Gold IRA Medicare Considerations

Essential Planning for High-Income Retirees

Medicare isn't one-size-fits-all. If you've built substantial wealth through a Gold IRA, your retirement healthcare costs could be dramatically higher than expected due to Medicare's Income-Related Monthly Adjustment Amount (IRMAA) surcharges.

About 4.9 million Medicare beneficiaries paid Part B IRMAA surcharges in 2024, amounting to about 7% of the 67 million total enrollees. While this affects a minority of Medicare recipients, Gold IRA holders are disproportionately likely to face these additional costs due to their typically higher retirement incomes.

Understanding the Medicare-Gold IRA Connection

Medicare premiums skyrocket for high earners. The IRMAA system was designed to ensure wealthy retirees pay their fair share of Medicare costs. It applies only to Medicare beneficiaries with a modified adjusted gross income above $106,000 (individual return) or $212,000 (joint return) for 2025.

Here's what makes this particularly challenging for Gold IRA holders:

- Two-year lag effect: Whether you pay an IRMAA in 2025 depends on the income shown on your 2023 tax returns

- Cliff structure: If your modified adjusted gross income exceeds the threshold by as little as a dollar, you will have to pay higher premiums

- Compounding impact: Both spouses on Medicare face surcharges independently

2025 IRMAA Thresholds and Premium Impact

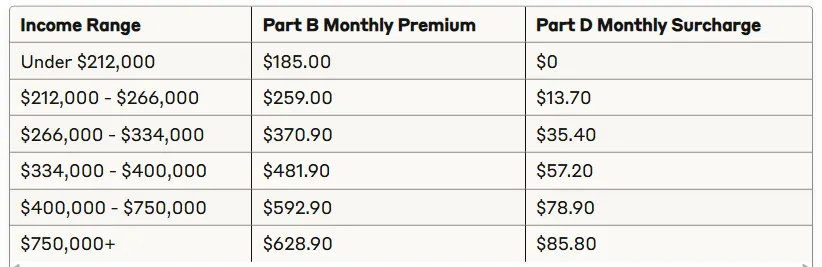

The Medicare IRMAA brackets for 2025 create substantial premium increases:

Single Filers (2023 Income)

Married Filing Jointly (2023 Income)

Real-world impact: A married couple with $220,000 in 2023 income pays an additional $1,776 annually in Part B premiums alone ($74 × 12 months × 2 people), before considering Part D surcharges.

How Gold IRA Withdrawals Affect Medicare Costs

Traditional vs. Roth Gold IRA Implications

Traditional Gold IRAs create immediate MAGI impact. Every dollar withdrawn from a traditional Gold IRA increases your Modified Adjusted Gross Income, potentially pushing you into higher IRMAA brackets.

Roth Gold IRAs offer Medicare protection. Any qualified Roth IRA distributions are not included in MAGI for Medicare purposes, making them powerful tools for managing Medicare costs.

Required Minimum Distributions: The Medicare Time Bomb

When you reach age 73 you must take a required minimum distribution (RMD) for that year and for every year thereafter. For Gold IRA holders, this creates a unique challenge:

RMDs automatically increase IRMAA exposure. An RMD is included in your modified adjusted gross income (MAGI) that is used to determine your Medicare Part B and Part D costs two years down the road.

The snowball effect intensifies with age. As life expectancy factors decrease, RMD amounts increase annually, potentially pushing retirees into progressively higher IRMAA brackets.

Calculating Your RMD Impact

Using the Gold IRA calculator methodology:

- Age 73: Divide account balance by 26.5

- Age 80: Divide account balance by 20.2

- Age 90: Divide account balance by 12.2

Example: A $500,000 Gold IRA at age 73 requires a $18,868 RMD. By age 80, the same account (assuming modest growth) could require a $30,000+ RMD.

Strategic Withdrawal Planning to Minimize IRMAA

Timing Strategies for Gold IRA Distributions

Front-load withdrawals before Medicare eligibility. You will want to get the conversion done before the income from the conversion would affect your MAGI for Medicare purposes. (Income in the year you turn 63 impacts IRMAA brackets in the year you turn 65.)

Coordinate withdrawals with the two-year lag. Plan major distributions for years when you can absorb higher IRMAA costs, avoiding spikes that push you into higher brackets unnecessarily.

Tax-Efficient Withdrawal Sequences

1. Use taxable accounts first to preserve Gold IRA tax advantages

2. Strategic Roth conversions during lower-income years

3. Qualified Charitable Distributions (QCDs) to satisfy RMDs without increasing MAGI

Managing Income Spikes

Bunch vs. spread strategy: Sometimes it's better to take larger distributions in one year rather than spreading them across multiple years if it avoids crossing multiple IRMAA thresholds.

Consider Medicare Advantage plans for high-IRMAA years, as they may offer cost savings compared to Original Medicare plus Medigap coverage.

Special Considerations for Gold IRA Holders

Volatility and Timing Issues

Gold price volatility affects distribution timing. Unlike traditional retirement accounts, Gold IRAs are subject to precious metals price fluctuations that can impact:

- RMD calculation base amounts

- Optimal withdrawal timing

- Tax planning strategies

Storage and Custodial Fees Impact

Annual fees reduce net account value. Based on typical Gold IRA structures:

- Storage fees: $100 annually

- Custodian fees: $225 annually

- Total annual fees: $325

These fees don't affect IRMAA calculations directly but reduce the net value available for retirement income.

Estate Planning Considerations

Inherited Gold IRAs trigger IRMAA exposure. Withdrawals from inherited IRAs are considered taxable income that must be added to your MAGI, potentially creating unexpected Medicare cost increases for beneficiaries.

Actionable Strategies and Best Practices

Professional Consultation Framework

Assemble your advisory team:

- Certified Financial Planner specializing in retirement income

- Tax professional familiar with precious metals IRAs

- Medicare specialist for enrollment and appeals strategy

Documentation and Record-Keeping

Maintain comprehensive records:

- Annual Gold IRA statements and valuations

- RMD calculations and distributions

- Tax returns showing MAGI calculations

- Medicare premium notices and IRMAA determinations

Appeal Process Preparation

Life-changing events that may reduce IRMAA:

- Work stoppage or reduction

- Death of spouse

- Divorce or annulment

- Loss of pension income

- Significant reduction in other income sources

File Form SSA-44 within 60 days of receiving an IRMAA notice if your circumstances have changed significantly.

Advanced Planning Techniques

Qualified Charitable Distributions

With a QCD, you can transfer up to $105,000 annually from your IRA to a charity tax-free. This strategy:

- Satisfies RMD requirements

- Excludes distributions from MAGI

- Provides charitable tax benefits

Roth Conversion Ladders

Strategic conversion timing: If you are in your early sixties you may want to consider converting to a Roth IRA sooner rather than later to minimize future RMD impact on Medicare costs.

Medicare Supplement Strategy

Consider Medicare Advantage during high-IRMAA years. When IRMAA surcharges are substantial, Medicare Advantage plans might offer better value than Original Medicare plus Medigap coverage.

Timeline for Medicare Enrollment and Planning

Ages 62-63: Critical Planning Window

- Assess Gold IRA withdrawal strategy

- Consider Roth conversions

- Plan income management for Medicare eligibility

Age 64: Medicare Preparation Year

- Enroll in Medicare Part A and B

- Calculate projected IRMAA impact

- Finalize withdrawal strategy

Age 65+: Ongoing Management

- Monitor IRMAA notifications

- Adjust withdrawal strategies annually

- Consider appeals when appropriate

Bottom Line: Medicare Planning is Wealth Planning

Gold IRA holders face unique Medicare cost challenges that require proactive planning. The combination of required minimum distributions, IRMAA surcharges, and the two-year lag effect can create substantial unexpected healthcare costs in retirement.

Key takeaways for action:

- Start planning by age 62 to optimize income timing for Medicare eligibility

- Consider Roth conversions during lower-income years to reduce future IRMAA exposure

- Use QCDs strategically to satisfy RMDs without increasing MAGI

- Maintain detailed records for potential IRMAA appeals

- Work with specialized professionals who understand both precious metals IRAs and Medicare rules

The stakes are high. Due to means testing, that's what could happen if you're a diligent saver who stashes every penny you can into your 401(k) or other pre-tax retirement savings account - and the same logic applies to Gold IRAs.

With proper planning, you can minimize Medicare's impact on your Gold IRA wealth while ensuring adequate healthcare coverage throughout retirement. The key is understanding these rules before you need Medicare, not after you're already enrolled.

This article provides general information about Medicare and Gold IRA interactions. Tax laws and Medicare rules are complex and change frequently. Consult with qualified tax, financial, and Medicare professionals before making decisions that could affect your retirement income and healthcare costs.