Gold During Economic Uncertainty: Your Shield Against Financial Turbulence

Economic storms are brewing. Inflation rates fluctuate wildly, stock markets swing like pendulums, and geopolitical tensions threaten global stability. When traditional investments crumble under pressure, smart investors turn to an asset that has weathered every financial storm for over 5,000 years: gold.

But why does this yellow metal continue to attract investors when uncertainty strikes? And more importantly, how can you position yourself to benefit from gold's protective qualities during turbulent times?

Why Gold Becomes Your Financial Lifeline During Crisis

The Inflation Fighter

When inflation erodes the purchasing power of your dollars, gold typically moves in the opposite direction. As prices for everyday goods skyrocket, gold often increases in value, helping preserve your wealth. This inverse relationship has played out repeatedly throughout history.

During the 1970s stagflation period, when inflation reached double digits, gold prices surged from $35 per ounce to over $800 per ounce – a gain of more than 2,000%.

Currency Devaluation Shield

Gold doesn't rely on any government's promise to maintain value. While currencies can be printed endlessly, leading to devaluation, gold's supply remains relatively fixed. This scarcity makes it a powerful hedge against currency weakness.

Portfolio Diversification Powerhouse

Gold typically moves independently of stocks and bonds. When traditional markets crash, gold often holds steady or even gains value, providing crucial portfolio balance during volatile periods.

Your Gold Investment Options During Uncertain Times

Physical Gold: Tangible Security

Gold Coins and Bars

- Complete control over your investment

- No counterparty risk

- Immediate liquidity

- Privacy and anonymity

Considerations:

- Storage and insurance costs

- Security concerns

- Potential premiums over spot price

Gold IRAs: Tax-Advantaged Protection

A Gold IRA allows you to hold physical gold within a tax-advantaged retirement account. This option combines gold's protective qualities with significant tax benefits.

Key Advantages:

- Tax-deferred growth (Traditional Gold IRA)

- Tax-free withdrawals in retirement (Roth Gold IRA)

- Professional storage in IRS-approved depositories

- Portfolio diversification within retirement accounts

IRA-Eligible Gold Requirements:

- Minimum 99.5% purity

- Must be coins or bars from approved manufacturers

- Examples: American Gold Eagles, Canadian Maple Leafs, certain gold bars

Gold ETFs: Market Accessibility

Exchange-traded funds that track gold prices offer:

- Easy buying and selling through stock brokers

- Lower storage costs

- Professional management

Trade-offs:

- No physical possession

- Counterparty risk

- Management fees

Real-World Proof: Gold's Crisis Performance

2008 Financial Crisis

While the S&P 500 plummeted 37% in 2008, gold gained 5.8%. By 2011, as the economy struggled to recover, gold had increased over 70% from pre-crisis levels.

COVID-19 Pandemic Response

As governments worldwide printed trillions of dollars in stimulus money during 2020-2021, gold prices surged to record highs above $2,000 per ounce, providing protection against currency debasement fears.

Historical Inflation Periods

1970s Stagflation:

- Inflation rate: Up to 14.8%

- Gold performance: +2,000% over the decade

- Stock market: Largely stagnant

Early 1980s Recession:

- Economic uncertainty and high interest rates

- Gold maintained value while other assets struggled

Smart Gold Strategies for Uncertain Times

Portfolio Allocation Guidelines

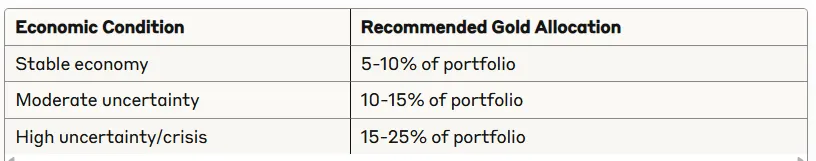

Financial experts typically recommend:

Timing Your Gold Investments

Dollar-Cost Averaging Instead of trying to time the market perfectly, consider regular purchases over time. This strategy helps smooth out price volatility and reduces timing risk.

Crisis Preparation The best time to buy gold is before you need it. Waiting until a crisis hits often means paying premium prices.

Storage and Security Considerations

For Physical Gold:

- Home safes (limited amounts)

- Bank safety deposit boxes

- Private storage facilities

- Insurance coverage

For Gold IRAs:

- IRS-approved depositories required

- Segregated vs. non-segregated storage options

- Professional security and insurance included

The Economic Uncertainty Playbook

When economic storm clouds gather, consider this action plan:

1. Assess your current portfolio exposure to inflation-sensitive assets

2. Determine your risk tolerance and economic outlook

3. Choose your gold investment vehicle based on your goals:

- Physical gold for maximum control

- Gold IRA for tax advantages

- Gold ETFs for convenience

4. Implement gradually using dollar-cost averaging

5. Monitor and rebalance as economic conditions change

Common Mistakes to Avoid

Overallocation Gold should complement, not dominate, your portfolio. Even during uncertain times, maintain diversification across asset classes.

Panic Buying Emotional decisions often lead to poor timing. Stick to your strategy rather than making impulsive moves.

Ignoring Costs Factor in storage, insurance, and transaction costs when calculating returns.

Take Control of Your Financial Future

Economic uncertainty isn't a question of "if" but "when." The next financial crisis, inflation surge, or currency devaluation could happen tomorrow or next year. The key is preparing before it strikes.

Gold has protected wealth through every major economic crisis in modern history. From the Great Depression to the 2008 financial meltdown to the COVID-19 pandemic, gold has consistently provided the stability that traditional investments couldn't deliver.

Whether you choose physical gold for maximum control, a Gold IRA for tax advantages, or ETFs for convenience, the important step is taking action now – while stability still exists.

Your future self will thank you for having the foresight to build a financial fortress that can weather any economic storm. The question isn't whether you can afford to invest in gold during uncertain times – it's whether you can afford not to.