Canadian Gold Maple Leaf IRA: Your Complete Investment Guide

Attention investors: The Canadian Gold Maple Leaf stands as one of the world's purest gold coins and represents a premium option for precious metals IRAs. While countless gold products compete for your retirement dollars, the Maple Leaf's exceptional purity and government backing create compelling advantages for serious investors.

Growing interest stems from the coin's 99.99% pure gold content—exceeding IRS requirements and surpassing most competing products. This ultra-high purity, combined with the Royal Canadian Mint's reputation for quality and the Canadian government's backing, positions Maple Leafs as a trusted store of value.

Smart investors desire the security and potential growth that physical gold provides, especially during economic uncertainty. The Canadian Gold Maple Leaf offers that security with added benefits: superior purity, global recognition, and seamless IRA integration.

Take action by understanding how Canadian Gold Maple Leafs can strengthen your retirement portfolio and the specific steps required to add them to your IRA.

What Makes Canadian Gold Maple Leafs IRA-Eligible

The Internal Revenue Service maintains strict standards for precious metals in retirement accounts. Canadian Gold Maple Leafs not only meet these requirements—they exceed them significantly.

IRS Purity Requirements

Gold products must achieve a minimum fineness of 99.5% (.995) to qualify for IRA inclusion. Canadian Gold Maple Leafs contain 99.99% (.9999) pure gold, making them among the purest gold coins available worldwide.

This exceptional purity provides several advantages:

- Higher gold content per coin compared to lower-purity alternatives

- Enhanced recognition in global precious metals markets

- Premium positioning that often maintains value better during market fluctuations

- Reduced alloy content minimizing potential tarnishing or degradation

Government Backing and Authenticity

The Royal Canadian Mint, a Crown corporation of the Canadian government, produces every Gold Maple Leaf with guaranteed weight and purity. This government backing provides:

- Legal tender status in Canada with a face value of $50 CAD

- Quality assurance backed by the Canadian government's reputation

- Anti-counterfeiting measures including micro-engraved security features

- Consistent production standards ensuring uniform quality across all coins

Approved Manufacturer Status

The Royal Canadian Mint maintains accreditation with major precious metals exchanges and meets all IRS requirements for approved manufacturers, ensuring seamless IRA eligibility.

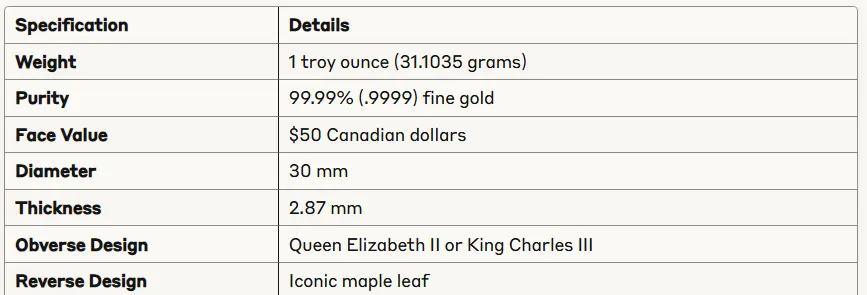

Canadian Gold Maple Leaf Specifications

Understanding the physical characteristics helps investors make informed decisions about their precious metals allocation.

Anti-Counterfeiting Features

Recent Canadian Gold Maple Leafs include advanced security elements:

- Radial lines creating a light-diffracting pattern

- Micro-engraved maple leaf visible only under magnification

- Precise laser technology ensuring consistent security features

- Distinctive visual elements easily verified by dealers and investors

Annual Production and Availability

The Royal Canadian Mint produces Gold Maple Leafs annually, ensuring consistent availability for IRA investors. Production numbers vary based on market demand, but the coins remain readily accessible through authorized dealers.

Setting Up Your Canadian Gold Maple Leaf IRA

Converting your interest into actual gold ownership requires specific steps and partnerships with qualified professionals.

Custodian Selection Requirements

Self-directed IRAs require specialized custodians experienced in precious metals.

Your custodian must:

- Maintain IRS approval for precious metals IRAs

- Partner with approved depositories for secure storage

- Provide transparent fee structures without hidden costs

- Offer educational resources supporting informed decisions

- Demonstrate compliance expertise ensuring regulatory adherence

Minimum Investment Thresholds

Most precious metals IRA providers require:

- Initial investment: $5,000 minimum for account establishment

- Subsequent purchases: $1,000 minimum for additional acquisitions

- Annual contributions: Follow standard IRA limits ($7,000 for 2025, $8,000 if 50 or older)

Storage Requirements

IRS regulations mandate professional storage for all IRA precious metals. You cannot store Gold Maple Leafs at home while maintaining tax-advantaged status.

Approved depositories provide:

- High-security facilities with armed guards and surveillance systems

- Insurance coverage protecting against theft or damage

- Segregated storage options keeping your metals separate from others

- Regular auditing ensuring accurate inventory management

- Geographic diversification with multiple location options

Documentation and Compliance

Proper documentation ensures IRA compliance and protects your investment:

- Certificate of authenticity from the Royal Canadian Mint

- Purity verification meeting IRS standards

- Chain of custody records from purchase through storage

- Annual reporting to maintain tax-advantaged status

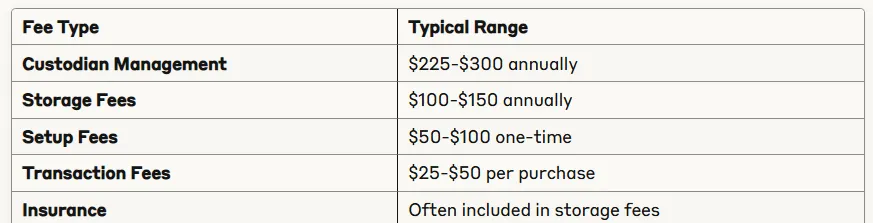

Cost Analysis: Understanding Your Investment

Transparent cost analysis helps optimize your precious metals allocation and avoid unexpected expenses.

Premium Over Spot Price

Gold Maple Leafs typically trade at premiums of 2-5% over spot gold prices, depending on:

- Market demand and supply conditions

- Dealer margins and competitive factors

- Purchase quantity with larger orders receiving better pricing

- Market volatility affecting premium fluctuations

Annual Fees and Ongoing Costs

Expect these typical annual costs for Gold Maple Leaf IRAs:

Comparison with Other Gold Products

Canadian Gold Maple Leafs often compete favorably with alternatives:

Advantages over American Gold Eagles:

- Higher purity (99.99% vs 91.67%)

- Often lower premiums

- Excellent liquidity globally

Advantages over gold bars:

- Government backing and recognition

- Standardized weight and purity

- Enhanced anti-counterfeiting features

Investment Benefits and Strategic Considerations

Portfolio Diversification Advantages

Gold Maple Leafs provide several diversification benefits:

- Low correlation with stocks and bonds

- Currency hedge against dollar weakness

- Inflation protection historically maintaining purchasing power

- Crisis insurance performing well during economic uncertainty

Liquidity Factors

Canadian Gold Maple Leafs offer excellent liquidity due to:

- Global recognition by dealers and institutions worldwide

- Standardized specifications ensuring easy verification

- Government backing providing confidence in authenticity

- High purity appealing to international markets

Risk Considerations

Understanding potential risks helps develop realistic expectations:

Market Volatility: Gold prices fluctuate based on economic conditions, interest rates, and market sentiment.

Storage Dependency: Your investment relies on third-party storage, creating counterparty risk.

Opportunity Cost: Gold doesn't produce dividends or interest, potentially limiting total returns compared to growth investments.

Liquidity Timing: Converting gold to cash requires coordination with custodians and may take several days.

Tax Implications and Distribution Planning

Traditional vs Roth IRA Options

Traditional Gold IRA:

- Contributions may be tax-deductible

- Growth occurs tax-deferred

- Distributions taxed as ordinary income

- Required minimum distributions begin at age 73

Roth Gold IRA:

- Contributions made with after-tax dollars

- Growth and qualified distributions are tax-free

- No required minimum distributions during owner's lifetime

- Five-year rule applies for earnings withdrawals

Distribution Options

When accessing your Gold Maple Leaf IRA, you can:

- Take cash distributions by having the custodian sell your gold

- Receive physical gold by taking in-kind distributions (creates taxable event)

- Implement systematic withdrawals spreading distributions over time

- Meet RMD requirements with partial liquidations

Early Withdrawal Penalties

Distributions before age 59½ typically incur:

- 10% early withdrawal penalty in addition to regular taxes

- Exceptions for first-time home purchases, higher education, and medical expenses

- Roth contributions (but not earnings) can be withdrawn penalty-free anytime

Making Your Decision: Key Factors to Consider

Successful Gold Maple Leaf IRA investing requires evaluating several critical factors:

Your Investment Timeline

- Short-term (1-5 years): Consider volatility and liquidity needs

- Medium-term (5-15 years): Evaluate inflation protection benefits

- Long-term (15+ years): Focus on portfolio diversification and wealth preservation

Risk Tolerance Assessment

- Conservative investors: May appreciate gold's stability and government backing

- Moderate investors: Often use gold as portfolio stabilizer (5-10% allocation)

- Aggressive investors: Might view gold as crisis insurance or inflation hedge

Overall Portfolio Context

Gold Maple Leafs work best as part of a diversified retirement strategy, typically representing 5-20% of total precious metals allocation within a broader investment portfolio.

Your Next Steps: Building Your Gold Maple Leaf IRA

Ready to add Canadian Gold Maple Leafs to your retirement portfolio? Here's your action plan:

Step 1: Research and select a qualified precious metals IRA custodian with strong reviews and transparent pricing.

Step 2: Determine your initial investment amount and ongoing contribution strategy within IRA limits.

Step 3: Complete the account setup process, including funding through rollover, transfer, or new contributions.

Step 4: Work with your custodian to purchase Canadian Gold Maple Leafs and arrange approved storage.

Step 5: Monitor your investment and consider periodic rebalancing as part of your overall retirement strategy.

The bottom line: Canadian Gold Maple Leafs represent a premium choice for precious metals IRAs, offering exceptional purity, government backing, and global recognition. Their 99.99% gold content exceeds IRS requirements while providing potential portfolio diversification and inflation protection.

Success with Gold Maple Leaf IRAs requires careful planning, qualified professional guidance, and realistic expectations about costs and market dynamics. When properly implemented as part of a diversified retirement strategy, these ultra-pure gold coins can provide both security and growth potential for your financial future.

Ready to Start Your Gold IRA Journey?

Don't let economic uncertainty threaten your retirement security. Take control of your financial future with the proven stability of Canadian Gold Maple Leafs in your IRA.

Get Your FREE Gold IRA Kit Now →

This comprehensive kit includes:

- Complete guide to Gold IRA investing

- Current market analysis and pricing

- Step-by-step setup instructions

- Expert consultation with precious metals specialists

Join thousands of smart investors who've already secured their retirement with physical gold. Your financial future deserves the protection that only real assets can provide.

Claim Your Free Kit Today - No Obligation →

This information is for educational purposes only and does not constitute financial advice. Consult with qualified tax and financial professionals before making investment decisions.