Gold IRA Storage Facility Insurance: Complete Protection Guide

Your gold sits in a vault somewhere, but what happens if disaster strikes?

Gold IRA storage facility insurance stands between your retirement savings and potential catastrophic loss.

Understanding this protection could save your financial future.

The Security Imperative: Why Insurance Matters

When you invest in a Gold IRA, the IRS requires your precious metals to be stored in an approved depository facility. You cannot keep these assets at home or in a personal safe deposit box. This mandatory third-party storage creates a unique insurance need that many investors overlook until it's too late.

The harsh reality: Your precious metals face risks from theft, natural disasters, transportation accidents, and even facility bankruptcy. Without proper insurance coverage, a single catastrophic event could wipe out decades of retirement planning.

IRS Storage Requirements and Insurance Implications

The Internal Revenue Service mandates that all Gold IRA assets must be:

- Stored in an IRS-approved depository

- Managed by a qualified custodian

- Kept separate from personal holdings

This regulatory framework creates multiple layers where insurance protection becomes essential. Your custodian selects the depository, but you need to understand what insurance coverage protects your specific assets.

Key insight: IRS compliance alone doesn't guarantee insurance protection. The law requires secure storage but doesn't mandate specific insurance minimums.

Types of Insurance Coverage for Gold IRA Storage

Depository Insurance

The storage facility itself carries primary insurance coverage. Major depositories like Delaware Depository, Brinks Global Services, and Texas Precious Metals Depository typically maintain comprehensive policies covering:

- All-risk coverage for theft, burglary, and mysterious disappearance

- Natural disaster protection including fire, flood, earthquake, and severe weather

- Transportation insurance during shipment to and from the facility

- Terrorism and civil unrest coverage in most policies

Custodian Insurance

Your IRA custodian may carry additional insurance layers, including:

- Errors and omissions coverage for administrative mistakes

- Fidelity bonds protecting against employee theft or fraud

- Cyber liability insurance for digital security breaches

Segregated vs. Non-Segregated Storage Insurance

Segregated Storage:

- Your metals are stored separately and individually identified

- Insurance claims are typically straightforward

- Higher storage fees but clearer ownership and coverage

Non-Segregated (Commingled) Storage:

- Your metals are stored with other investors' assets

- Insurance coverage is proportional to your holdings

- Lower storage fees but more complex claim processes

Major Depository Insurance Details

Delaware Depository

- Coverage amount: Typically $1 billion in comprehensive coverage

- Insurer: Lloyd's of London and other A-rated carriers

- Special features: 24/7 monitoring, armed response teams

Brinks Global Services

- Coverage amount: Multi-billion dollar coverage limits

- Insurer: International insurance consortium

- Special features: Military-grade security, redundant systems

Texas Precious Metals Depository

- Coverage amount: $1 billion minimum coverage

- Insurer: Major commercial insurers

- Special features: Texas-based operations, segregated storage specialization

What Insurance Covers (and Critical Exclusions)

Covered Events

✅ Theft and burglary - Complete protection for criminal activity

✅ Fire damage - Full replacement value coverage

✅ Flood and water damage - Natural disaster protection

✅ Transportation losses - Coverage during shipment

✅ Employee theft - Protection from internal fraud

✅ Terrorism acts - Coverage for man-made disasters

Common Exclusions

❌ War and nuclear events - Typically excluded from standard policies

❌ Government confiscation - Political risk generally not covered

❌ Market value fluctuations - Insurance covers replacement, not investment gains

❌ Custodian bankruptcy - May require separate coverage

❌ Processing errors - Administrative mistakes might not be covered

How to Verify Your Gold IRA Insurance Coverage

Essential Questions for Your Custodian

1. "Which specific depository stores my metals?"

2. "What is the total insurance coverage amount?"

3. "Who are the insurance carriers and their ratings?"

4. "Is my account segregated or commingled?"

5. "What events are specifically excluded from coverage?"

6. "How are claims processed and how long do they take?"

Documentation to Request

- Copy of the depository's insurance certificate

- Detailed policy exclusions list

- Claims processing procedures

- Annual insurance renewal confirmations

Red Flags to Watch For

⚠️ Vague insurance descriptions - Lack of specific coverage details

⚠️ Unusually low storage fees - May indicate inadequate insurance

⚠️ Unrated insurance carriers - Unknown or poorly-rated insurers

⚠️ No segregated storage options - Limited protection for your specific assets

Insurance Costs and Fee Structure

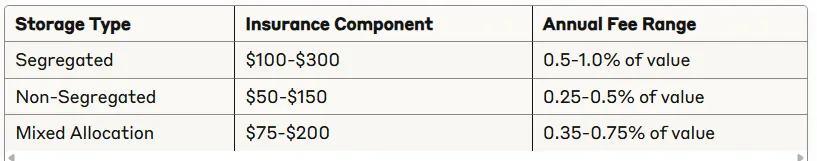

Typical Annual Costs

Who Pays for Insurance?

Standard practice: Insurance costs are built into storage fees charged to investors. You don't pay insurers directly, but insurance represents a significant portion of your annual Gold IRA maintenance costs.

Cost breakdown (typical):

- Storage facility: 60-70% of fees

- Insurance premiums: 20-30% of fees

- Administrative costs: 10-20% of fees

Making the Right Insurance Decision

Questions to Consider

How much insurance is enough?

Most experts recommend coverage equal to 100% of your account value, with reputable depositories offering this as standard.

Should you pay extra for segregated storage?

If your account exceeds $100,000, segregated storage often provides better insurance claim processes despite higher costs.

What about additional coverage?

Some investors purchase separate precious metals insurance policies, but these typically duplicate existing coverage and add unnecessary costs.

Peace of Mind Through Proper Coverage

Gold IRA storage facility insurance represents one of the most important protections for your retirement assets. The right coverage protects against virtually every risk except market fluctuations and government actions.

Take action today:

- Contact your custodian to verify current insurance details

- Request documentation of coverage limits and exclusions

- Understand whether your storage is segregated or commingled

- Review insurance annually when policies renew

Your retirement security depends on more than just gold's performance. Proper insurance coverage ensures your precious metals remain safe regardless of external circumstances.

Remember: The best Gold IRA insurance is the coverage you understand completely. Don't leave your retirement to chance – verify your protection today.