Gold as Protection Against Government Debt: Your Shield in Uncertain Times

Government debt levels have reached unprecedented heights globally. The U.S. national debt now exceeds $33 trillion, while countries worldwide grapple with debt-to-GDP ratios that would have been unthinkable just decades ago. For investors watching these alarming trends, a critical question emerges: How can you protect your wealth when governments resort to their time-tested solution of inflating away their obligations?

Smart investors are rediscovering gold's protective power against government debt manipulation. Unlike paper currencies that governments can print at will, gold maintains its intrinsic value and has served as a monetary anchor for thousands of years. When governments face unsustainable debt burdens, they historically turn to currency devaluation and inflation—making gold's protection more valuable than ever.

The desire for financial security grows stronger as investors witness how government debt crises unfold. From the Weimar Republic's hyperinflation to Argentina's multiple defaults, history shows that excessive government debt inevitably impacts currency stability and citizen wealth. Gold offers a tested shield against these systematic risks.

Take action now by understanding how gold protects against government debt and implementing strategies to safeguard your financial future before the next debt crisis unfolds.

Understanding Government Debt Risks for Investors

Government debt creates several interconnected risks that directly threaten your purchasing power and investment returns:

Currency Devaluation: The Invisible Tax

When governments accumulate excessive debt, they face three options:

- Raise taxes (politically difficult)

- Cut spending (economically painful)

- Devalue currency (hidden from most voters)

Governments consistently choose the third option because it's politically expedient. They print more money to pay obligations, effectively taxing savers and investors through currency debasement.

Inflation as Debt Reduction Strategy

Inflation serves as government debt relief by:

- Reducing real debt burden: A $1 trillion debt becomes less burdensome when inflation makes $1 trillion worth less

- Increasing nominal tax revenue: Higher prices generate more tax dollars without raising rates

- Transferring wealth: From savers to debtors (including the government)

Historical data shows that countries with debt-to-GDP ratios exceeding 90% frequently experience currency crises within a decade.

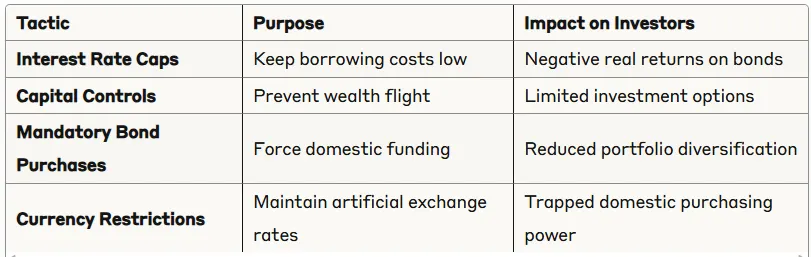

Financial Repression Tactics

Heavily indebted governments often implement:

Gold's protective mechanisms work through several powerful channels that have proven effective across centuries of government debt crises.

Store of Value Across Millennia

Unlike fiat currencies, gold maintains purchasing power over extended periods:

- Ancient Rome: One ounce of gold bought approximately the same amount of wheat as today

- Medieval Period: Gold consistently purchased similar quantities of basic goods

- Modern Era: Despite short-term volatility, gold preserves long-term value

This stability stems from gold's physical properties—it cannot be created, destroyed, or manipulated by government decree.

Inflation Hedge Performance

Gold demonstrates strong correlation with inflation over long periods:

1970s Stagflation Example:

- U.S. inflation averaged 7.4% annually (1970-1979)

- Gold price increased from $36 to $512 per ounce

- Real return significantly outpaced inflation

Mathematical Protection: When inflation reaches 5% annually, $100,000 in cash loses $5,000 in purchasing power yearly. Gold typically maintains or increases its real value during equivalent inflationary periods.

Currency Diversification Benefits

Gold provides currency diversification because:

- Universal acceptance: Recognized worldwide regardless of local currency

- No counterparty risk: No government or institution backing required

- Inverse dollar correlation: Typically rises when dollar weakens

- Crisis premium: Gains value during currency emergencies

Portfolio Insurance Characteristics

Gold functions as portfolio insurance by:

- Negative correlation: Often moves opposite to stocks during crises

- Liquidity maintenance: Remains tradeable when other markets freeze

- Wealth preservation: Protects against systematic financial risks

- Generational transfer: Maintains value across political transitions

Practical Implementation Strategies

Physical Gold Ownership Options

Gold Coins:

- American Gold Eagles (1 oz, ½ oz, ¼ oz, 1/10 oz)

- Canadian Gold Maple Leafs (various sizes)

- South African Krugerrands (multiple denominations)

Advantages: Direct ownership, no counterparty risk, portable wealth Considerations: Storage security, insurance costs, liquidity premiums

Gold Bars:

- 1 oz to 400 oz sizes available

- Lower premiums than coins

- LBMA-approved refiners preferred

Gold IRA Protection Strategy

Gold IRAs offer tax-advantaged government debt protection:

Eligibility Requirements:

- Minimum 99.5% purity for gold products

- IRS-approved manufacturers only

- Professional storage at approved depositories

Annual Contribution Limits (2025):

- $7,000 for investors under 50

- $8,000 for investors 50 and older

Tax Benefits:

- Traditional Gold IRA: Tax-deferred growth, deduct contributions

- Roth Gold IRA: Tax-free qualified withdrawals

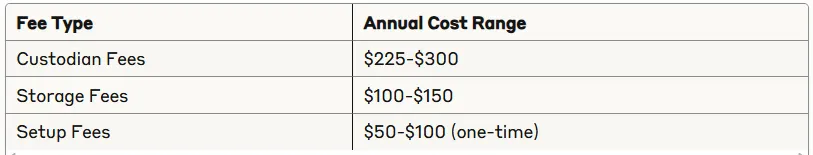

Typical Costs:

Strategic Allocation Recommendations:

Conservative Approach (Ages 50+):

- 10-15% precious metals allocation

- 70% gold, 20% silver, 10% platinum/palladium

- Focus on wealth preservation

Aggressive Strategy (Ages 25-45):

- 15-25% precious metals allocation

- Emphasize growth potential during debt crises

- Higher risk tolerance for volatility

Crisis Preparation Allocation:

- 25-30% precious metals (temporary increase)

- Increase during obvious debt sustainability concerns

- Reduce when crisis passes

Timing Considerations

Optimal Purchase Indicators:

- Government debt-to-GDP ratios exceeding 100%

- Central bank money printing acceleration

- Currency devaluation against trading partners

- Rising inflation expectations

Dollar-Cost Averaging Benefits:

- Reduces timing risk

- Smooths price volatility

- Builds position systematically

- Recommended: Monthly purchases over 12-24 months

Real-World Case Studies

Weimar Republic Hyperinflation (1921-1923)

Situation: Germany printed money to pay war reparations

Result: Currency became worthless, gold holders preserved wealth

Lesson: Extreme government debt leads to currency destruction

Key Metrics:

- Inflation peaked at 29,500% monthly

- Gold price in German marks increased 1.3 trillion percent

- Citizens with gold maintained purchasing power

1970s U.S. Stagflation Period

Situation: Vietnam War spending and oil shocks created inflation

Government Response: Wage and price controls, currency devaluation

Gold Performance: Increased from $35 to $850 (2,300% gain)

Protection Mechanism: Gold outpaced inflation and stock market losses simultaneously

2008 Financial Crisis

Situation: Government bailouts expanded money supply dramatically

Market Response: Stocks declined 50%, bonds provided little protection

Gold Performance: Gained 25% during crisis, continued rising afterward

Recent Examples (2020-2022)

COVID-19 Response:

- U.S. government spending increased $6 trillion

- Federal Reserve expanded balance sheet 120%

- Gold gained 24% in 2020, maintained value during 2021-2022 inflation

Risks and Considerations

Volatility Factors

Gold experiences short-term price volatility due to:

- Speculation: Short-term trading impacts prices

- Dollar strength: Strong dollar periods pressure gold prices

- Interest rates: Rising real rates can reduce gold appeal

- Mining supply: New discoveries or production changes

Management Strategy: Focus on long-term protection rather than short-term gains

Storage and Insurance Costs

Physical Gold Costs:

- Home storage: Security system, safe, insurance

- Bank safety deposit: $50-$300 annually

- Private vaults: $200-$500 annually

- IRA storage: $100-$150 annually (mandatory)

Liquidity Considerations

High Liquidity:

- Major gold coins and bars

- Exchange-traded products

- Futures contracts

Lower Liquidity:

- Numismatic coins

- Small quantities

- Remote storage locations

Optimization: Maintain 80% in highly liquid forms, 20% in specialized products

Advanced Protection Strategies

Geographic Diversification

International Storage Benefits:

- Political risk reduction

- Currency diversification

- Access during domestic restrictions

Popular Jurisdictions:

- Switzerland: Political stability, banking privacy

- Singapore: Asian access, strong property rights

- Canada: Stable neighbor, gold-friendly policies

Hybrid Approaches

Combination Strategy:

- 40% physical gold (direct ownership)

- 30% Gold IRA (tax advantages)

- 20% gold mining stocks (leverage to gold prices)

- 10% gold ETFs (liquidity and convenience)

Crisis Escalation Plan

Phase 1 (Early Warning): Increase allocation to 15-20%

Phase 2 (Obvious Problems): Reach maximum comfortable allocation

Phase 3 (Crisis Peak): Begin strategic profit-taking

Phase 4 (Recovery): Maintain core position, reduce excess

Conclusion: Your Golden Shield Against Government Debt

Government debt represents one of the most significant threats to long-term wealth preservation in modern history. As debt levels reach unprecedented heights and governments exhaust conventional solutions, currency devaluation and inflation become inevitable.

Gold provides proven protection through its role as a store of value, inflation hedge, and currency alternative. Historical evidence demonstrates that gold maintains purchasing power when governments manipulate their currencies to manage debt burdens.

Key implementation principles:

- Start Early: Begin building positions before crisis becomes obvious

- Diversify Approaches: Combine physical gold, IRAs, and strategic alternatives

- Maintain Discipline: Focus on long-term protection, not short-term trading

- Professional Guidance: Work with experienced precious metals dealers and tax advisors

The time for action is now. Government debt problems don't resolve quickly—they typically worsen over years or decades before reaching crisis points. Smart investors position themselves early, understanding that gold's protective power grows stronger as government debt pressures intensify.

Whether through physical ownership, Gold IRAs, or hybrid strategies, gold offers a time-tested shield against government debt manipulation. As central banks continue expanding money supplies and governments accumulate unsustainable obligations, gold's ancient role as monetary protection becomes increasingly relevant for modern investors.

Your financial future depends on decisions you make today. While government debt continues growing, gold stands ready to preserve your wealth across whatever monetary challenges lie ahead.