Gold IRA for Retirement Security

The economic landscape of 2025 presents unprecedented challenges for retirement planning. With inflation concerns persisting and market volatility creating uncertainty for traditional investments, many investors are seeking alternative strategies to protect their retirement savings.

Enter the Gold IRA—a powerful tool that combines the tax advantages of traditional retirement accounts with the stability and inflation-hedging properties of precious metals.

As gold prices reached all-time records above $2,925 per ounce in 2025 and year-over-year inflation in January rose to 3%—above analyst expectations and the Federal Reserve's 2% target range, more retirees are discovering how gold can serve as an anchor in turbulent financial waters.

What is a Gold IRA?

A gold IRA is a type of individual retirement account (IRA) that is self-directed and contains physical gold assets such as bars or coins. Unlike traditional IRAs that limit investments to stocks, bonds, and mutual funds, a Gold IRA allows you to hold actual physical precious metals as part of your retirement portfolio.

Check out our page on the Top 5 Gold IRA Companies below: https://goldenkey.foundation/blog/best-gold-ira-companies-2025/

Key Characteristics:

- Self-directed retirement account structure

- Holdings include physical gold, silver, platinum, and palladium

- Same tax benefits as traditional or Roth IRAs

- Professional storage in IRS-approved depositories

- Administered by specialized third-party custodians

The concept became possible through legislation passed by Congress in 1997, which expanded investment options for self-directed IRAs to include precious metals meeting specific purity requirements.

Why Consider a Gold IRA for Retirement Security?

Inflation Protection

Gold has historically served as a powerful hedge against inflation. Gold has outperformed inflation by 3% on average per year throughout the past four decades. When the purchasing power of the dollar declines, gold typically maintains or increases its value, protecting your retirement savings from erosion.

When inflation rises, the value of the dollar decreases, but gold tends to increase in value during these periods, making it a reliable safeguard for purchasing power. This relationship makes gold particularly valuable in today's economic environment where inflationary pressures remain elevated.

Market Volatility Buffer

Gold has long been considered a hedge against inflation, recession, and currency devaluation. During market downturns, gold often moves independently of traditional assets, providing stability when stocks and bonds face pressure.

Historical Performance During Crisis:

- 2008 Financial Crisis: Gold maintained value while markets crashed

- COVID-19 Pandemic: Gold reached new highs as traditional markets struggled

- While stocks can go to zero, the price of gold can never fall to zero

Portfolio Diversification

A gold IRA gives you access to a completely different asset class and offers protection against market turbulence. By allocating a portion of your retirement funds to precious metals, you reduce correlation risk and create a more balanced portfolio.

Financial experts often recommend a 5-15% allocation to precious metals for optimal diversification benefits without over-concentration in any single asset class.

How Gold IRAs Work

The Setup Process

1. Choose an IRS-Approved Custodian A Gold IRA must be held by an IRS-approved custodian—such as a bank, credit union, or trust company—that specializes in self-directed retirement accounts. These custodians ensure compliance with IRS regulations and facilitate all transactions.

2. Fund Your Account There are several ways to fund a Gold IRA: Rollover from an Existing IRA or 401(k), Direct Contributions, or Transfer from Another Custodian.

Funding Options:

- Direct Rollover: Funds transfer directly from your existing retirement account

- Indirect Rollover: You receive funds and have 60 days to deposit into new account

- Fresh Contributions: Annual contributions subject to IRS limits

- Transfers: Moving funds between custodians of the same account type

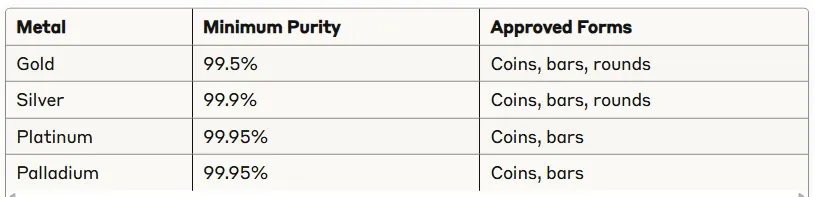

3. Purchase Approved Metals Not all gold qualifies for IRA investment. You can invest in specific IRS-approved precious metals that fulfill specific purity criteria: Physical gold with a purity of 99.5%, Physical silver with a purity of 99.9%, Physical platinum with a purity of 99.95%, Physical palladium with a purity of 99.95%.

4. Secure Storage Your physical gold must be stored with a recognized depository, which typically holds your gold in a vault for safekeeping. You may not store your gold at home, or the IRS will consider it a distribution.

2025 Rules and Regulations

Contribution Limits

For 2025, the contribution limit for a Gold IRA is $7,000, with a $1,000 catch-up contribution for individuals over the age of 50. These limits apply across all your IRA accounts combined, not per account.

Age-Based Limits:

- Under 50: $7,000 maximum annual contribution

- 50 and older: $8,000 maximum (includes $1,000 catch-up)

Eligible Metals Standards

The IRS maintains strict requirements for precious metals held in retirement accounts:

Storage Requirements

Only six depository vaults in the entire United States of America are approved to hold the valuable contents of these extremely resource-rich retirement accounts. Recently, the IRS amended this rule to allow for gold IRA physical offshore storage in approved international vaults and countries.

Storage Rules:

- Must use IRS-approved depositories

- Home storage strictly prohibited

- Professional security and insurance required

- Regular auditing and reporting mandated

Tax Implications

Gold IRAs follow the same tax treatment as traditional retirement accounts:

Traditional Gold IRA:

- Tax-deductible contributions (based on income limits), Tax-deferred growth; withdrawals taxed as ordinary income

- RMDs start at age 73; 10% penalty for early withdrawals

Roth Gold IRA:

- Contributions are post-tax; tax-free withdrawals if qualified, No RMDs during the account owner's lifetime

- Gold Roth IRAs have income limits that determine eligibility for full contributions, which are set at $146,000 for individuals and $230,000 for married couples filing jointly in 2025

Benefits and Drawbacks

Advantages

Tax Benefits

- Same preferential tax treatment as traditional IRAs

- Tax-deferred growth in traditional accounts

- Tax-free growth in Roth accounts

- Professional management within retirement framework

Inflation Protection Gold has historically preserved value during high-inflation periods, offering a hedge against dollar depreciation. In the past five years alone, gold prices have nearly doubled.

Tangible Asset Ownership Unlike stocks or bonds, gold is a tangible asset that can't be hacked or erased digitally. You own a physical commodity with intrinsic value that has been recognized for thousands of years.

Portfolio Stability Adding physical gold to your portfolio helps reduce overall risk and adds balance during market downturns.

Disadvantages

Higher Costs Gold IRAs have higher maintenance fees than other types of IRAs, due to the additional costs associated with investing in gold. These include:

- Setup fees

- Annual custodian fees

- Storage and insurance costs

- Transaction fees for buying/selling

No Income Generation Unlike stocks, which may provide regular dividends, or bonds, that offer interest payments, investing in physical gold offers neither dividends nor interest.

Liquidity Concerns Gold is a highly illiquid asset, meaning that it can be difficult to find a buyer for large sales without discounting the price. This can be particularly challenging when required minimum distributions begin.

Performance Limitations Between 1984 and 2024, the S&P 500, with dividends reinvested, returned an inflation-adjusted annualized total return of 8.6%. In the same time frame, gold generated an inflation-adjusted annualized return of 1.5%.

Getting Started with a Gold IRA

Choosing the Right Custodian

Key Factors to Consider:

- IRS approval and regulatory compliance

- Fee structure transparency

- Storage facility partnerships

- Customer service quality

- Industry experience and reputation

Find out about the top custodians HERE:

https://goldenkey.foundation/blog/best-gold-ira-custodians/

Essential Steps

1. Research and Compare Custodians

- Request fee schedules

- Verify regulatory standing

- Read customer reviews

- Understand storage options

2. Complete Application Process

- Provide required documentation

- Fund your account

- Select approved precious metals

- Arrange secure storage

3. Ongoing Management

- Monitor account performance

- Stay informed on regulatory changes

- Plan for required distributions

- Review portfolio allocation annually

Red Flags to Avoid

Warning Signs:

- Promises of guaranteed returns

- High-pressure sales tactics

- Unclear fee structures

- Unregistered custodians

- Home storage offers

Gold IRA custodians don't undergo the same regulatory oversight as traditional brokerage firms. They won't evaluate the legitimacy or reliability of the investments you put into your SDIRA.

Making the Decision

A Gold IRA isn't suitable for everyone. Consider this option if you:

- Seek portfolio diversification beyond traditional assets

- Want protection against inflation and currency devaluation

- Have concerns about long-term economic stability

- Can afford the additional costs associated with precious metals storage

- Understand the liquidity limitations

If you wish to allocate a large percentage, say 15% or more, of your retirement portfolio to gold, a gold IRA is worth considering. If you plan to allocate a smaller percentage, you may be better off using a publicly traded gold security—such as an exchange-traded fund (ETF).

Conclusion

Gold IRAs represent a compelling option for retirement security in an uncertain economic environment. While they come with unique costs and considerations, the combination of tax advantages, inflation protection, and portfolio diversification makes them worthy of serious consideration for many investors.

Gold has a 5,000-year history of being a store of value, and Goldman Sachs analysts expect gold to reach $3,100 per ounce by the end of 2025. For investors seeking to protect and preserve retirement wealth against the challenges of modern financial markets, a Gold IRA may provide the security and peace of mind they're seeking.

Before making any investment decisions, consult with qualified financial and tax advisors to determine if a Gold IRA aligns with your specific retirement goals and risk tolerance. The key to successful retirement planning lies in understanding all your options and making informed decisions based on your unique circumstances.

Ready to explore Gold IRAs further? Research reputable custodians, understand all associated costs, and consider how precious metals might fit into your overall retirement strategy. Your future financial security may depend on the diversification decisions you make today.