Gold and Federal Reserve Policy

The Federal Reserve's monetary policy decisions create ripple effects throughout financial markets, but few assets respond as dramatically as gold. Understanding this relationship is crucial for anyone considering gold as part of their investment strategy, particularly within retirement accounts.

How Federal Reserve Policy Directly Impacts Gold Prices

Interest Rate Decisions: The Primary Driver

When the Federal Reserve raises interest rates, gold typically faces headwinds. Higher rates increase the opportunity cost of holding non-yielding assets like gold, making bonds and savings accounts more attractive. Conversely, when the Fed cuts rates, gold often shines brighter as investors seek alternatives to low-yielding traditional investments.

The mechanism works through several channels:

- Opportunity cost: Higher rates make bonds more attractive than gold

- Dollar strength: Rate hikes typically strengthen the dollar, making gold more expensive for foreign buyers

- Real rates: The difference between nominal rates and inflation affects gold's appeal

Quantitative Easing: Money Creation and Gold

Quantitative easing (QE) programs have historically been gold's best friend. When the Fed purchases bonds and injects money into the banking system, several things happen:

- Currency debasement concerns drive investors toward hard assets

- Inflation expectations rise, making gold attractive as an inflation hedge

- Dollar weakness often follows, supporting gold prices

The Dollar Connection

Since gold is priced in U.S. dollars, Federal Reserve policies that affect dollar strength directly impact gold prices. A weaker dollar makes gold cheaper for international buyers, typically boosting demand and prices.

Historical Analysis: Fed Actions and Gold Performance

The 1970s Inflation Era

The 1970s provide the most dramatic example of how Fed policy impacts gold. As the Federal Reserve struggled with stagflation, gold prices soared from $35 per ounce in 1971 to over $800 by 1980.

Key factors included:

- Abandonment of the gold standard in 1971

- Expansionary monetary policy to combat recession

- Rising inflation expectations

- Dollar weakness throughout the decade

2008 Financial Crisis Response

Following the 2008 financial crisis, the Federal Reserve implemented unprecedented monetary stimulus:

- Interest rates dropped to near zero

- Three rounds of QE pumped trillions into the economy

- Gold prices responded by climbing from around $800 in 2008 to over $1,900 in 2011

This period demonstrated gold's role as a hedge against aggressive monetary expansion and financial system uncertainty.

COVID-19 Pandemic Policies

The Fed's response to the pandemic included:

- Cutting rates to zero in March 2020

- Implementing unlimited QE

- Supporting credit markets through various facilities

Gold initially surged to new all-time highs above $2,000 per ounce in August 2020, reflecting concerns about massive monetary stimulus and its long-term consequences.

Current Fed Policy Environment and Gold

Recent Rate Trajectory

Following the aggressive rate hiking cycle that began in 2022 to combat inflation, the Federal Reserve has shifted toward a more neutral stance. Current considerations include:

- Inflation progress toward the 2% target

- Employment conditions and labor market strength

- Economic growth sustainability

- Global economic factors affecting U.S. policy

Market Expectations and Gold

Gold prices often move based on expectations of future Fed policy rather than current rates. Key factors investors watch include:

- Fed meeting minutes and policy statements

- Economic data that might influence Fed decisions

- Chair statements and guidance about future policy direction

- Market pricing of future rate moves through fed funds futures

Why Investors Turn to Gold During Fed Policy Shifts

Hedge Against Currency Debasement

When the Fed implements expansionary policies, concerns about long-term dollar purchasing power drive investors toward gold. This makes gold particularly attractive during periods of:

- Large-scale asset purchases

- Extended periods of low interest rates

- Government deficit spending requiring Fed accommodation

Portfolio Diversification Benefits

Gold often moves independently of stocks and bonds, particularly during Fed policy transitions. This diversification benefit becomes most valuable when:

- Traditional asset correlations increase during stress

- Policy uncertainty creates market volatility

- Investors seek alternatives to rate-sensitive investments

Store of Value During Uncertainty

Fed policy changes can create periods of significant market uncertainty. Gold's role as a store of value becomes particularly important when:

- Policy effectiveness is questioned

- Inflation expectations become unanchored

- Financial market stability is threatened

Practical Implications for Gold IRA Investors

Timing Considerations

While timing the market is difficult, understanding Fed policy cycles can inform gold allocation decisions:

Favorable conditions for gold allocation:

- Early stages of monetary easing cycles

- Periods of below-target inflation with accommodative policy

- Times of significant policy uncertainty or regime change

Challenging conditions for gold:

- Aggressive tightening cycles with rising real rates

- Strong dollar trends supported by rate differentials

- Periods of stable, predictable monetary policy

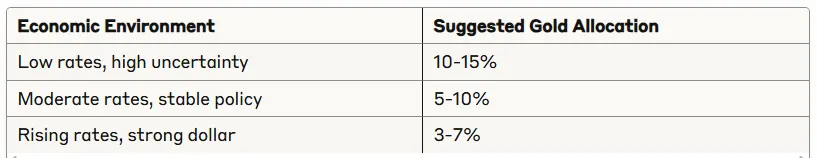

Portfolio Allocation Strategy

Rather than trying to time Fed policy perfectly, consider gold as a strategic allocation within your retirement portfolio:

For retirement investors, gold IRAs offer a way to gain exposure to gold within a tax-advantaged account structure.

Consider these factors:

- IRA-approved gold products meet specific purity requirements

- Storage requirements mandate IRS-approved depositories

- Rollover opportunities from existing retirement accounts

- Tax treatment varies between traditional and Roth gold IRAs

Strategic Considerations

Long-Term Perspective

While Fed policy drives short-term gold price movements, successful gold investing requires a long-term perspective focused on:

- Monetary system stability and potential changes

- Global central bank policies beyond just the Fed

- Structural economic trends affecting currency values

- Geopolitical factors that influence safe-haven demand

Risk Management

Gold shouldn't be viewed as a guaranteed hedge against Fed policy changes. Consider:

- Volatility can be significant during policy transitions

- Correlation breakdown periods when gold doesn't behave as expected

- Opportunity costs during periods of strong stock and bond performance

Conclusion

The relationship between Federal Reserve policy and gold prices remains one of the most important dynamics in precious metals markets. While the correlation isn't perfect, understanding how monetary policy affects gold can help investors make more informed allocation decisions.

For retirement investors considering gold IRAs, the key is viewing gold as part of a diversified strategy rather than a short-term trading opportunity. Fed policy will continue evolving, but gold's role as a hedge against monetary expansion and currency debasement remains relevant for long-term portfolio protection.

The most successful approach involves maintaining a strategic allocation to gold that can benefit from Fed policy cycles while contributing to overall portfolio diversification and risk management.