Gold IRA vs Bank Account Safety: Which Protects Your Retirement Better?

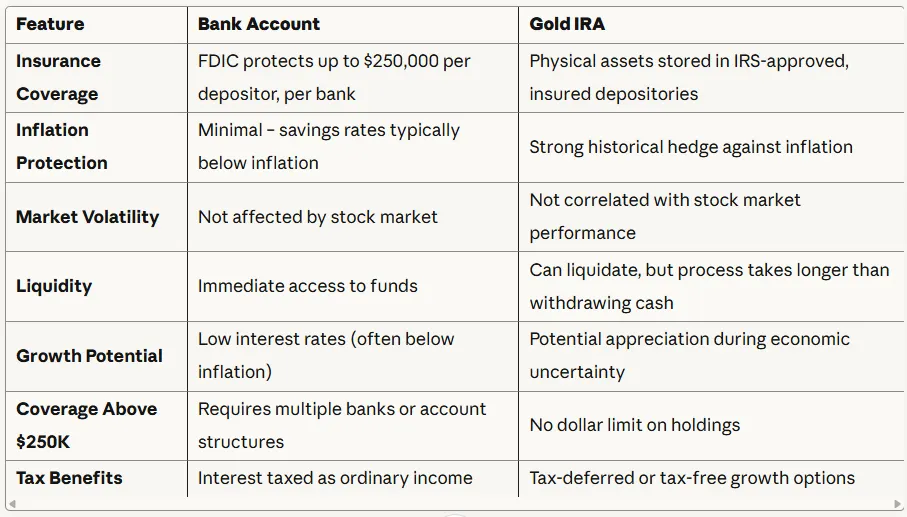

Here's something most people don't realize: the FDIC only covers $250,000 per depositor, per bank, for each account ownership category. If you've got more than that sitting in your checking or savings account, you're exposed.

Even worse? While your cash sits "safely" in the bank, inflation quietly eats away at its purchasing power every single day.

For professionals over 40 looking to secure their retirement, this creates a serious problem. You've worked decades to build your nest egg, but traditional bank accounts might be undermining your financial security in ways you haven't considered.

The Hidden Vulnerabilities in Your Bank Account

Bank accounts feel safe. After all, they're FDIC-insured, right?

Here's what that really means:

Since the FDIC was founded in 1933, no depositor has lost a penny of FDIC-insured funds. That sounds reassuring until you understand the fine print.

The FDIC Insurance Reality:

- Coverage caps at $250,000 per depositor, per bank, per ownership category

- If you have multiple accounts at the same bank in your name only, they're added together under that single $250,000 limit

- Three of the four largest bank failures in American history occurred in 2023, and all three held an abnormally large percentage of uninsured deposits

- Accounts above the limit faced genuine risk of loss

Even if you structure accounts across multiple ownership categories to maximize coverage, there's a bigger threat lurking: inflation.

The Inflation Problem:

Your cash loses purchasing power every year. Inflation rose to 2.7% in late 2024, nearly a full percentage point above the Federal Reserve's 2% goal. That means if you have $100,000 in the bank earning minimal interest, you're effectively losing money in real terms.

Traditional savings accounts and CDs rarely beat inflation. Your account balance might grow nominally, but your actual buying power shrinks.

How Gold IRAs Provide Different Protection

A Gold IRA is a self-directed retirement account that allows investors to hold physical gold and other precious metals as part of their retirement savings. Unlike traditional IRAs limited to stocks and bonds, Gold IRAs let you own tangible assets.

Key Protection Features:

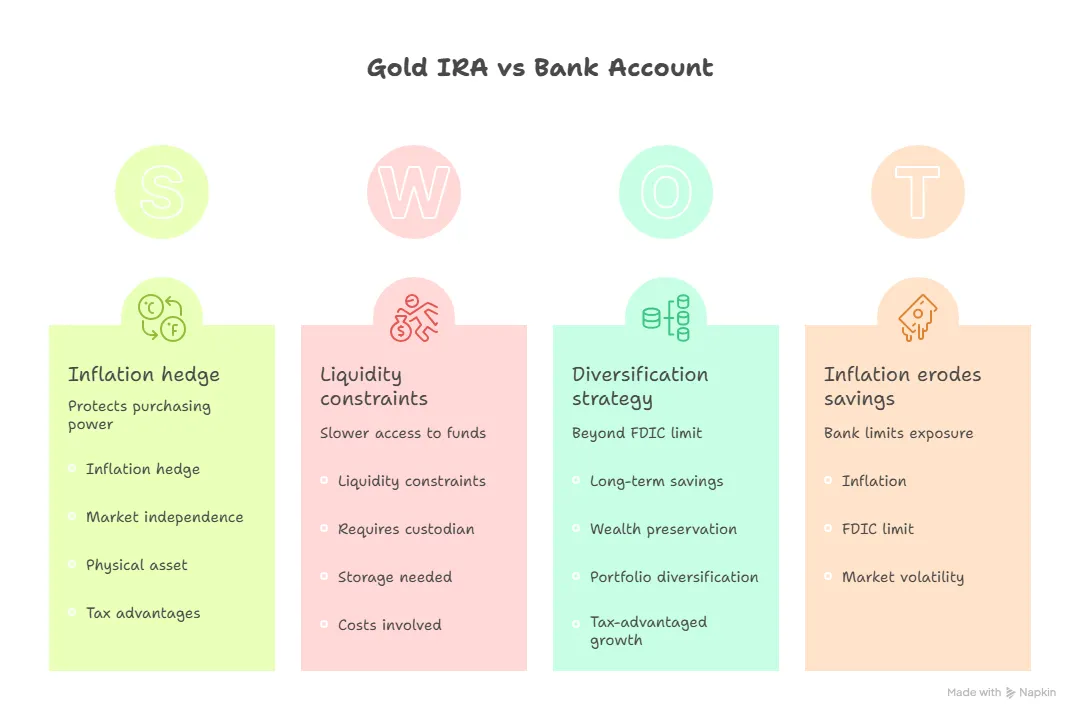

Inflation Hedge: Gold has historically maintained its value, making it a strong hedge against inflation. As the dollar weakens, gold prices often rise, protecting purchasing power.

Market Independence: Unlike stocks and bonds, gold's value is not directly correlated to financial markets, making it a safe-haven asset during economic downturns.

Physical Asset: You own actual gold bars or coins that meet IRS purity standards (minimum 99.5% pure), stored in IRS-approved depositories.

Tax Advantages: Gold IRAs operate under the same tax-advantaged structures as traditional and Roth IRAs, meaning tax-deferred or tax-free growth depending on which type you choose.

Safety Comparison: Bank Account vs Gold IRA

The Real Inflation Threat

Let's run the numbers.

If you keep $500,000 in a bank account earning 0.5% interest annually, and inflation runs at 2.7%, here's what happens:

- Year 1: Your purchasing power drops by approximately $11,000

- Year 5: You've lost roughly $60,000 in real value

- Year 10: Your half-million dollars buys what $380,000 bought when you started

Meanwhile, gold saw a surge in price throughout 2024, breaking numerous records. During the same inflationary periods that erode cash, gold typically maintains or increases its value.

Smart Diversification Strategy

You don't have to choose one or the other.

The strongest retirement strategy often includes both:

Keep in Bank Accounts:

- Emergency fund (3-6 months expenses)

- Short-term savings for planned expenses

- Operating cash you need readily available

Consider for Gold IRA:

- Long-term retirement savings beyond the FDIC limit

- Wealth preservation against inflation

- Portfolio diversification beyond stocks and bonds

- For 2025, you can contribute up to $7,000 annually if under 50, or $8,000 if 50 or older

Who Should Consider a Gold IRA?

Gold IRAs make particular sense if you:

- Have accumulated retirement savings exceeding FDIC coverage limits

- Are concerned about inflation eroding your purchasing power

- Want diversification beyond traditional stock and bond portfolios

- Are politically conservative and prefer tangible asset protection

- Have above-median household income and can allocate funds for long-term holding

- Are within 10-20 years of retirement and want to preserve wealth

Important Considerations

Gold IRAs Require:

- Working with an IRS-approved custodian

- Storage in approved depositories (you cannot keep IRA gold at home)

- Understanding of contribution limits and distribution rules

- Patience – this is a long-term wealth preservation strategy, not a get-rich-quick scheme

Costs to Know:

- Setup fees for opening the account

- Annual custodian fees

- Storage fees at the depository

- Potential transaction fees when buying or selling metals

Your Next Step

Your retirement deserves better protection than hoping inflation stays low and your bank balance stays under the FDIC limit.

Gold IRAs offer a time-tested way to preserve purchasing power, diversify beyond traditional investments, and protect wealth that took decades to build.

Ready to learn more about protecting your retirement with a Gold IRA?

Birch Gold Group specializes in helping professionals like you diversify retirement savings with precious metals. They offer transparent pricing, educational resources, and personalized guidance through the entire process.

Discover how a Gold IRA can strengthen your retirement strategy →

Don't let inflation and bank account limits undermine your financial security. Take control of your retirement protection today.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor and tax professional before making investment decisions.