Gold IRA Estate Planning: Secure Your Legacy with Precious Metals

Are you worried about leaving your heirs a retirement account that could lose half its value overnight? Traditional IRAs tied to volatile stocks and bonds have left many families watching their inheritance shrink when they need it most.

Gold IRAs offer a different path—one that has protected wealth for thousands of years and can provide your beneficiaries with tangible assets that hold their value through economic uncertainty.

The Hidden Estate Planning Problem Most People Miss

Here's what most financial advisors won't tell you: Traditional retirement accounts can create massive tax burdens and wealth erosion for your heirs. When your beneficiaries inherit a conventional IRA, they face:

- Required minimum distributions that force taxable withdrawals

- Income tax obligations on every dollar withdrawn

- Market volatility that can devastate account values at the worst possible time

- Currency debasement that erodes purchasing power over decades

Your carefully saved retirement funds could lose 30-50% of their value before your heirs see a penny—not exactly the legacy you planned to leave.

Why Gold IRAs Transform Estate Planning

A Gold IRA operates under the same tax-advantaged rules as traditional retirement accounts, but holds physical precious metals instead of paper assets. This fundamental difference creates powerful estate planning advantages:

Tangible Asset Protection

Unlike stocks that can become worthless overnight, physical gold and silver maintain intrinsic value. Your heirs inherit real assets, not promises from corporations or governments.

Inflation Hedge for Future Generations

Gold has maintained purchasing power for over 5,000 years. While the dollar has lost 96% of its value since 1913, gold continues protecting wealth across generations.

Tax-Deferred Growth Potential

Gold IRAs provide the same tax advantages as traditional IRAs—your precious metals can appreciate without current tax consequences, leaving more wealth for your beneficiaries.

Portfolio Diversification

Adding precious metals to your estate creates diversification beyond traditional financial assets, reducing overall risk for your heirs.

Key Estate Planning Benefits of Gold IRAs

1. Simplified Inheritance Process Physical precious metals are easier to value and transfer than complex financial instruments. Your heirs receive tangible assets with clear, established worth.

2. Protection Against Government Policy Changes Precious metals provide a hedge against future tax policy changes, currency devaluations, or retirement account rule modifications that could impact traditional IRAs.

3. Global Acceptance Gold and silver are universally recognized stores of value, providing your heirs with assets that maintain worth regardless of local economic conditions.

4. Privacy Advantages Physical precious metals held in approved depositories offer more privacy than traditional financial accounts, with fewer reporting requirements for transfers between family members.

Critical Rules and Regulations You Must Know

IRS-Approved Precious Metals

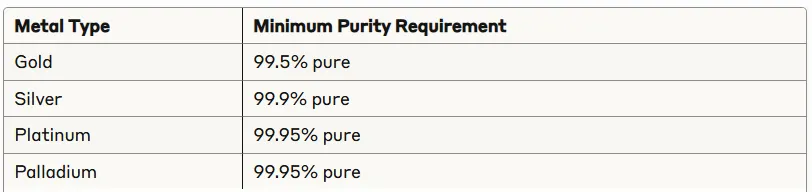

Not all gold and silver qualify for IRA inclusion. Approved metals must meet specific purity standards:

Storage Requirements

IRS regulations mandate that Gold IRA precious metals be stored in approved depositories—not your home safe or local bank vault. Approved storage facilities provide:

- Insurance coverage protecting your metals

- Segregated storage options keeping your metals separate

- Annual reporting to the IRS

- Professional security with 24/7 monitoring

Beneficiary Designation Rules

Gold IRAs follow the same beneficiary rules as traditional IRAs:

- Spouse beneficiaries can roll inherited Gold IRAs into their own accounts

- Non-spouse beneficiaries must follow required distribution schedules

- Multiple beneficiaries can split inherited accounts

- Trust beneficiaries require special planning considerations

Step-by-Step Gold IRA Estate Planning Implementation

Step 1: Choose a Reputable Gold IRA Custodian

Select an IRS-approved custodian specializing in precious metals IRAs. Look for:

- Transparent fee structures

- Established track records

- Comprehensive storage options

- Educational resources and support

Step 2: Fund Your Gold IRA

You can fund a Gold IRA through:

- Direct contributions (subject to annual limits)

- Rollovers from existing IRAs or 401(k)s

- Transfers from other retirement accounts

Step 3: Select Approved Precious Metals

Work with your custodian to choose IRS-approved gold, silver, platinum, or palladium that aligns with your estate planning goals.

Step 4: Arrange Secure Storage

Your custodian will facilitate storage at an approved depository, ensuring compliance with IRS regulations.

Step 5: Update Beneficiary Designations

Ensure your Gold IRA beneficiary forms are current and align with your overall estate planning strategy.

Step 6: Coordinate with Your Estate Plan

Integrate your Gold IRA with your will, trusts, and other estate planning documents for seamless wealth transfer.

Common Gold IRA Estate Planning Mistakes to Avoid

❌ Failing to Update Beneficiaries Outdated beneficiary forms can create legal complications and tax problems for your heirs.

❌ Ignoring Required Minimum Distributions Even Gold IRAs have RMD requirements after age 73—plan accordingly to avoid penalties.

❌ Choosing Unreliable Custodians Some companies charge excessive fees or provide poor service. Research thoroughly before committing.

❌ Mixing Personal and IRA Precious Metals Never store IRA metals at home or commingle them with personal precious metals collections.

❌ Neglecting Regular Reviews Estate planning needs change over time—review your Gold IRA strategy annually.

Tax Considerations for Your Heirs

Understanding the tax implications helps your beneficiaries make informed decisions:

For Spouse Beneficiaries

- Can treat inherited Gold IRA as their own

- May delay required distributions until their required beginning date

- Enjoys continued tax-deferred growth potential

For Non-Spouse Beneficiaries

- Must begin required minimum distributions by December 31 of the year following your death

- Can stretch distributions over their life expectancy (for eligible designated beneficiaries)

- Pay ordinary income tax rates on distributions

Trust Beneficiaries

- Complex rules apply depending on trust structure

- May require accelerated distribution schedules

- Professional guidance essential for compliance

Making Your Decision: Is Gold IRA Estate Planning Right for You?

Consider a Gold IRA as part of your estate planning if you:

✅ Want to diversify beyond traditional financial assets

✅ Seek protection against inflation and currency debasement

✅ Desire tangible assets for your heirs

✅ Have concerns about long-term economic stability

✅ Want to minimize counterparty risk in your estate plan

Gold IRAs aren't suitable for everyone. They require:

- Long-term investment horizons

- Understanding of precious metals markets

- Comfort with storage and custodian relationships

- Integration with comprehensive estate planning

Secure Your Family's Financial Future Today

Your legacy deserves protection that goes beyond paper promises and market volatility. Gold IRAs offer a time-tested approach to wealth preservation that can provide your heirs with tangible, valuable assets when they need them most.

The question isn't whether economic uncertainty will impact your family's future—it's whether you'll take action now to protect them.

Take Action: Get Your FREE Gold IRA Estate Planning Kit

Don't let another day pass wondering if your retirement savings will survive long enough to benefit your heirs. Right now, you can access a comprehensive Gold IRA information kit that includes:

✅ Complete Gold IRA Estate Planning Guide - Step-by-step strategies for protecting your legacy

✅ IRS-Approved Precious Metals List - Know exactly which metals qualify for your IRA

✅ Tax Implications Worksheet - Understand how Gold IRAs impact your beneficiaries

✅ Custodian Comparison Chart - Choose the right company for your needs

✅ Free Consultation with Gold IRA specialists who understand estate planning

Click Here to Get Your FREE Gold IRA Estate Planning Kit →

This information kit has helped thousands of Americans protect their retirement savings and create lasting legacies for their families. There's no cost, no obligation, and no high-pressure sales tactics—just the honest information you need to make an informed decision about your family's financial future.

Time is your enemy when it comes to estate planning. Market volatility, inflation, and policy changes don't wait for convenient moments. The sooner you act, the more time your Gold IRA has to work for your family.

Secure Your FREE Kit Now - Click Here

Remember: This information is for educational purposes only and should not replace personalized advice from qualified financial and legal professionals familiar with your specific situation.