Conservative Gold IRA Companies

Your Shield Against Economic Uncertainty

ATTENTION: With gold prices reaching historic highs of $3,499.88 in April 2025 and analysts predicting continued growth toward $3,700 by year-end, conservative investors are flocking to Gold IRAs as a proven hedge against inflation and market volatility.

INTEREST: As traditional retirement accounts face mounting pressure from economic uncertainty, political instability, and rising national debt exceeding $36 trillion, smart investors are diversifying with precious metals IRAs that have protected wealth for thousands of years.

DESIRE: The right Gold IRA company can transform your retirement strategy, offering tax advantages, portfolio protection, and peace of mind during turbulent times. But choosing the wrong provider could cost you thousands in excessive fees and poor service.

ACTION: This comprehensive guide reveals the top conservative Gold IRA companies for 2025, helping you make an informed decision that safeguards your financial future.

Why Conservative Investors Choose Gold IRAs in 2025

The investment landscape has shifted dramatically. With gold prices surging 27.87% in 2025 alone and reaching all-time highs above $3,400 per ounce, conservative investors recognize precious metals as essential portfolio protection.

Unlike volatile stocks or bonds vulnerable to interest rate changes, gold has maintained purchasing power for millennia. The World Gold Council reports that Q1 2025 saw the quarterly average gold price reach $2,860/oz, up 38% year-over-year, driven by geopolitical uncertainty, US tariff policies, and continued central bank accumulation.

Key Benefits for Conservative Investors:

- Inflation Hedge: Gold traditionally moves inversely to currency devaluation

- Portfolio Diversification: Reduces correlation with traditional assets

- Crisis Protection: Performs well during economic downturns

- Tax Advantages: Same benefits as traditional IRAs

- Tangible Assets: Physical ownership of precious metals

Top 5 Conservative Gold IRA Companies for 2025

Based on comprehensive analysis of customer reviews, industry ratings, and fee structures, here are the leading providers:

1. Augusta Precious Metals - Best Overall

Why Conservatives Choose Augusta: Founded in 2012, Augusta Precious Metals consistently ranks #1 among gold IRA companies, earning this position through transparent practices and exceptional investor education.

Key Features:

- Minimum Investment: $50,000

- Storage: Delaware Depository

- BBB Rating: A+

- Unique transparency approach with "reasons NOT to buy gold" content

- Harvard-educated economist consultations

- No-pressure sales approach

Best For: High-net-worth conservative investors seeking premium service and extensive educational resources.

2. American Hartford Gold - Most Transparent Pricing

Why It Stands Out: American Hartford Gold earned recognition for standout transparency and no-nonsense pricing, with no-fee buyback programs.

Key Features:

- Fee Structure: $75 annually (accounts ≤$100K), $125 (accounts >$100K)

- Metals Offered: Gold, silver, platinum, palladium

- BBB Rating: A+ and AAA from Business Consumers Alliance

- Price Match Guarantee available

- Same-day IRA setup capability

Best For: Conservative investors prioritizing transparent fees and competitive pricing.

3. Goldco - Best for IRA Rollovers

Why Conservatives Trust Goldco: Established reputation with thousands of five-star reviews and streamlined rollover processes.

Key Features:

- No minimum investment requirement

- Multiple precious metals options

- Excellent customer service ratings

- Comprehensive educational resources

- Simplified 3-step investment process

Best For: First-time Gold IRA investors and those rolling over existing retirement accounts.

4. Patriot Gold Group - Best for Fast Setup

Why It Appeals to Conservatives: Patriot Gold Group offers 24-hour account setup and advertises no fees for life on accounts over $100,000.

Key Features:

- 24-hour turnaround for new accounts

- Dealer-direct company (no middleman markups)

- No lifetime fees for larger accounts

- Simplified 3-step process

- Conservative-friendly marketing approach

Best For: Investors wanting quick account establishment with minimal fees.

5. Advantage Gold - Best Customer Service

Why Conservative Investors Approve: Founded in 2014, Advantage Gold boasts exceptional reviews with 98% of 1,780 TrustPilot reviews being five-star ratings.

Key Features:

- Strong buyback guarantee

- Four metals available (gold, silver, platinum, palladium)

- Reputable custodial partnerships

- Excellent customer care ratings

- Educational focus over sales pressure

Best For: Conservative investors prioritizing exceptional customer service and support.

Critical Factors for Conservative Investors

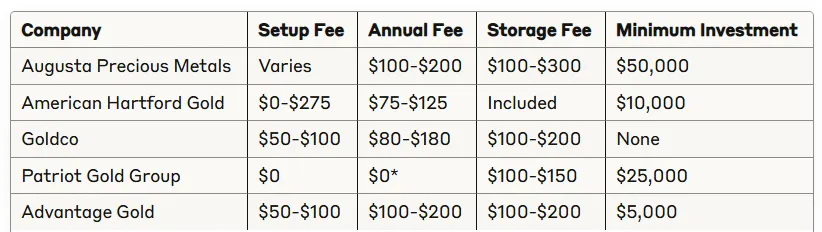

Fee Structure Analysis

Understanding fees is crucial for long-term returns:

Security and Storage

Conservative investors demand maximum security:

- Delaware Depository: Most trusted facility, used by Augusta and Advantage Gold

- Brink's Depository: High-security option for American Hartford Gold

- Segregated Storage: Your metals stored separately from others

- Insurance Coverage: Full insurance against theft or damage

- IRS-Approved Facilities: Ensures compliance with regulations

Regulatory Compliance

Top companies maintain:

- Better Business Bureau A+ ratings

- Proper licensing in all operating states

- IRS-approved precious metals inventory

- Transparent fee disclosure

- Ethical business practices

The Conservative Investment Case for Gold IRAs in 2025

Economic Fundamentals Supporting Gold

Goldman Sachs projects gold could reach $3,700 per ounce by end-2025, driven by:

1. Central Bank Demand: Central banks added over 1,000 tonnes for the third consecutive year in 2024, with demand accelerating in Q4

2. Federal Debt Concerns: Rising interest payments on $36+ trillion national debt

3. Geopolitical Uncertainty: Trade tensions and international conflicts

4. Inflation Protection: Historically outperforms during inflationary periods

Portfolio Allocation Strategies

Conservative financial advisors typically recommend:

- 5-10% precious metals allocation for balanced portfolios

- 10-20% for more defensive positioning

- Higher allocations during economic uncertainty period

Getting Started: Step-by-Step Process

1. Choose Your Company

Research and compare the providers listed above based on your priorities: fees, service, or minimum investment.

2. Open Your Account

Most companies offer:

- Phone consultations with specialists

- Educational materials and guides

- Help with paperwork completion

- Coordination with existing IRA custodians

3. Fund Your IRA

Options include:

- Direct Transfer: Move funds from existing IRA

- 401(k) Rollover: Transfer from employer plan

- Cash Contribution: Annual contribution limits apply

- In-Kind Transfer: Move existing precious metals

4. Select Your Metals

IRS-approved options include:

- Gold: American Eagles, Canadian Maple Leafs, bars

- Silver: American Silver Eagles, bars

- Platinum: American Platinum Eagles

- Palladium: American Palladium Eagles

5. Secure Storage

Your chosen company arranges:

- Transport to IRS-approved depository

- Segregated or allocated storage

- Insurance coverage

- Annual statements and reporting

Red Flags to Avoid

Conservative investors should be wary of companies that:

- Use high-pressure sales tactics

- Promise guaranteed returns

- Charge excessive markups over spot price

- Lack proper licensing or BBB accreditation

- Refuse to provide clear fee disclosure

- Push exotic or collectible coins

Market Outlook and Timing Considerations

Current Market Conditions

With gold increasing 27.87% since January 2025 and trading around $3,360 as of June 2025, some investors question timing. However, conservative strategies focus on long-term protection rather than market timing.

Expert Predictions for 2025-2030

Leading analysts project:

- Goldman Sachs: $3,700 by end-2025

- J.P. Morgan: Targets near $3,000 with potential upside

- Long-term projections: Some forecasts suggest $4,000+ by 2026

Dollar-Cost Averaging Strategy

Conservative investors often employ systematic investment approaches:

- Monthly or quarterly contributions

- Reduces timing risk

- Smooths out price volatility

- Builds positions gradually

Tax Implications for Conservative Investors

Traditional vs. Roth Gold IRAs

Traditional Gold IRA:

- Tax-deductible contributions

- Tax-deferred growth

- Taxed as ordinary income upon withdrawal

- Required Minimum Distributions at age 73

Roth Gold IRA:

- After-tax contributions

- Tax-free growth and withdrawals

- No required distributions

- Better for younger investors or those expecting higher future tax rates

Distribution Strategies

Conservative withdrawal approaches:

- Wait until age 59½ to avoid penalties

- Consider Required Minimum Distributions

- Plan for potential liquidation needs

- Understand buyback procedures

Frequently Asked Questions

Is a Gold IRA Right for Conservative Investors?

Gold IRAs suit conservative investors seeking portfolio diversification, inflation protection, and tangible asset ownership. They're particularly valuable during economic uncertainty.

How Much Should I Allocate to Gold?

Most financial advisors recommend 5-20% allocation, depending on risk tolerance and market conditions. Conservative investors often start with 10%.

Can I Hold Gold at Home?

IRS regulations require Gold IRA assets to be stored in approved depositories. Home storage disqualifies the account from IRA status.

What Happens During Market Crashes?

Gold often performs well during equity market downturns, providing portfolio

stability when traditional assets decline.

Bottom Line: Protecting Your Conservative Investment Strategy

The Conservative Advantage: Gold IRAs offer time-tested protection against economic uncertainty, inflation, and market volatility. With Goldman Sachs forecasting continued price appreciation to $3,100-$3,700 by end-2025, establishing positions now could benefit long-term wealth preservation.

Action Steps:

- Request information kits from 2-3 top companies

- Compare fee structures and service offerings

- Consult with specialists to understand your options

- Start with modest allocation (5-10% of portfolio)

- Consider dollar-cost averaging for entry strategy

Final Recommendation: Augusta Precious Metals leads for comprehensive service and education, while American Hartford Gold excels in transparent pricing. Choose based on your priorities: premium service versus cost efficiency.

The key to conservative success lies in choosing reputable companies, understanding all costs, and maintaining a long-term perspective. Gold IRAs aren't get-rich-quick schemes—they're wealth preservation tools that have protected investors for generations.

Investment Disclaimer: This article is for educational purposes only. Consult with qualified financial advisors before making investment decisions. Past performance doesn't guarantee future results.