Gold IRA Company Comparison: Your Complete Guide to Choosing the Right Provider

The precious metals IRA market has exploded in recent years, with thousands of Americans seeking to protect their retirement savings from economic uncertainty.

But here's the challenge: not all Gold IRA companies are created equal. Some charge excessive fees, others provide poor customer service, and a few might not even be legitimate.

Choosing the wrong provider could cost you thousands in unnecessary fees and put your retirement at risk. That's why we've created this comprehensive comparison of America's top Gold IRA companies, breaking down everything you need to know to make an informed decision.

What Makes a Gold IRA Company Worth Your Trust?

Before diving into specific companies, you need to understand what separates the winners from the wannabes.

Here are the critical factors that should guide your decision:

Essential Evaluation Criteria

Regulatory Compliance and Reputation

- Better Business Bureau (BBB) rating and accreditation

- Years in business and track record

- Compliance with IRS regulations

- Customer complaint history

Fee Transparency

- Clear, upfront disclosure of all costs

- Competitive pricing structure

- No hidden charges or surprise fees

- Reasonable minimum investment requirements

Customer Education and Support

- Quality educational resources

- Responsive customer service

- Dedicated account representatives

- Clear communication throughout the process

Storage and Security

- Partnerships with IRS-approved depositories

- Insurance coverage for stored metals

- Segregated storage options

- Geographic diversification of storage facilities

Top Gold IRA Companies: Head-to-Head Analysis

Augusta Precious Metals

Strengths: Known for exceptional customer education and transparency. Offers extensive educational resources and has built a reputation for ethical business practices.

Minimum Investment: $50,000 Standout Feature: Comprehensive educational approach with detailed guides and one-on-one consultations

Goldco

Strengths: Strong track record with over a decade in business. Offers both Gold and Silver IRA options with competitive pricing.

Minimum Investment: $25,000 Standout Feature: Simplified rollover process with dedicated specialists guiding each step

American Hartford Gold

Strengths: No minimum investment requirement makes it accessible to smaller investors. Strong customer service ratings.

Minimum Investment: None Standout Feature: Flexibility for investors with smaller retirement accounts

Birch Gold Group

Strengths: Comprehensive precious metals selection including gold, silver, platinum, and palladium. Strong educational resources.

Minimum Investment: $10,000 Standout Feature: Diverse precious metals options and lower entry barrier

Noble Gold Investments

Strengths: Offers both traditional IRA storage and innovative home storage options in select states.

Minimum Investment: $20,000 Standout Feature: Alternative storage solutions for qualifying investors

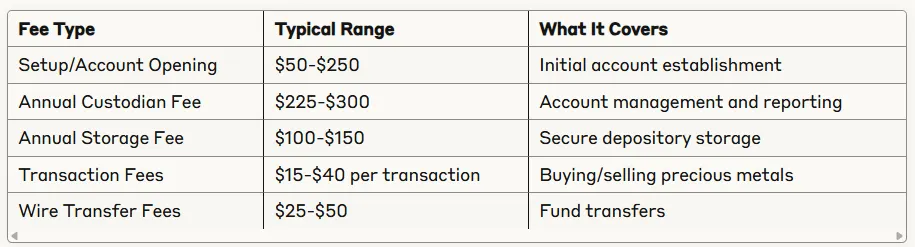

Fee Structure Comparison: Where Your Money Really Goes

Understanding fees is crucial because they directly impact your long-term returns. Here's how the major companies typically structure their costs:

The Real Cost Impact

A $100,000 Gold IRA typically faces annual fees of $325-$450. Over 20 years, this compounds to $6,500-$9,000 in total fees, not including transaction costs. This is why comparing fee structures matters significantly.

Red Flag Warning: Avoid companies that won't provide clear fee schedules upfront or those charging excessive markups on precious metals purchases.

Customer Service: Your Lifeline During the Process

Gold IRA investing can be complex, making quality customer support essential. Here's what to expect from top-tier companies:

What Excellent Service Looks Like

- Dedicated account representatives who know your situation

- Educational materials that explain complex concepts clearly

- Responsive communication via phone, email, and online chat

- Proactive updates on account status and market conditions

- Clear guidance on IRS compliance requirements

Questions to Test Their Service Quality

- "Can you explain the rollover process step-by-step?"

- "What educational resources do you provide?"

- "How do you ensure IRS compliance?"

- "What are your storage options and associated costs?"

- "Can you provide references from current clients?"

Storage and Security: Protecting Your Precious Metals

Your gold must be stored in an IRS-approved depository to maintain your IRA's tax-advantaged status. Here's what you need to know:

Storage Options Explained

Segregated Storage

- Your metals stored separately from other investors' holdings

- Higher security and easier identification

- Typically costs $25-$50 more annually than non-segregated

Non-Segregated (Commingled) Storage

- Your metals stored with other investors' similar metals

- Lower cost option

- Still fully insured and secure

Major Depository Partners

- Delaware Depository (Wilmington, DE)

- Brinks (multiple locations)

- Texas Precious Metals Depository (Shiner, TX)

All reputable Gold IRA companies partner with these established, fully insured facilities.

Making Your Decision: A Practical Action Plan

Now that you understand the landscape, here's your step-by-step approach to choosing the right Gold IRA company:

Your Due Diligence Checklist

Phase 1: Initial Research

- [ ] Verify BBB accreditation and rating

- [ ] Check online reviews and complaint history

- [ ] Confirm IRS compliance and proper licensing

- [ ] Review company's years in business

Phase 2: Direct Evaluation

- [ ] Request fee schedules from 3-5 companies

- [ ] Ask for educational materials

- [ ] Test their customer service responsiveness

- [ ] Inquire about storage options and locations

Phase 3: Final Comparison

- [ ] Calculate total annual costs for your investment amount

- [ ] Compare minimum investment requirements

- [ ] Evaluate educational resources quality

- [ ] Assess comfort level with each company's approach

Questions That Reveal Everything

When speaking with potential providers, ask these revealing questions:

- "What is your total annual fee for a $[your amount] account?" Good companies provide clear, immediate answers

- "Can you walk me through your rollover process timeline?" Quality providers have detailed, proven procedures

- "What happens if I want to take distributions?" This reveals their understanding of IRS rules

- "What educational support do you provide ongoing clients?" Top companies invest in client education beyond the sale

Your Next Steps

Choosing a Gold IRA provider is a significant financial decision that will impact your retirement for decades. Don't rush the process, but don't let analysis paralysis prevent you from acting.

Start by requesting information from 3-4 companies that meet your minimum requirements. Compare their fee structures, educational resources, and customer service quality. Most importantly, choose a company that makes you feel confident and informed about your decision.

Remember: the best Gold IRA company for you depends on your specific situation, investment amount, and personal preferences. Take time to find the right fit, but once you do, act decisively to begin protecting and diversifying your retirement savings.

The companies highlighted in this comparison represent some of America's most established and reputable Gold IRA providers. Each has strengths that may align with your specific needs. Your job is to determine which combination of fees, service, and expertise best serves your retirement goals.

Ready to take the next step? Contact 2-3 companies from this list to begin your detailed evaluation process. Your future self will thank you for the careful consideration you put into this important decision.