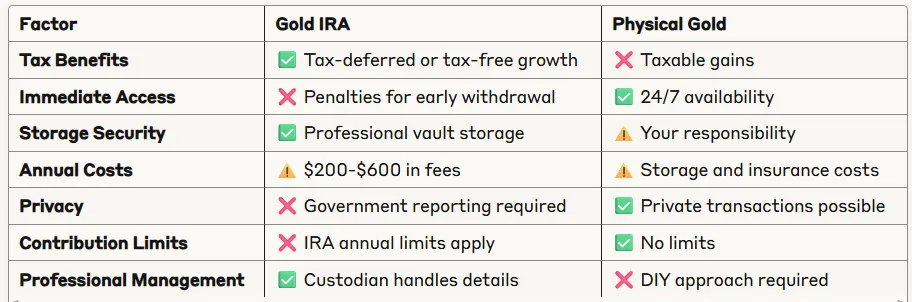

Head-to-Head Comparison: Gold IRA vs Physical Gold

Which Strategy Fits Your Situation?

Choose Gold IRA If You:

- Want tax advantages for retirement planning

- Prefer professional management of storage and compliance

- Have existing retirement accounts to rollover

- Don't need immediate access to your gold

- Want set-and-forget investing

Choose Physical Gold If You:

- Value immediate access to your wealth

- Want complete control over your assets

- Prefer maximum privacy in transactions

- Have secure storage solutions already in place

- Want to avoid ongoing fees

The Smart Money Move: Consider Both

Here's what wealthy investors know: You don't have to choose just one strategy.

Many successful precious metals investors use a hybrid approach:

- 70% Gold IRA for tax-advantaged retirement planning

- 30% Physical Gold for immediate access and privacy

This combination maximizes tax benefits while maintaining some direct control over your precious metals holdings.

Your Next Steps: Secure Your Financial Future Today

The clock is ticking on your retirement security. Every day you delay is another day your wealth remains vulnerable to inflation and market volatility.

Here's your action plan:

- Evaluate your current retirement portfolio - How much is at risk?

- Determine your gold allocation strategy - IRA, physical, or hybrid?

- Connect with precious metals experts who understand your goals

- Start with a free consultation to explore your options

Don't let another market crash or economic crisis catch you unprepared. Take control of your financial future with the stability and security that only precious metals can provide.

Ready to protect your wealth with gold?

Get Your Free Gold Investment Guide and Consultation →

Discover how thousands of Americans are already protecting their retirement savings with precious metals. Click now to speak with a gold investment specialist and receive your complimentary investment guide.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Consult with qualified financial and tax professionals before making investment decisions.