Gold IRA During Civil Unrest: Your Retirement Shield When Society Fractures

You're watching the news. Again.

Protests escalating. Supply chains breaking. Political divisions deepening. Currency debates intensifying.

And somewhere in the back of your mind, a question keeps nagging: What happens to my retirement savings if this gets worse?

Here's what most financial advisors won't tell you: Traditional retirement accounts are built on a foundation that crumbles during civil unrest. When social stability fractures, paper assets can evaporate faster than morning fog.

But there's one asset that's protected wealth through every crisis, revolution, and collapse for 5,000 years.

Gold.

Why Your Traditional IRA is Vulnerable During Civil Unrest

Let's be blunt about what happens to conventional investments when civil unrest strikes:

Stock markets panic. During the 2020 civil unrest, the S&P 500 experienced its fastest decline into bear market territory in history. Your carefully built portfolio can lose 30% or more in weeks.

Currency values plummet. When governments face internal instability, they print money. Venezuela. Zimbabwe. Weimar Germany. The pattern repeats. Your dollar-denominated savings lose purchasing power overnight.

Banks become targets. Civil unrest often leads to bank runs, frozen accounts, or capital controls. Your money might be "safe" in theory, but inaccessible in practice.

Supply chains collapse. Remember empty shelves in 2020? Now imagine that lasting months or years. Your retirement funds can't buy what isn't available.

The uncomfortable truth? Your traditional IRA is a promise written on paper, backed by the stability of systems that civil unrest directly threatens.

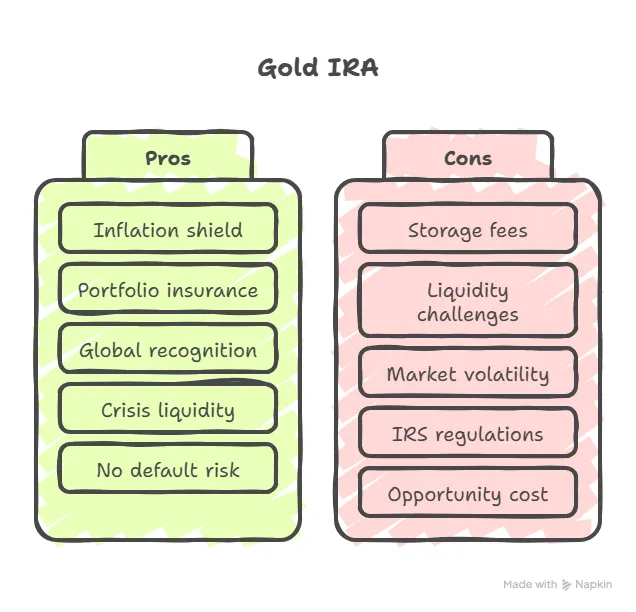

Why Gold IRAs Stand Strong When Everything Else Falls

Gold doesn't care about election results. It doesn't worry about protests. It doesn't depend on supply chains or banking systems or political promises.

Gold simply is.

Here's what makes Gold IRAs uniquely suited for protecting your retirement during turbulent times:

It's survived every empire's collapse. Rome fell. The British pound lost its dominance. The Soviet Union crumbled. Through it all, gold retained its value. Not because of government backing, but because of 5,000 years of human recognition of its worth.

You own something real. Unlike stocks (company promises), bonds (government IOUs), or digital currency (electronic data), gold is physical. Tangible. It exists independent of any system or institution.

It moves opposite to chaos. When civil unrest increases, gold prices typically rise. As others panic-sell stocks, smart investors accumulate gold. During the 2011 debt ceiling crisis and civil unrest, gold hit all-time highs above $1,900 per ounce.

No counterparty risk. Your gold doesn't depend on a corporation staying solvent, a government keeping promises, or a bank remaining liquid. It's yours, period.

What is a Gold IRA? (The Simple Explanation)

A Gold IRA is a self-directed Individual Retirement Account that holds physical precious metals instead of paper assets.

It works exactly like your traditional IRA or 401(k):

- Same contribution limits

- Same tax advantages

- Same early withdrawal penalties

- Same RMD (Required Minimum Distribution) rules

The only difference? Instead of holding stocks, bonds, or mutual funds, your IRA holds physical gold, silver, platinum, or palladium coins and bars.

The IRS has specific requirements for which metals qualify (minimum purity standards), and your precious metals must be stored in an IRS-approved depository.

But the process is straightforward when you work with an experienced company.

7 Ways Gold IRAs Protect Your Retirement During Civil Unrest

1. Inflation Shield

When governments respond to civil unrest by printing money, gold maintains purchasing power. During the 1970s stagflation crisis (marked by civil unrest and economic turmoil), gold prices increased over 1,400% while the dollar's purchasing power collapsed.

2. Portfolio Insurance

Financial advisors recommend 5-15% portfolio allocation to precious metals specifically as protection against systemic risk. During unrest, this allocation can preserve the value of your entire portfolio.

3. Global Recognition

Gold is recognized and valued worldwide. If civil unrest escalates to the point where you need to relocate, gold crosses borders more easily than complicated investment portfolios.

4. Crisis Liquidity

During severe civil unrest when banks might close or freeze accounts, physical gold provides tradeable value. It's been currency for 5,000 years and remains so today.

5. No Default Risk

Companies can go bankrupt. Governments can default. Gold cannot default because it isn't a promise—it's an asset. During civil unrest when institutional trust evaporates, this matters enormously.

6. Privacy and Control

While your Gold IRA holdings are stored in approved depositories, you have direct ownership. You can request delivery when you reach retirement age. You control the asset, not a fund manager making decisions based on corporate interests.

7. Tax Advantages Maintained

You get the same tax-deferred growth (traditional IRA) or tax-free growth (Roth IRA) as conventional retirement accounts, but with the security of physical assets.

How to Set Up Your Gold IRA: The 5-Step Process

Setting up a Gold IRA is simpler than you think:

Step 1: Choose a reputable Gold IRA company

This is critical. You need a company with experience, transparency, and expertise in IRS regulations. Look for companies with strong track records and education-first approaches.

Step 2: Open your self-directed IRA account

Your chosen company will handle the paperwork. This typically takes 24-48 hours.

Step 3: Fund your account

You can transfer funds from an existing IRA, roll over a 401(k), or make a direct contribution. Most companies handle the entire transfer process for you.

Step 4: Select your precious metals

Choose from IRS-approved gold, silver, platinum, or palladium products. Your company's specialists will guide you based on your goals.

Step 5: Secure storage

Your metals are shipped directly to an IRS-approved depository where they're stored, insured, and inventoried in your name.

The entire process typically takes 7-10 days from start to finish.

Why Birch Gold Group for Your Gold IRA?

Not all Gold IRA companies are created equal. During times of civil unrest and uncertainty, you need a partner you can trust.

Birch Gold Group specializes in helping people just like you protect their retirement savings through precious metals. They focus on education first, ensuring you understand exactly what you're investing in and why it matters.

No high-pressure sales tactics. No hidden fees. Just straightforward guidance from a company that's helped thousands of Americans secure their financial futures.

What You Need to Know Before You Start

Storage is secure: Your metals are stored in IRS-approved depositories with full insurance and regular audits. You're not keeping gold bars under your mattress.

Liquidity is available: While Gold IRAs are designed for long-term retirement holding, you can sell your metals if needed. Reputable companies facilitate buybacks.

Fees are transparent: Expect setup fees, annual storage fees, and custodian fees. Legitimate companies disclose all costs upfront.

IRS rules apply: You must use approved metals (typically .995+ purity for gold), and you can't personally possess the metals until you take a distribution.

The Time to Protect Your Retirement is Before the Crisis Intensifies

History teaches a harsh lesson: By the time everyone recognizes the crisis, it's too late to protect yourself effectively.

The families who protected their wealth during Venezuela's collapse? They acted years before hyperinflation hit.

The investors who preserved their portfolios during the 2008 financial crisis? They diversified into precious metals beforehand.

Smart investors don't wait for chaos to intensify. They prepare when they still have time to act calmly and deliberately.

Take Action Now: Get Your Free Gold IRA Information Kit

Birch Gold Group offers a comprehensive, no-obligation information kit that explains exactly how Gold IRAs work and how they can protect your retirement during uncertain times.

This free kit includes:

- Complete Gold IRA guide

- Current precious metals market analysis

- IRS rules and regulations explained

- Step-by-step process breakdown

There's no cost, no obligation, and no high-pressure sales calls. Just valuable information that could protect decades of hard work and savings.

Click here to request your FREE Gold IRA Information Kit from Birch Gold Group

Your retirement savings took decades to build. Don't let civil unrest and economic instability destroy them in months.

The best time to prepare was yesterday. The second-best time is right now.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor and tax professional before making investment decisions.