Gold IRA Legal Ownership Structure: What You Need to Know Before Investing

Here's something that confuses most investors:

You can own gold in your retirement account. But you can't actually hold it in your hands.

Sounds contradictory, right?

The legal ownership structure of a Gold IRA is different from buying gold coins at your local dealer. And if you get it wrong, the IRS will hit you with taxes and penalties that could wipe out years of gains.

Let me show you exactly how Gold IRA ownership works, what the IRS requires, and how to structure your account properly.

What Exactly Is a Gold IRA?

A Gold IRA is a self-directed Individual Retirement Account that holds physical precious metals instead of traditional assets like stocks and bonds.

The account operates under IRC Section 408, the same tax code that governs regular IRAs. This means:

- Contributions are tax-deductible (Traditional Gold IRA)

- Growth is tax-deferred

- Qualified withdrawals follow standard IRA rules

But here's where it gets different.

Physical gold requires special handling. Storage. Security. Insurance. That's where the legal ownership structure comes into play.

The Three-Party Gold IRA System

Unlike a regular IRA where you might own shares of an ETF directly through a broker, a Gold IRA requires three separate entities:

1. You (The Account Holder)

- You own the beneficial interest in the gold

- You make all investment decisions

- You control contributions and distributions

- You designate beneficiaries

2. The IRA Custodian

- Holds legal title to the assets on your behalf

- Maintains account records

- Reports to the IRS

- Processes transactions

- Ensures IRS compliance

3. The Approved Depository

- Stores the physical metals

- Provides insurance

- Maintains segregated or allocated storage

- Delivers metals upon distribution

Think of it like a safety deposit box at a bank. You own what's inside. The bank holds it. But you can't take it home until you close the account properly.

Understanding Your Ownership Rights

You have beneficial ownership of the gold in your IRA.

This means:

- The gold belongs to you

- It's titled in your IRA's name

- You decide when to buy or sell

- You choose which metals to hold

- You determine beneficiaries

But you don't have physical possession.

The IRS is crystal clear on this: IRA assets must remain with a qualified custodian.

Take physical possession, and the IRS treats it as a distribution. That triggers:

- Income taxes on the full value

- A 10% early withdrawal penalty (if under 59½)

- Loss of future tax-deferred growth

One mistake costs thousands.

Types of Gold IRA Ownership Structures

Individual Gold IRA

The most common structure. One person owns the account. Simple. Straightforward.

Best for:

- Single individuals

- Primary earners wanting separate retirement accounts

- Anyone seeking maximum control

Spousal Gold IRA

Married couples can each have their own Gold IRA, even if only one spouse works. The working spouse contributes to the non-working spouse's IRA.

Benefits:

- Doubles your household's gold holdings

- Separate beneficiary designations

- Individual control of investments

Inherited Gold IRA

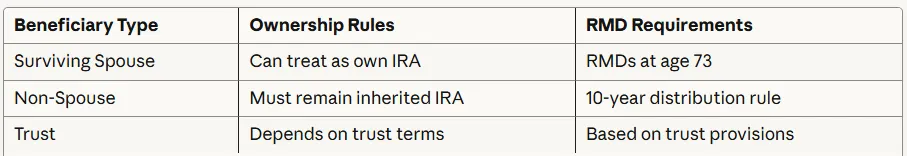

When you inherit a Gold IRA, the ownership structure changes based on your relationship to the deceased:

Self-Directed IRA LLC (Checkbook Control)

An advanced structure where your IRA owns an LLC, and the LLC purchases the metals. This gives you "checkbook control" over investments.

Warning: This structure is complex and requires strict adherence to prohibited transaction rules. One misstep triggers full account distribution.

Critical IRS Rules You Must Follow

The IRS doesn't mess around with retirement accounts. These rules are non-negotiable:

Prohibited Transactions:

- You cannot store IRA metals at home

- You cannot use IRA assets for personal benefit

- No transactions with disqualified persons (you, spouse, parents, children)

- You cannot buy collectible coins (some exceptions apply)

Approved Metals: Gold must be 99.5% pure minimum:

- American Gold Eagle coins

- Canadian Gold Maple Leaf coins

- Gold bars from approved refiners

- Other IRS-approved bullion

Required Minimum Distributions (RMDs): Starting at age 73, you must take RMDs from your Gold IRA. The custodian can either:

- Sell metals and distribute cash

- Distribute physical metals (you pay tax on fair market value)

Contribution Limits (2025):

- Under 50: $7,000 per year

- 50 and older: $8,000 per year (includes $1,000 catch-up)

The Biggest Ownership Mistakes (And How to Avoid Them)

Mistake #1: Taking Personal Possession

Some investors think they can "temporarily" hold their IRA gold. Wrong. The moment you take physical possession, the IRS considers it a taxable distribution.

Solution: Always use an approved depository. No exceptions.

Mistake #2: Improper Beneficiary Designations

Your beneficiary designation determines who inherits your Gold IRA. Many investors:

- Never name a beneficiary

- Forget to update after major life events

- Name their estate instead of individuals

Solution: Review beneficiaries annually. Name primary and contingent beneficiaries. Consider a trust for complex situations.

Mistake #3: Commingling IRA and Personal Assets

You cannot mix personal gold holdings with IRA gold. If you store them together, the IRS may disqualify your entire IRA.

Solution: Keep IRA metals completely separate. Use an IRS-approved depository that provides segregated storage.

Mistake #4: Using an Unapproved Custodian

Not every financial institution offers Gold IRAs. Traditional banks and brokers typically don't have the infrastructure.

Solution: Work with a specialized precious metals IRA custodian who understands the unique requirements.

Why Proper Ownership Structure Protects You

Getting the legal structure right isn't just about IRS compliance. It provides real benefits:

Asset Protection: IRAs enjoy creditor protection in most states. Properly structured Gold IRAs keep your metals safe from lawsuits and creditors (with some exceptions).

Tax Advantages:

- Tax-deferred growth means more compounding

- No capital gains taxes on metals sold within the IRA

- Potential for tax-free growth (Roth Gold IRA)

Estate Planning Benefits: Proper beneficiary designations allow your Gold IRA to pass directly to heirs, bypassing probate. This means:

- Faster transfer

- Lower costs

- More privacy

- Continued tax advantages for beneficiaries

What About Storage Options?

The depository holding your gold offers two storage types:

Commingled Storage:

- Your metals are stored with others' metals

- Lower fees

- Metals are fungible (interchangeable)

Segregated Storage:

- Your specific bars/coins are separated and labeled

- Higher fees

- You receive your exact metals upon distribution

Both are IRS-approved. Choose based on your preferences and budget.

Setting Up Your Gold IRA Ownership Structure Correctly

Here's the step-by-step process:

- Choose a specialized Gold IRA custodian

- Open a self-directed IRA account

- Fund the account (transfer, rollover, or contribution)

- Select your precious metals

- Custodian purchases metals on behalf of your IRA

- Metals are shipped to approved depository

- Storage is maintained in your IRA's name

The entire process typically takes 7-14 days.

Ready to Secure Your Retirement with Physical Gold?

Understanding the legal ownership structure is just the first step. The real question is: Are you ready to protect your retirement savings with the stability of physical precious metals?

Birch Gold Group specializes in helping investors over 40 set up properly structured Gold IRAs. They handle:

- IRS-compliant account setup

- Rollover assistance from existing retirement accounts

- Approved precious metals selection

- Coordination with qualified custodians and depositories

- Ongoing account management and support

Get Your Free Gold IRA Information Kit from Birch Gold Group →

Their team will walk you through the entire ownership structure, answer your questions, and ensure your account is set up correctly from day one.

Don't risk IRS penalties and taxes by getting the structure wrong. Work with specialists who understand the legal requirements inside and out.

Disclaimer: This article is for informational purposes only and should not be considered financial, tax, or legal advice. Gold IRAs involve specific IRS regulations and requirements. Consult with a qualified financial advisor, tax professional, and legal counsel before making any investment decisions. The author may receive compensation through affiliate relationships with companies mentioned in this article, including Birch Gold Group. Past performance does not guarantee future results. All investments carry risk, including the potential loss of principal.