Gold as a Dollar Devaluation Hedge: Your Financial Shield Against Currency Decline

The dollar's purchasing power has declined by over 96% since 1913, and recent economic policies have accelerated concerns about further devaluation. If you're watching inflation erode your savings while interest rates fail to keep pace, you're witnessing firsthand why smart investors turn to gold as their financial insurance policy.

Gold has served as humanity's most trusted store of value for over 5,000 years, and modern economic data proves why this ancient wisdom remains relevant today. When the dollar weakens, gold typically strengthens, creating a natural hedge that protects your wealth from currency decline.

Understanding Dollar Devaluation: The Silent Wealth Destroyer

Dollar devaluation occurs when the currency loses purchasing power relative to other currencies and commodities. This happens through several mechanisms:

Primary Causes of Dollar Devaluation:

- Excessive money printing by the Federal Reserve

- High government debt levels and deficit spending

- Low interest rates that reduce dollar attractiveness

- Geopolitical tensions affecting dollar confidence

- Trade imbalances and current account deficits

The impact hits your wallet directly. That $100 grocery bill from five years ago now costs $130 or more. Your retirement savings lose purchasing power even while sitting in "safe" accounts. Real estate, education, and healthcare costs outpace wage growth, creating a wealth transfer from savers to debtors.

The Gold-Dollar Inverse Relationship: Mathematical Protection

Gold and the dollar maintain an inverse relationship rooted in fundamental economics. When dollar strength declines, investors flee to gold as an alternative store of value. This relationship isn't coincidental—it's based on gold's unique monetary properties.

Why Gold Rises When Dollars Fall:

- Intrinsic Value: Gold has inherent worth independent of government backing

- Limited Supply: Cannot be printed or created digitally like fiat currency

- Global Recognition: Accepted worldwide as a store of value

- Inflation Hedge: Maintains purchasing power over long periods

- Crisis Premium: Gains value during economic uncertainty

Historical data confirms this relationship. During the 1970s stagflation period, gold prices rose from $35 to over $800 per ounce while the dollar weakened significantly. The 2008 financial crisis saw similar patterns, with gold climbing from $800 to over $1,900 as dollar confidence waned.

Historical Evidence: Gold's Proven Track Record

1970s Stagflation Period:

- Dollar lost 50% of purchasing power

- Gold increased 2,200% from 1970-1980

- Outperformed stocks, bonds, and cash significantly

2000-2011 Dollar Decline:

- Dollar Index fell from 120 to 75

- Gold rose from $300 to $1,900 per ounce

- Delivered 533% returns during dollar weakness

2020-2021 Monetary Expansion:

- Fed balance sheet expanded by $4 trillion

- Gold reached new highs above $2,000

- Outperformed most traditional assets

These periods demonstrate gold's effectiveness as a dollar devaluation hedge across different economic environments and policy regimes.

Practical Implementation: Building Your Gold Defense Strategy

Physical Gold Ownership

Advantages:

- Direct ownership and control

- No counterparty risk

- Privacy and confidentiality

- Immediate access during crises

Considerations:

- Storage and insurance costs

- Liquidity timing for large amounts

- Authentication and purity verification

Gold IRAs: Retirement Protection Strategy

Gold IRAs offer tax-advantaged protection for retirement funds against dollar devaluation. These self-directed accounts hold physical precious metals in IRS-approved depositories while maintaining the tax benefits of traditional retirement accounts.

Gold IRA Benefits:

- Tax-deferred or tax-free growth potential

- Professional storage and insurance

- Portfolio diversification beyond paper assets

- Protection from currency devaluation

- Inflation hedge for retirement years

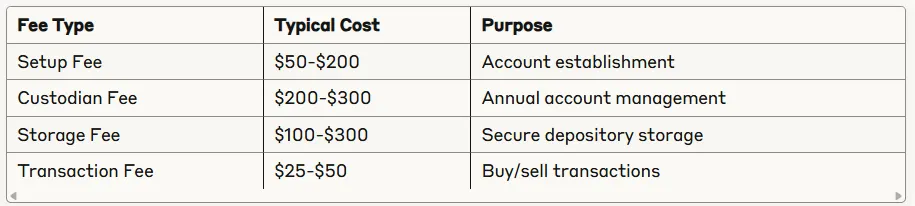

Annual Fees Structure:

Portfolio Allocation Guidelines

Financial experts typically recommend 5-20% precious metals allocation, with higher percentages during periods of elevated dollar devaluation risk.

Conservative Approach (5-10%):

- Suitable for stable economic periods

- Provides basic insurance against dollar decline

- Minimal impact on overall portfolio volatility

Moderate Approach (10-15%):

- Appropriate during uncertain economic times

- Balances protection with growth potential

- Recommended for pre-retirees and retirees

Aggressive Approach (15-20%+):

- Used during high inflation or currency crisis periods

- Maximum protection against dollar devaluation

- Requires careful monitoring and professional guidance

Timing and Market Considerations

Gold performs best as a dollar hedge during specific economic conditions:

Optimal Conditions for Gold:

- Rising inflation exceeding interest rates

- Expansionary monetary policy

- Geopolitical tensions and uncertainty

- Declining dollar strength vs. major currencies

- Negative real interest rates

Challenging Conditions:

- Rising interest rates with strong dollar

- Deflationary environments

- Strong economic growth with dollar strength

- Technology sector booms attracting capital

Taking Action: Your Implementation Roadmap

Step 1: Assess Your Current Exposure Evaluate how much of your wealth is denominated in dollars and vulnerable to devaluation. Include cash, bonds, and dollar-based investments.

Step 2: Determine Appropriate Allocation Consider your age, risk tolerance, and economic outlook. Younger investors might start with 5-10%, while those nearing retirement may prefer 15-20%.

Step 3: Choose Your Gold Investment Vehicle

- Physical gold for direct ownership

- Gold IRAs for retirement account protection

- Gold ETFs for liquidity and convenience

- Mining stocks for growth potential (higher risk)

Step 4: Select Reputable Dealers and Custodians Research companies with strong track records, transparent pricing, and proper accreditations. For Gold IRAs, ensure custodians are IRS-approved and depositories meet storage requirements.

Step 5: Monitor and Rebalance Review your allocation quarterly and rebalance as needed. Gold's price volatility may require periodic adjustments to maintain target percentages.

Professional Guidance and Risk Management

While gold offers protection against dollar devaluation, it's not a perfect hedge for every situation. Work with qualified financial advisors who understand precious metals investing and can help optimize your strategy.

Consider these additional protective measures:

- Diversify across multiple currencies and regions

- Include other hard assets like real estate

- Maintain some liquid cash reserves

- Monitor economic indicators and policy changes

Dollar devaluation represents a real threat to your financial security, but gold provides a time-tested defense mechanism. By understanding the relationship between gold and dollar strength, implementing appropriate allocation strategies, and choosing the right investment vehicles, you can protect your wealth from the silent erosion of currency devaluation.

The question isn't whether the dollar will face future pressure—it's whether you'll be prepared when it happens. Gold offers that preparation, serving as your financial insurance policy against an uncertain monetary future. Request more information from custodians, such as Birch Gold Group to see how they can help you prepare for the future.