Gold IRA Investor Education Resources:

Your Complete Guide to Making Informed Decisions

Picture this: You're ready to diversify your retirement portfolio with precious metals, but you're drowning in conflicting information. One website promises "guaranteed returns," another warns of "IRA scams," and your neighbor swears by home storage (which is actually illegal). Sound familiar?

Here's the problem: The Gold IRA market is flooded with biased sales materials masquerading as educational content. Without proper education, you risk making costly mistakes that could jeopardize your retirement savings.

This guide cuts through the noise to show you exactly where to find reliable, unbiased Gold IRA education resources.

Why Gold IRA Education Matters More Than You Think

Gold IRAs aren't your typical retirement account. Unlike traditional IRAs that hold paper assets like stocks and bonds, Gold IRAs require specialized knowledge about:

- IRS compliance requirements for precious metals purity and storage

- Custodian selection and their fee structures

- Rollover procedures from existing retirement accounts

- Storage regulations at approved depositories

- Tax implications for different account types

Making uninformed decisions in any of these areas can result in penalties, unexpected fees, or even disqualification of your IRA's tax-advantaged status.

Essential Topics Every Gold IRA Investor Must Master

1. Gold IRA Fundamentals

Before diving into specific resources, understand these core concepts:

What Makes Gold IRAs Different:

- Physical precious metals vs. paper assets

- Required third-party custodian management

- Mandatory storage at IRS-approved depositories

- Higher fees compared to traditional IRAs

- Less liquidity than conventional investments

Types of Gold IRAs:

- Traditional Gold IRA: Pre-tax contributions, tax-deferred growth, taxed

withdrawals

- Roth Gold IRA: After-tax contributions, tax-free qualified withdrawals

- SEP Gold IRA: For self-employed individuals and small business owners

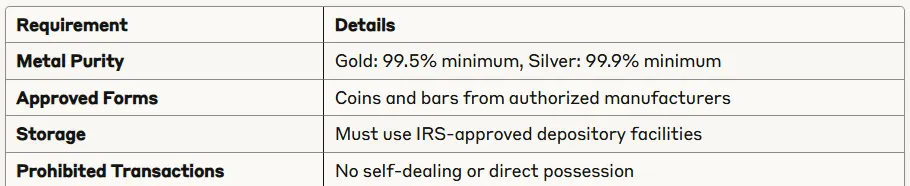

2. IRS Requirements and Regulations

The IRS has strict rules governing Gold IRAs:

Top-Tier Educational Resource Categories

1. Official Government Sources (Most Reliable)

Internal Revenue Service (IRS)

- Publication 590-A and 590-B for IRA rules

- Precious metals IRA guidelines

- Prohibited transaction regulations

- Annual contribution limits and RMD requirements

Commodity Futures Trading Commission (CFTC)

- "10 Things to Ask Before Buying Physical Gold, Silver, or Other Metals"

- Consumer advisories on precious metals schemes

- Fraud prevention guidelines

Securities and Exchange Commission (SEC)

- Investor alerts on self-directed IRA risks

- Due diligence guidelines for alternative investments

2. Independent Financial Education Platforms

Investopedia

- Comprehensive Gold IRA definitions and explanations

- Comparison articles between investment options

- Regular updates on regulation changes

Bankrate

- Gold IRA pros and cons analysis

- Fee comparison tools

- Customer experience insights

Morningstar

- Investment research and analysis

- Precious metals market trends

- Portfolio allocation guidance

3. Industry Research and Analysis

Better Business Bureau (BBB)

- Company ratings and customer complaints

- Accreditation status verification

- Dispute resolution records

Consumer Affairs

- Real customer reviews and experiences

- Company comparison tools

- Warning signs and red flags

4. Academic and Professional Sources

Financial Planning Association (FPA)

- Professional perspectives on precious metals investing

- Retirement planning best practices

- Risk assessment frameworks

CFA Institute

- Alternative investment research

- Portfolio diversification studies

- Risk-return analysis of precious metals

Red Flags: Educational Resources to Avoid

Not all information sources are created equal. Watch out for:

Biased Company Materials

- Problem: Many Gold IRA companies create "educational" content that's actually sales material in disguise

- Red Flag: Articles that only mention benefits without discussing risks or fees

- Solution: Cross-reference information with independent sources

Outdated Information

- Problem: IRS rules and fee structures change regularly

- Red Flag: Articles without recent publication dates or last-updated timestamps

- Solution: Verify current regulations with official IRS publications

Misleading Claims

- Problem: Some sources make unrealistic promises about returns or guarantees

- Red Flag: Language like "guaranteed profits" or "100% safe investment"

- Solution: Remember that all investments carry risk

Building Your Gold IRA Knowledge Foundation: A Step-by-Step Approach

Phase 1: Basic Understanding

(Week 1)

- Read IRS Publication 590-A sections on self-directed IRAs

- Review CFTC's "10 Things to Ask" consumer guide

- Study the differences between Gold IRAs and traditional IRAs

Phase 2: Deep Dive Research

(Week 2-3)

- Research IRS-approved precious metals requirements

- Compare custodian fee structures across multiple providers

- Understand rollover procedures for your specific account type

Phase 3: Due Diligence

(Week 4)

- Verify custodian licensing and insurance coverage

- Research depository facilities and their security measures

- Read actual customer reviews and BBB ratings

Essential Questions to Ask Any Gold IRA Education Source

Before trusting any educational resource, ask:

- Who funded this content? Look for clear disclosure of funding sources

- When was this published? Ensure information reflects current regulations

- Are risks discussed honestly? Legitimate education covers both benefits and drawbacks

- Are specific fees mentioned? Avoid vague language about "competitive pricing"

- Can claims be verified? Check if statistics and statements have credible sources

Your Gold IRA Education Checklist

Use this checklist to ensure you've covered all essential areas:

Regulatory Knowledge:

- [ ] Understand IRS requirements for precious metals purity

- [ ] Know storage and custodian regulations

- [ ] Familiar with prohibited transaction rules

- [ ] Understand tax implications for your account type

Practical Considerations:

- [ ] Researched multiple custodian options and fees

- [ ] Understand rollover procedures for your current accounts

- [ ] Know the costs involved (setup, annual, storage, transaction)

- [ ] Understand liquidity and distribution options

Risk Assessment:

- [ ] Understand how Gold IRAs fit in overall portfolio

- [ ] Know the risks of precious metals investing

- [ ] Understand market volatility and timing considerations

- [ ] Aware of potential scams and how to avoid them

Taking Action: Your Next Steps

Now that you know where to find reliable Gold IRA education resources, here's how to proceed:

1. Start with official sources: Begin your education with IRS and CFTC materials for unbiased, accurate information

2. Cross-reference everything: Never rely on a single source for important decisions

3. Focus on your specific situation: Tailor your research to your age, current accounts, and investment goals

4. Document your research: Keep notes on what you learn to compare options effectively

5. Consult professionals: Consider speaking with a fee-only financial advisor familiar with precious metals investing

Remember: The time you invest in education now can save you thousands in fees and prevent costly mistakes later. Your retirement deserves nothing less than well-informed decisions based on reliable, unbiased information.

The gold market will always be there, but the opportunity to make the right choice for your specific situation requires proper preparation. Start your education journey today with these trusted resources, and build the knowledge foundation your retirement security demands.