Gold IRA Form 1099-R: What Every Precious Metals Investor Needs to Know

Are You Prepared for the Tax Consequences of Your Gold IRA Distributions?

Picture this: You've wisely diversified your retirement portfolio with precious metals, watching your Gold IRA grow as traditional markets fluctuate. Then tax season arrives, and you're staring at Form 1099-R, wondering what it means for your financial future.

If you're taking distributions from your Gold IRA—or planning to—understanding Form 1099-R isn't just helpful, it's essential for protecting your hard-earned wealth.

What Exactly is Form 1099-R?

Form 1099-R is the IRS document that reports distributions from retirement accounts, including your Gold IRA. Think of it as the government's way of tracking money flowing out of tax-advantaged accounts.

Key details Form 1099-R captures:

- Total distribution amount

- Taxable portion (if any)

- Distribution code indicating the type of withdrawal

- Federal and state tax withholdings

- Your account information

The form arrives by January 31st following the year you took a distribution, giving you crucial information for accurate tax filing.

How Gold IRAs Trigger Form 1099-R

Your Gold IRA custodian must issue Form 1099-R whenever you:

1. Take Required Minimum Distributions (RMDs) Starting at age 73, you must withdraw specific amounts annually. These distributions are typically taxable as ordinary income.

2. Make Early Withdrawals Distributions before age 59½ usually trigger penalties plus taxes, with specific exceptions for hardships.

3. Process Rollovers or Transfers Even when moving funds between accounts, temporary 1099-R forms may be issued.

4. Convert Traditional to Roth Converting your traditional Gold IRA to Roth status creates taxable events requiring proper reporting.

Critical Distribution Codes You Must Understand

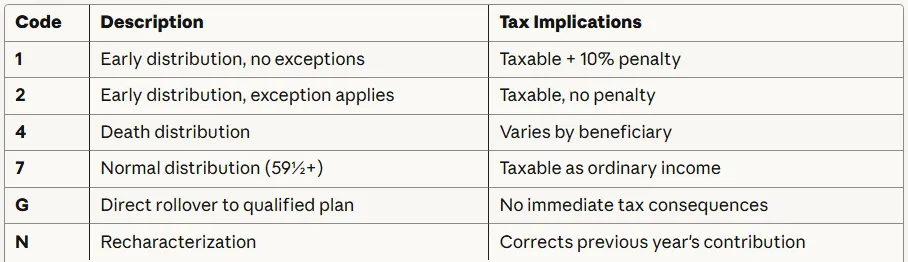

The distribution code on your 1099-R determines your tax obligations. Here are the most important codes for Gold IRA investors:

Code Description Tax Implications

Why codes matter: The wrong code can cost you thousands in unnecessary penalties or taxes. Always verify the code matches your actual distribution type.

Tax Reporting Requirements: What You Must Know

For Taxable Distributions

When you receive Form 1099-R for a taxable Gold IRA distribution:

1. Report on Tax Return Include the distribution amount on your Form 1040, typically on the "IRA distributions" line.

2. Calculate Taxes Owed Traditional Gold IRA distributions are taxed as ordinary income at your current tax rate—potentially 22% to 37% for higher earners.

3. Address Penalties Early distributions (before 59½) face an additional 10% penalty unless specific exceptions apply.

Common Reporting Mistakes to Avoid

- Ignoring the 1099-R: Failing to report can trigger IRS audits and penalties

- Misunderstanding rollover rules: 60-day rollover violations create unwanted tax events

- Incorrect code reporting: Always verify your custodian used the right distribution code

- Missing state requirements: Some states have different reporting rules for precious metals

Strategic Distribution Planning

Smart Gold IRA investors plan distributions carefully:

Timing Considerations

Lower Income Years If you expect reduced income (retirement, job change), consider distributions when your tax bracket is lower.

Market Conditions Precious metals prices fluctuate. Strategic timing can maximize your distribution value.

Tax Law Changes Legislative changes may affect future tax rates, making current distributions more or less attractive.

Professional Guidance Benefits

Working with experienced precious metals companies provides crucial advantages:

- Expert knowledge of Gold IRA distribution rules

- Proper documentation and code assignment

- Strategic planning for tax efficiency

- Compliance with complex IRS regulations

Why Your Choice of Gold IRA Company Matters

Not all precious metals companies handle distributions equally.

The best providers:

✅ Ensure accurate 1099-R reporting

✅ Provide clear documentation

✅ Offer tax planning guidance

✅ Maintain IRS compliance standards

✅ Support you through distribution processes

Poor handling can result in incorrect forms, unnecessary taxes, and compliance headaches that cost far more than working with reputable firms from the start.

Protect Your Financial Future Today

Understanding Gold IRA Form 1099-R is just one piece of successful precious metals investing. The bigger picture requires working with trusted professionals who understand both the opportunities and obligations of Gold IRAs.

Don't let tax confusion or poor planning erode your retirement security. The decisions you make today about your Gold IRA distributions will impact your financial future for years to come.

Ready to ensure your Gold IRA distributions are handled correctly?

Get your FREE Gold IRA information kit from Birch Gold Group – the trusted choice for Americans seeking to protect their retirement savings with precious metals.

Their experienced team will guide you through distribution planning, tax considerations, and ensure your 1099-R forms are handled properly.

Your financial security is too important to leave to chance. Take action today and discover how proper Gold IRA management can protect and grow your retirement wealth, regardless of economic uncertainty.

Click here to speak with a Birch Gold Group specialist now.

This article is for educational purposes. Consult qualified tax professionals for advice specific to your situation.