Gold IRA Confiscation Risk:

Separating Historical Reality from Modern Fear

Gold has reached historic highs above $3,500 per ounce in 2025, marking a remarkable 27.76% gain year-to-date, driving unprecedented interest in precious metals investing. Yet alongside this golden bull run comes a darker concern haunting many investors: could the government seize your Gold IRA like they did in 1933?

The fear isn't unfounded. On April 5, 1933, President Franklin D. Roosevelt signed Executive Order 6102, forbidding the hoarding of gold coin, gold bullion, and gold certificates within the continental United States. But before you panic about your retirement gold, let's examine what actually happened, why it's unlikely to repeat, and how Gold IRAs offer unique protection.

The 1933 Gold Confiscation: What Really Happened

The United States federal government confiscated all non-rare and non-collectible gold holdings in the early 1930s under then-President Franklin D. Roosevelt. This wasn't a sudden power grab—it was a calculated response to economic catastrophe.

The Perfect Storm

The Great Depression had devastated America's economy. By the late 1920s, the Federal Reserve was in danger of hitting the limit on Federal Reserve Notes it could issue based on gold reserves, since the Federal Reserve Act of 1913 required 40% gold backing of all Federal Reserve notes.

Roosevelt faced an impossible situation: the economy needed more money in circulation to combat deflation, but the gold standard prevented printing additional currency without corresponding gold reserves.

The Legal Framework

Executive Order 6102 was made under the authority of the Trading with the Enemy Act of 1917, as amended by the Emergency Banking Relief Act in March 1933. Congress passed the Emergency Banking Act of 1933 on March 9th allegedly without reading it and with very little debate.

The order required Americans to surrender their gold by May 1, 1933, in exchange for paper currency at $20.67 per ounce. Violations were punishable by fine up to $10,000 (equivalent to $243,000 in 2024), up to ten years in prison, or both.

The Devastating Aftermath

The real theft came later. Immediately following passage of the Gold Reserve Act of 1934, President Roosevelt changed the statutory price of gold from $20.67 per troy ounce to $35. Americans who surrendered their gold at $20.67 watched the government instantly profit from the 69% price increase.

Why Modern Gold Confiscation Is Unlikely

Several fundamental changes make a 1933-style gold seizure highly improbable today:

1. No Gold Standard Constraint

The primary motivation for Roosevelt's confiscation no longer exists. The U.S. abandoned the gold standard in 1971, giving the Federal Reserve unlimited ability to print money without gold backing. The motivations Roosevelt had back in the 1930s simply don't exist anymore since the country is no longer on a gold standard.

2. Minimal Gold Ownership

Only a tiny fraction of Americans own gold today, with most having never even seen a gold coin. Unlike 1933, when gold was widely held currency, today's gold ownership represents a small percentage of wealth.

3. Superior Alternatives for Government Revenue

If the government wants to steal wealth, it doesn't need to knock on your door—it can do it quietly and continuously by printing money and debasing the currency. Modern governments have more efficient wealth extraction methods than physical confiscation.

How Gold IRAs Provide Enhanced Protection

Gold IRAs offer several layers of protection that personal gold holdings lack:

Custodial Protection

Assets in a Gold IRA are managed by a third-party custodian, making them harder to seize than personal holdings. This creates legal and logistical barriers that didn't exist for home-stored gold in 1933.

IRS-Approved Depositories

Gold IRAs store metals in IRS-approved depositories, which operate under strict oversight and safeguard assets while reducing the risk of physical confiscation. These facilities are heavily regulated and provide institutional-grade security.

Segregated Storage Options

Unlike 1933's easily traceable bank deposits, modern depositories offer segregated storage where your specific metals are individually identified and stored separately, making bulk seizure more complex.

Risk Mitigation Strategies

Smart Gold IRA investors can further reduce confiscation risk through these strategies:

1. Diversify with Other Metals

Silver, platinum, and palladium were not targeted during previous confiscation efforts. Diversifying with these metals reduces the risk of losing investments to future regulations.

2. Consider International Storage

The Taxpayer Relief Act of 1997 modified the rules to allow for offshore storage, with more investors opting for storage facilities in safe foreign countries that are more resistant to confiscation. Popular jurisdictions include:

- Switzerland

- Singapore

- Hong Kong

- Canada

3. Include Collectible Coins

There was a paragraph exempting "gold coins having recognized special value to collectors of rare and unusual coins" that protected recognized gold coin collections from legal seizure. Numismatic coins remain a potential exemption.

The Real Modern Threat: Windfall Profits Taxes

Rather than outright confiscation, experts warn of a more likely scenario: punitive taxation.

Historical Precedent

In 1980, Congress passed the Crude Oil Windfall Profit Tax Act, which levied up to 70% on so-called "windfall profits" from domestic oil producers. A similar tax could target gold gains during currency crises.

Roth IRA Advantage

Investments held in a Roth IRA are far less likely to be targeted by a windfall-profits tax—especially one aimed at gold. Roth IRAs offer tax-free growth and withdrawals, potentially shielding gains from future taxation.

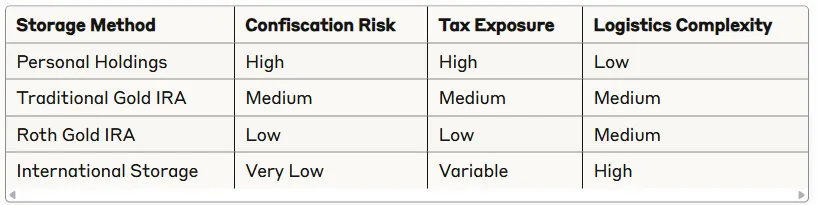

Comparative Risk Assessment

Action Steps to Protect Your Gold IRA

- Choose Reputable Custodians: Work with established custodians with strong track records and transparent fee structures.

- Select Secure Depositories: Avoid "co-mingled storage" where depositories lump all clients' precious metals together. Opt for segregated storage.

- Diversify Metal Types: Include silver, platinum, and palladium alongside gold to reduce concentration risk.

- Consider Roth Conversion: Convert traditional Gold IRA funds to Roth status to minimize future tax exposure.

- Evaluate International Options: For larger holdings, consider offshore storage in stable jurisdictions.

- Include Numismatic Coins: Add collectible coins that historically received exemptions.

- Stay Informed: Monitor economic policies and maintain flexibility to adjust strategies.

Bottom Line

While the specter of 1933 haunts gold investors, the economic and political realities of 2025 make traditional confiscation highly unlikely. The likelihood of governments resorting to confiscation measures in the future is relatively low, especially for Gold IRAs stored in approved depositories with third-party custodians.

The greater risks today involve taxation rather than seizure. By choosing appropriate storage methods, diversifying metals, and structuring investments thoughtfully, Gold IRA investors can build robust protection against both historical and modern threats.

Remember: in times of crisis, governments become desperate. While outright confiscation remains improbable, staying informed and prepared ensures your retirement gold continues serving its intended purpose—protecting your wealth when you need it most.