Gold IRA Setup Process: Your Complete Step-by-Step Guide

Setting up a Gold IRA might seem complex, but breaking it down into clear steps makes the process straightforward. Whether you're looking to diversify your retirement portfolio or hedge against economic uncertainty, this guide walks you through exactly what you need to do.

What You Need to Know Before Starting

A Gold IRA is a self-directed individual retirement account that holds physical precious metals instead of traditional paper assets. Unlike regular IRAs filled with stocks and bonds, your Gold IRA contains actual gold, silver, platinum, or palladium stored in an IRS-approved depository.

Key Benefits That Drive This Decision:

- Portfolio diversification beyond traditional assets

- Inflation hedge protection

- Tax-advantaged retirement savings

- Tangible asset ownership

The entire setup process typically takes 7-14 business days once you have all required documentation ready.

Pre-Setup Preparation: Getting Your Ducks in a Row

Documentation You'll Need

- Government-issued photo ID

- Social Security card or documentation

- Proof of address (utility bill or bank statement)

- Existing retirement account statements (for rollovers)

- Employment verification (for SEP IRAs)

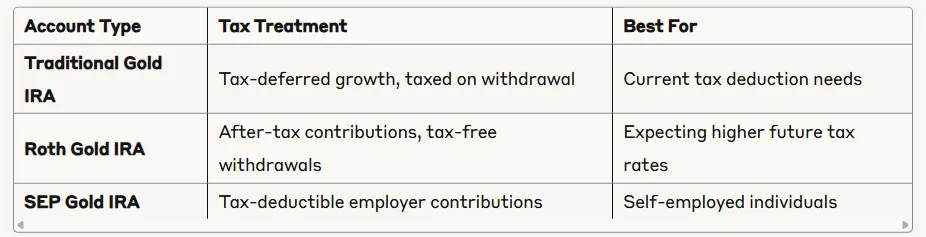

Choose Your Account Type

Financial Minimums

Most reputable Gold IRA companies require minimum investments between $10,000-$50,000.

Factor in setup fees ($50-$100), annual custodian fees ($100-$300), and storage fees ($100-$300 annually).

The 6-Step Gold IRA Setup Process

Step 1: Choose Your Custodian

Your custodian manages the administrative side of your Gold IRA. Look for:

- IRS approval and proper licensing

- Fee transparency (avoid hidden charges)

- Experience with precious metals IRAs

- Strong customer service ratings

- Insurance coverage for your assets

Research companies like Equity Trust, STRATA Trust, or other established custodians. Avoid high-pressure sales tactics or companies making unrealistic promises.

Step 2: Select a Precious Metals Dealer

Choose a dealer who:

- Offers IRA-approved metals only

- Provides transparent pricing

- Has established relationships with custodians

- Offers buyback programs

- Maintains proper licensing and insurance

Step 3: Open Your Account

Complete the custodian's application process:

- Fill out account opening forms

- Provide required documentation

- Choose beneficiaries

- Review and sign custodial agreements

- Pay setup fees

This step typically takes 2-3 business days for approval.

Step 4: Fund Your Account

Three Funding Options:

Direct Rollover (Most Common)

- Funds transfer directly from existing retirement account

- No tax consequences or penalties

- 60-day rule doesn't apply

- Most efficient method

Indirect Rollover

- You receive funds and have 60 days to deposit

- Subject to 20% withholding

- Higher risk of tax consequences

- Generally not recommended

Direct Contribution

- New money from your income

- Subject to annual contribution limits

- $7,000 limit for 2024 (under 50)

- $8,000 limit for 2024 (50 and older)

Step 5: Purchase Approved Metals

IRA-Approved Metals Requirements:

- Gold: Minimum 99.5% purity

- Silver: Minimum 99.9% purity

- Platinum: Minimum 99.95% purity

- Palladium: Minimum 99.95% purity

Popular IRA-Approved Options:

- American Gold Eagles

- Canadian Gold Maple Leafs

- American Silver Eagles

- PAMP Suisse gold bars

- Johnson Matthey silver bars

Work with your dealer to select metals that fit your investment goals and budget.

Step 6: Arrange Secure Storage

Storage Requirements:

- Must use IRS-approved depository

- Cannot store metals at home

- Choose between segregated or non-segregated storage

Storage Options:

Storage Type Description Cost Security Segregated Your metals stored separately Higher fees Maximum security Non-Segregated Metals commingled with others Lower fees Standard security Popular depositories include Delaware Depository, Brinks, and Texas Precious Metals Depository.

Critical Decisions During Setup

Custodian Selection Criteria

Beyond basic requirements, evaluate:

- Communication quality - Do they explain processes clearly?

- Technology platform - Can you easily access account information?

- Reputation - Check Better Business Bureau ratings and customer reviews

- Experience - How long have they specialized in precious metals IRAs?

Metal Selection Strategy

Consider your goals:

- Growth focus: Higher-premium collectible coins

- Stability focus: Lower-premium bullion

- Diversification: Mix of gold, silver, and other metals

- Liquidity needs: Stick to widely recognized products

Timeline and Cost Breakdown

Typical Setup Timeline:

- Account opening: 2-3 business days

- Funding transfer: 3-7 business days

- Metal purchase and delivery: 7-10 business days

- Total process: 12-20 business days

Cost Structure:

- Setup fee: $50-$100

- Annual custodian fee: $100-$300

- Storage fee: $100-$300 annually

- Transaction fees: $25-$50 per transaction

- Closing fee: $250-$300 (if you close the account)

Avoiding Common Setup Pitfalls

Prohibited Transactions

Never:

- Store metals at home or in a safe deposit box

- Buy metals directly for personal use

- Sell metals to yourself or family members

- Use IRA funds for personal benefit before retirement

Compliance Issues

- Only purchase IRA-approved metals

- Ensure proper insurance coverage

- Keep detailed records of all transactions

- Report required minimum distributions after age 73

Tax Traps

- Understand your account type's tax implications

- Don't miss required minimum distributions

- Be aware of early withdrawal penalties (10% before age 59½)

What Happens After Setup

Ongoing Management:

- Monitor account statements monthly

- Review metal performance and market conditions

- Consider rebalancing if portfolio allocation shifts significantly

- Stay informed about IRS rule changes

Distribution Planning:

- Understand distribution options (cash or physical metals)

- Plan for required minimum distributions

- Consider tax implications of withdrawal timing

- Develop exit strategy aligned with retirement goals

Taking Action

Setting up a Gold IRA requires careful planning but follows a straightforward process. Start by researching custodians and getting quotes from multiple companies. Gather your documentation early to avoid delays.

Remember that a Gold IRA is a long-term retirement strategy. Focus on reputable companies with transparent pricing rather than high-pressure sales tactics or unrealistic promises.

The key to success lies in understanding each step before you begin, choosing quality partners, and maintaining compliance with IRS regulations. With proper setup, your Gold IRA can serve as a valuable component of your retirement portfolio for decades to come.

Ready to get started? Contact 2-3 custodians for quotes, compare their fee structures, and choose the one that best fits your investment goals and communication preferences.